- The Futurizts' Weekly Newsletter

- Posts

- 09 Dec: Bitcoin Holds $17,000, Fed to go with a 50 bps hike on 13 Dec, Inflation Uncertainties - Weekly Newsletter

09 Dec: Bitcoin Holds $17,000, Fed to go with a 50 bps hike on 13 Dec, Inflation Uncertainties - Weekly Newsletter

*This week's newsletter is sent two days earlier because I will be in Bangkok for a break from 10th to 13th December. Mr. Sani will replace me for this Sunday's weekly analysis.

This week's top headlines:

i) Bitcoin holds the $17,000 support and continues to trade sideways.

ii) Crypto investors flee from centralized exchanges. Bitcoin outflows hit an all-time high of almost 200,000 BTC in the past 30 days. Exchange balance at 4-year low.

iii) Markets await the Fed's latest rate hike decision (Dec 13-14). A 50-bps hike is already priced in.

iv) The latest US inflation data is scheduled to be released on Dec 13, coincidentally the same date as the final FOMC meeting.

Scroll down to read the details.

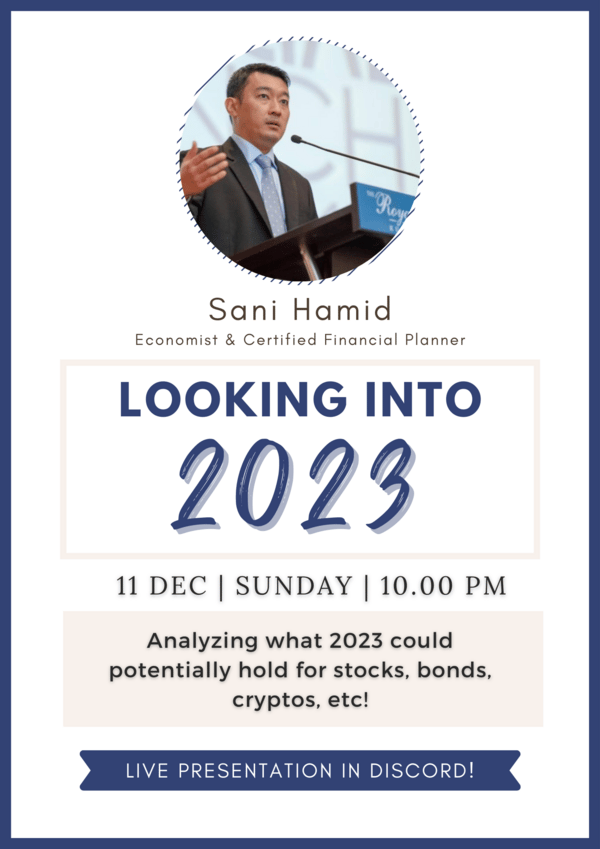

(SPECIAL EVENT) Looking into 2023 with Economist Sani Hamid

Join Mr. Sani Hamid, an economist and certified financial planner, as he breaks down what happened in 2022 and things to expect going into 2023!

He'll discuss:

i) Upcoming December Fed meeting expectations

ii) Overall outlook and the general trend of global markets

iii) The impact on local markets and re-evaluating the ringgit's strength

The live session will be conducted in our Discord on Sunday night (Dec 11)! It is FREE for everyone to join so be sure to bring your friends in. The recording will be posted in our YouTube and as usual, Learners and Gatherers will have a 2-day early access before it is released to the public.

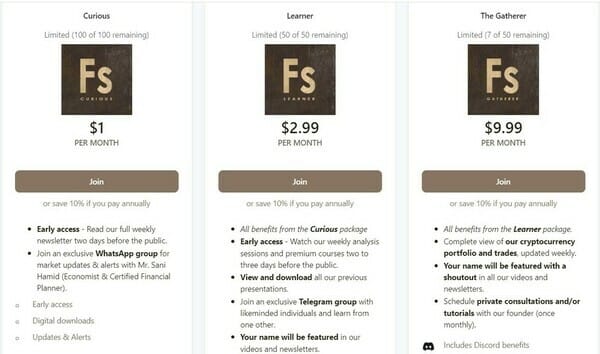

Get early access to our newsletter and miss nothing from the markets. Join our journey towards financial literacy today.

Our private announcement group will keep you updated with market movers and urgent matters. For only $1/month, you’ll receive the newsletter every Sunday night and notifications on important events, some with detailed thoughts from economist Mr. Sani Hamid.

✅ No commitments.

✅ Cancel anytime.

✅ Zero ads, zero shills.

Check out our different packages by clicking on this link.

A summary of what I covered in my previous issue (4th December):

i) The dollar fell to a 4-month low as Fed chair J. Powell indicated lower rate hikes to come as soon as December.

ii) US equities rallied from Powell’s speech. Bitcoin climbed to the week’s high of $17,400 before retracing back to $17,000 on Sunday's close (Dec 4).

iii) The ringgit surged to RM4.39 against the greenback due to the dollar's general weakness and the quick resolution of Malaysia's hung parliament.

Read the previous issue here.

Bitcoin holds $17,000 support, sideways movement continues.

i) Nothing notable happened to the crypto market this week. Like what I've covered in my previous issues, the market is currently waiting for catalysts to shift investors' sentiment. This consolidation should come to an end on Dec 13-14, during the final FOMC meeting of 2022 and the release of the latest inflation data from the US.

ii) Over the past 20 days, Bitcoin recovered gradually from its two year low of $15,500. Though less obvious, the higher lows observed in both the RSI and price could bring Bitcoin back to $17,500 before the Fed meeting.

Almost 200,000 Bitcoins flowed out of exchanges in the past 30 days.

In the wake of the FTX crisis, investors (both retail and whale) have been withdrawing their Bitcoin holdings from centralized exchanges to store them in cold wallets. Outflows from exchanges have reached an all-time high of 197,598 BTC in the last 30 days.

Normally, this is considered an extremely bullish signal because Bitcoins held in cold storage translates to less selling pressure on the market from centralized exchanges. But this is, of course, entirely dependent on the market not seeing another huge crisis again.

Bitcoin exchange balance is at a 4-year low.

The balance of Bitcoins on exchanges have dwindled to the levels seen in 2018 following the countless "Black Swan Events" that we've experienced in the crypto market this year (Terra Death Spiral, Celsius, 3AC, FTX, etc).

Low balances in exchanges is a double edged sword, because it becomes easier to move Bitcoins price, up or down.

What to expect during the upcoming FOMC meeting on Dec 13?

-> The Fed is largely favored to go with a 50-basis point hike as inflation showed steady signs of cooling from October's reading (CPI fell from 8.2% to 7.7%).

-> The step down from rate hikes would be consistent with Chairman Jerome Powell's speech at an economic forum last week, as he indicated that lower rate hikes could come "as soon as the December meeting".

-> Should the Fed adhere to expectations, we should see no negative reactions to the market as it has already been priced in.

The real question is how high rates could peak in 2023 before the Fed pauses or pivots.

-> Though the rate decision may not surprise investors, the current economic outlook and projections for future rate hikes could.

-> The Fed tends to look at the "evolving data" to settle on a best course of action to bring inflation back down to their target goal of 2%. In September, Powell released a "dot-plot" of the Fed's future rate hikes in 2023, which were expected to remain under 5%, but recent speech from him suggested otherwise.

-> Powell said that the ultimate peak for rates – the “terminal rate” – will be “somewhat higher than thought” as compared to the previous setting during the September FOMC meeting. Committee members at the time said they expected the terminal rate to hit 4.6%; markets now see it in the 5%-5.25% range, according to CME Group data.

Upcoming US inflation data is coincidentally the same date as the FOMC meeting - Dec 13.

-> The November Consumer Price Index (CPI) is set to be released on Dec 13, right before the Fed announces rates. The latest report will have a direct impact on the Fed's decisions.

-> While inflation has shown signs of cooling (previous reading of 7.7% beat expectations), the Fed believes that the October figure was probably a one-off.

-> The labor market remains stubbornly strong, which could hinder the committee's efforts to bring inflation down.

-> The data on Dec 13 will give the Fed a clearer picture on the trend of US inflation. If the report is promising, it will encourage the Fed to go with lower rate hikes in 2023, leading to a peak-rate of less than 5%.

Quick summary

i) Markets are currently trading sideways while waiting for the latest decision from the Federal Reserve.

ii) No negative reactions should spook the market if the Fed adheres to expectations with a 50 bps hike.

iii) While the latest decision is already priced in, what lies ahead for the Fed next year (and how aggressive the committee will be) is uncertain. Chairman J. Powell stated that rates are likely to peak higher and remain longer than expected.

iv) Inflation data from the US, scheduled to be released on Dec 13, is the next gauge for the Fed's future decisions, stretching into 2023. The strong US labor market could make inflation sticky.

That’s all for this week’s newsletter!

Disclaimer: I am not a financial advisor. This newsletter is based on my own analysis and research. Do not take any of it as financial advice.

*This newsletter was written at 10.30 AM on 9th December 2022 and completed at 3.30 PM the same day.

To read our newsletter on the day it is published, subscribe to Patreon membership for as little as $1 a month!

Reply