- The Futurizts' Weekly Newsletter

- Posts

- 04 Dec: Bitcoin climbs to $17,000, Dollar plunges to 4-month low, Ringgit surges to 4.39, China to loosen Covid restrictions - Weekly Newsletter

04 Dec: Bitcoin climbs to $17,000, Dollar plunges to 4-month low, Ringgit surges to 4.39, China to loosen Covid restrictions - Weekly Newsletter

This week's top headlines:

i) The dollar falls to a 4-month low as Fed chair J. Powell indicates lower rate hikes to come as soon as December.

ii) US equities rally from Powell's speech. Bitcoin climbed to the week's high of $17,400.

iii) The ringgit surges to RM4.39 against the greenback.

Scroll down to read the details.

Get early access to our newsletter and miss nothing from the markets. Join our journey towards financial literacy today.

Our private announcement group will keep you updated with market movers and urgent matters. For only $1/month, you’ll receive the newsletter every Sunday night and notifications on important events, some with detailed thoughts from economist Mr. Sani Hamid.

✅ No commitments.

✅ Cancel anytime.

✅ Zero ads, zero shills.

Check out our different packages by clicking on this link.

A summary of what I covered in my previous issue (27th November):

i) Bitcoin steadies and trades sideways between $16,000 and $16,500. Upcoming FOMC meeting on Dec 13 will be the next market mover.

ii) The King has selected Anwar as Malaysia’s 10th prime minister. The Bursa market and ringgit rallied in response, but will this last?

iii) Recent minutes from the Federal Reserve show lower interest rate hikes ‘soon’. US dollar slumps and stocks pump.

Read the previous issue here.

Dollar Continues its Freefall, Bitcoin Retraces to $17k, US Equity Markets Rally.

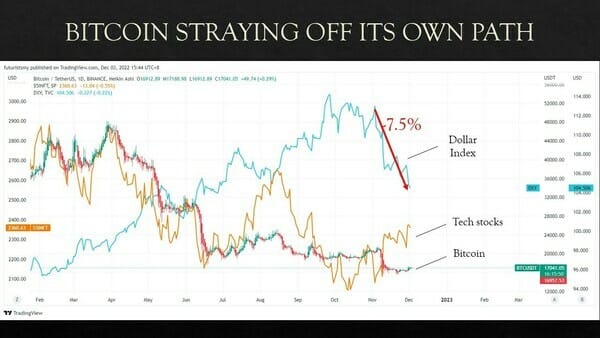

i) The crypto market has been largely serene in the wake of the recent FTX debacle. Although we saw a slight uptick to the week's high of $17,400 on Tuesday (29 Nov), Bitcoin quickly retraced to the $17,000 support and is looking to hover in this range for the next week.

ii) When compared to US tech stocks and the dollar, Bitcoin's "sideways" movement becomes clear. Typically, we expect the crypto market to follow stocks in the US, especially speculative assets. But the recent fiasco in the crypto market has left Bitcoin to stray on its own path.

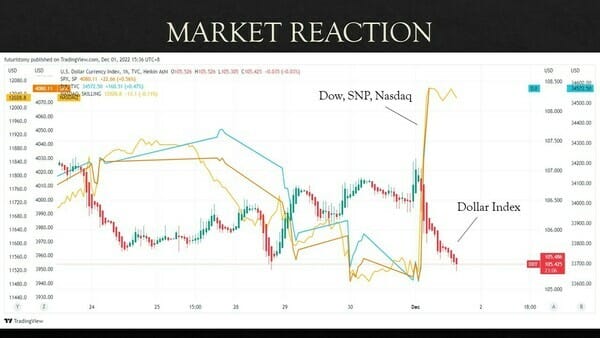

iii) The dollar, meanwhile, has had one of the worst months since the start of its parabolic rally this year. For the entire November, the US dollar index slumped. The steep downtrend removed over 7.5% of the dollar's value, while tech stocks, known to be inversely correlated to the greenback, recovered swiftly.

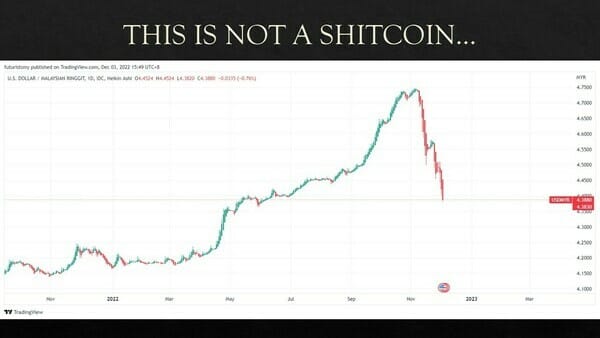

The Ringgit Surges to a 6 Month High of RM4.39.

The chart below is not a shitcoin. It's the weekly chart of the US dollar versus the ringgit. In the past 3 weeks, our local currency has gained over 8% against the greenback and is showing no signs of slowing down.

To understand why this is happening, we must go back to the basics of why currencies fluctuate in the first place. I've posted a thread about this on Twitter this week, but allow me to elaborate more on this topic.

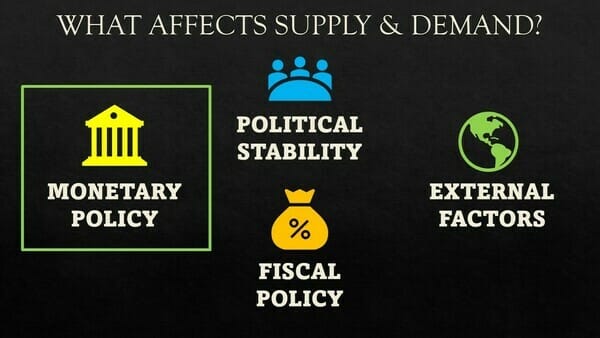

1. Currencies fluctuate due to supply and demand.

When the demand for a currency is high while its supply remains constricted, the currency will strengthen.

2. There are many factors affecting the supply and demand for a currency. Namely:

i) Monetary policy set by central banks (ie. adjusting interest rates, changing bank reserve requirements, buying/selling assets within the banks' balance sheet, etc). Example: The Federal Reserve's efforts to tame inflation by aggressively raising rates and selling assets from their balance sheet.

ii) Fiscal policy set by governments (ie. tax rates, government spending/borrowing, etc). Example: Sri Lanka's economic collapse due to unsound policies set by the government.

iii) Political stability. Example: UK's fiasco with former PM Lizz Truss.

iv) External/environmental factors. Example: War in Ukraine.

Factors (ii) to (iv) have varying effects on the supply and demand for a country's currency. Therefore, the monetary policy set by central banks is the most influential factor that determines the value of the currency.

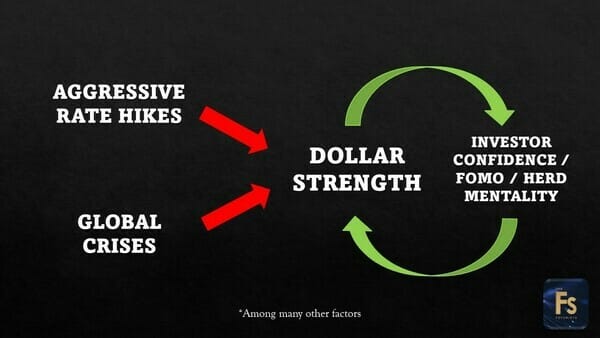

3. The dollar's rally this year was unstoppable.

The US was hammered by multi-decade high inflation due to the over-printing of money during the height of the Covid pandemic. From March 2020 to March 2021, the US committed a grand total of $5.2 trillion to counteract the Coronavirus.

When inflation began to spiral out of control, the Fed sought to aggressively raise interest rates to slow down the price hikes.

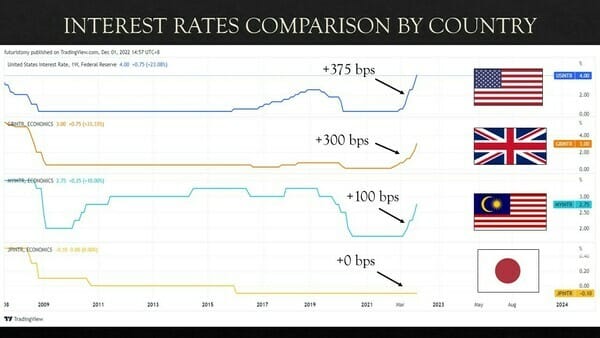

In less than 10 months, rates were raised from 0.25% to 4.00% - the fastest pace in over three decades.

4. When compared to other central banks, the Fed's pace of tightening becomes terrifyingly clear.

This caused more and more money to flow from other nations to the US dollar because it had a much higher yield.

Imagine a scenario between two local banks:

Bank A offers 2.75% for a fixed deposit of 12 months, while Bank B offers 4.00% with similar terms. Which bank would you prefer?

Anyone would have chosen Bank B, because the rates are much higher. This is a similar case to that of the US dollar.

5. Global crises triggered a flight to the dollar.

Let's not forget the numerous crises we have faced since the start of the pandemic:

-> Ukraine war

-> China crises (real estate, bank scandals, zero-Covid policy, etc)

-> UK's fiasco with former PM Liz Truss

-> Japan's reluctance in raising rates

etc.

6. Factors (4) and (5) cause a "chain effect", effectively creating a dollar squeeze.

The result was a parabolic rally, like what we've seen this year.

7. But the rally came to a halt when the US unveiled its most recent inflation report.

On 10 Nov, the US released its most recent inflation report, at 7.7%.

-> Though much higher than the Fed's target of 2%, it is significantly lower than the prior month and beat analysts' expectations for the first time in months.

-> Core inflation, which excludes volatile items like food and fuel, also came in much better than anticipated.

-> Markets cheered after the announcement while the dollar slumped. Investors are now expecting the Fed to be less aggressive in its upcoming rate hikes.

8. Fed chair Jerome Powell signals lower rate hikes to come as soon as December, confirming investors' predictions.

-> At an economic forum on Wednesday, Chairman J. Powell said rate hikes could slow as soon as December

“The time for moderating the pace of rate increases may come as soon as the December meeting. Despite some promising developments, we have a long way to go,” he said.

9. The confirmation from the Fed caused a steep drop in the dollar index but a strong rally across US equities.

The Dow Jones, SNP 500, and Nasdaq were up by 3% on average after Powell’s speech.

10. But I don't think this is the end of the dollar's bull run.

While the Fed has indicated that rate hikes will be less aggressive, chairman J. Powell stated that the peak interest rate will be higher than previously expected.

Powell also cautioned against prematurely loosening the monetary policy as inflation is still well above the Fed’s goal of 2%.

He stressed that the Fed would "stay the course until the job is done."

Quick summary

-> The dollar’s unstoppable rally this year was due to the rapid pace of tightening from the Fed plus other macro factors (China, Ukraine, UK, etc).

-> The rally was cut short when the Fed forecasted slower rate hikes in the future due to signs of cooling inflation.

-> But the dollar could still strengthen in the upcoming months, as the Fed indicated that the peak interest rate will be higher than previously expected.

China to ease Covid restrictions over widespread protests and anger

-> China is set to ease Covid restrictions as widespread protests and anger over the world’s toughest quarantine protocols shatter the nation’s fragile economy and citizens’ livelihoods. This includes a reduction in mass testing and allowing infected individuals to stay at home.

-> The move to soften lockdown procedures is a far cry from China’s recent “Zero-Covid” policy. For almost 3 years, entire districts were locked down, sometimes for weeks, even after just a single reported case.

-> The frustration came to a boiling point last week when citizens took to the streets to protest, demanding lesser restrictions and urging President Xi to step down.

-> Chinese stocks around the world dipped initially due to the violent protests, but quickly recovered when the government announced its new approach.

Disclaimer: I am not a financial advisor. This newsletter is based on my own analysis and research. Do not take any of it as financial advice.

*This newsletter was written at 12.00 PM on 4th December 2022 and completed at 4.45 PM the same day.

To read our newsletter on the day it is published, subscribe to Patreon membership for as little as $1 a month!

Reply