- The Futurizts' Weekly Newsletter

- Posts

- 18 Dec: Inflation slows to 7.1%, Bitcoin tops $18,400 before crashing back to $16,500, Fed hikes rates by 50 bps, Binance Drama - Weekly Newsletter

18 Dec: Inflation slows to 7.1%, Bitcoin tops $18,400 before crashing back to $16,500, Fed hikes rates by 50 bps, Binance Drama - Weekly Newsletter

Week 12-18 December

BTC week high: $18,400

BTC week low: $16,539

BTC current price: $16,748

$US1.00 = RM4.419

Top headlines:

i) Bitcoin rallies to $18,400 after the US unveiled its inflation report for November, which came in lower than expected, at 7.1%.

ii) The Federal Reserve hiked interest rates by 50 basis points, brining the benchmark rate to 4.25-4.50% as widely anticipated, but markets tanked.

iii) Mazars has halted work on Binance and all cryptocurrency exchanges. Panic selling ensued.

Scroll down to read the details.

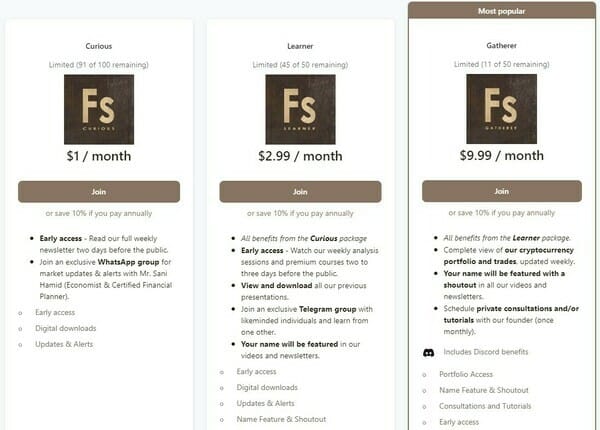

Get early access to our newsletter and miss nothing from the markets. Join our journey towards financial literacy today.

Our private announcement group will keep you updated with market movers and urgent matters. For only $1/month, you’ll receive the newsletter every Sunday night and notifications on important events, some with detailed thoughts from economist Mr. Sani Hamid.

✅ No commitments.

✅ Cancel anytime.

✅ Zero ads, zero shills.

Check out our different packages by clicking on this link.

A summary of what I covered in my previous issue (9th December):

i) Bitcoin held the $17,000 level and traded sideways as markets awaited the Fed's latest rate hike decision on December 13-14. A 50-bps hike has been priced in.

ii) The latest US inflation data, scheduled to be released on Dec 13, was coincidentally the same date as the final FOMC meeting. The reading will determine the Fed's future pace of rate hikes in 2023.

iii) Crypto investors flee from centralized exchanges. Bitcoin outflows hit an all-time high of almost 200,000 BTC in the past 30 days. Exchange balance dwindled to a 4-year low.

Read the previous issue here.

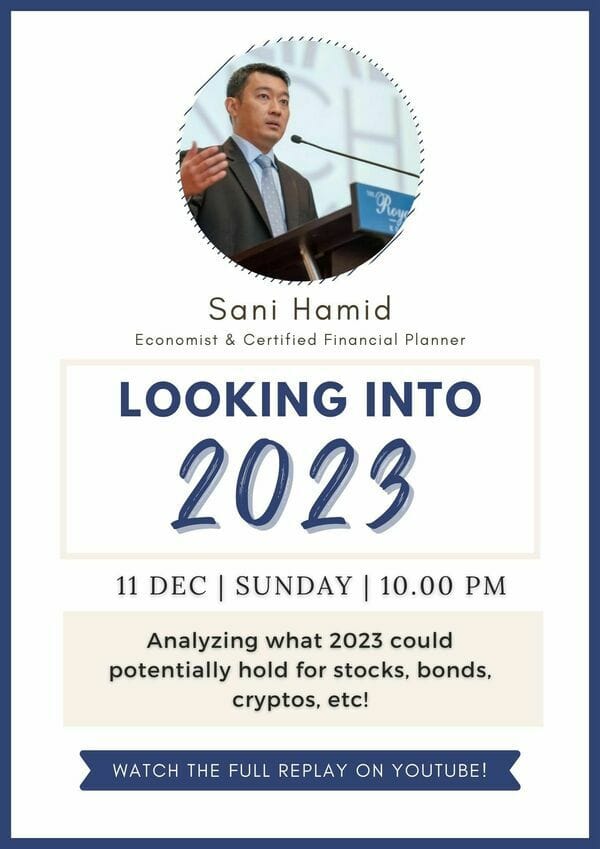

(FULL REPLAY) Looking into 2023 with Economist Sani Hamid

Last week, we invited certified financial planner and 30-year veteran economist Sani Hamid to give a detailed roundup of what happened in 2022 and forecasts for 2023.

Here's a quick summary of his session:

i) 2022 has been a tough year for all. Very rarely do we see stocks and bonds fall in tandem as both assets are negatively correlated.

ii) 2023 forecast (probabilities on the SNP index, currently 3,800 points):

- 5% no recession: SNP bottoms at ~3,800 points and resumes uptrend

- 50% recession: SNP falls further to ~3,000 points

- 30% crisis: SNP falls to ~2,000 points

- 15% depression: SNP plunges below 1,000 points

iii) Major financial institutions like Goldman Sachs and Deutsche Bank predict more downside in 2023, with the current trend being a bear trap. On average, these institutions are looking at the SNP to fall to ~3,200 points.

iv) The opportunities lie in Dollar Cost Averaging (DCA). As markets are expected to fall (but we don’t know by how much), having a 24-month DCA plan will prepare you for volatility and remove attempts to time the bottom.

Watch the full replay here.

THIS WEEK: Volatility returns. Bitcoin rallies to $18,400 before plunging back to $16,500.

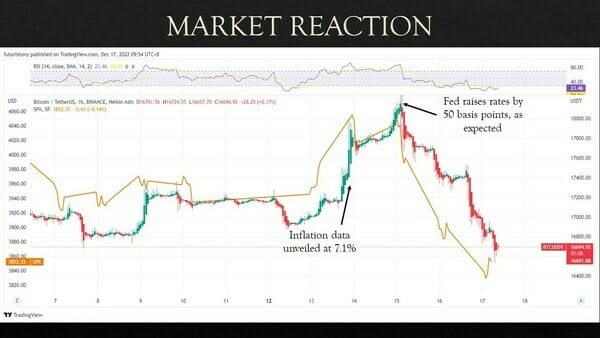

i) The serenity that we've seen in the past 4 weeks has disappeared. Bitcoin surged to a four-week high of $18,400 on Wednesday (Dec 14), fueled by speculation that the Federal Reserve will ease up on future rate hikes.

ii) The euphoria was quickly doused when the Fed confirmed that interest rates would stay higher for longer (more will be discussed below). Bitcoin removed all its gains and plunged to a low of $16,400 soon after.

iii) The higher low, which was a crucial support for bulls, has been broken, opening the floodgates for sellers to push Bitcoin lower. The relative strength index U-turned and is nearing oversold levels, suggesting that we may still see some selling pressure in the market before a retracement upwards.

A Quiet December.

Though we've seen some volatility this week, the long-term trend shows that the crypto market has turned eerily quiet in December.

After a spike in November (thanks to the FTX crisis), the short-term realized volatility for Bitcoin is currently at a 2-year low of 22% (1-week), and 28% (2-weeks).

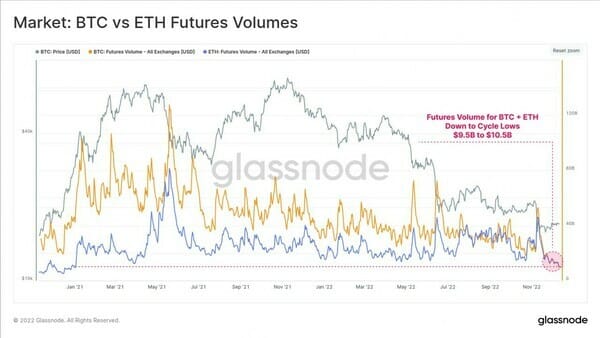

Investors are Deleveraging.

Futures volumes for Bitcoin and Ethereum are currently showing a steep decline.

The FTX crisis is probably the last straw to draw mass speculation out of the market. The widespread contagion has collapsed many lending and trading firms, which in turn, forced investors to tighten liquidity and reserve their risk appetite.

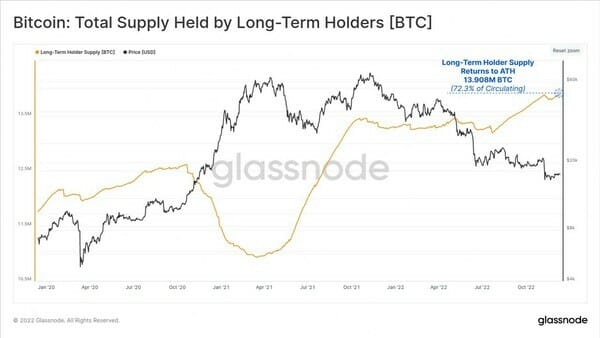

Long-term holders are back to "accumulation mode".

Despite the market mayhem, long-term holders are showing a renewed interest to accumulate and HODL.

The total supply held by the diamond hands has returned to an all-time high of 13.908 million BTC, after a series of panic spending in November due to the FTX fiasco.

Inflation slows to 7.1%, markets rallied in response.

i) The US unveiled its most recent inflation data for November at 9.30 PM MYT, Tuesday (Dec 13).

ii) The reading came in at 7.1%, significantly cooler than October's figure at 7.7% and lower than expectations at 7.3%. Core inflation also showed a similar trend of cooling.

iii) Markets rallied hard in response, with Bitcoin surging to a four week high of $18,400. Investors are confident that the Fed will ease on future interest rate hikes during its upcoming FOMC meeting on Dec 14.

The Federal Reserve hiked rates by 50 basis points as expected, but markets tanked.

On Wednesday (Dec 14), Fed chairman Jerome Powell laid out the committee's decisions and plans for 2023, shortly after the inflation data was revealed. I've wrote a thread (with video references) about this on Wednesday:

i) The 50-bps increase brings the benchmark interest rate from 3.75-4.00% to 4.25-4.50%. It is a huge step down from the four consecutive 75-bps hikes previously.

ii) Markets tanked when Powell indicated that the Fed will keep rates high through 2023 with no reductions.

iii) According to the Fed’s "dot-plot", the peak interest rate in 2023 was put at 5.1%, significantly higher compared to September’s figure of 4.6%.

iv) The latest FOMC statement remains largely unchanged. The Fed sees similar increases in the target range as appropriate.

v) Though inflation showed significant signs of cooling in the past two months, Powell said that "it will take substantially more evidence to give confidence that inflation is on a sustained downward path."

Binance auditor Mazars pauses work on all crypto firms. Panic selling ensued.

i) Following the collapse of FTX, many crypto exchanges began to submit proof of reserve reports to gain investor confidence.

ii) Binance was one of the first firms to do so. A little over 2 weeks ago, CZ announced that Binance released its proof of reserves using the Merkle Tree.

iii) On Friday (16 Dec), Mazars, the auditing firm for Binance, said in an emailed statement that it is pausing its work for crypto firms relating to proof-of-reserves reports. The link to the report on Mazars' website was subsequently deleted.

iv) "This is due to concerns regarding the way these reports are understood by the public," the company said.

v) The result was panic selling from retail investors. Bitcoin tumbled to a low of $16,400.

vi) An official statement has yet to be released from Mazars, so it's probably best to wait before doing anything rash.

Quick Summary

i) According to our previous session with Mr. Sani, investors should have a 24-month DCA plan and skip timing the bottom because we do not know how deep 2023’s recession will be.

ii) Bitcoin saw a brief uptick this week because of the optimistic inflation data, which came in at 7.1%.

iii) Even though the Fed adhered to expectations with a 50 bps hike, the bearish sentiment returned when Powell indicated that rates are likely to peak higher and the committee will not pivot till 2024.

iv) Bitcoin slid further afterwards due to the Binance FUD. Auditing firm Mazars announced that the firm will pause work on all crypto exchanges.

That’s all for this week’s newsletter!

Disclaimer: I am not a financial advisor. This newsletter is based on my own analysis and research. Do not take any of it as financial advice.

*This newsletter was written at 10.30 AM on 18th December 2022 and completed at 3.30 PM the same day.

To read our newsletter on the day it is published, subscribe to Patreon membership for as little as $1 a month!

Reply