- The Futurizts' Weekly Newsletter

- Posts

- 20 Nov: Bitcoin stabilizes at $16,500, Exchange Outflows at all-time high, Luno's Lending Partner Halts Withdrawals - Weekly Newsletter

20 Nov: Bitcoin stabilizes at $16,500, Exchange Outflows at all-time high, Luno's Lending Partner Halts Withdrawals - Weekly Newsletter

This week's top headlines:

i) The crypto market stabilizes. Bitcoin consolidates at $16,500 and trades sideways for the entire week.

ii) Outflows from exchanges hit an all-time high of 160k Bitcoins per day during the height of the FTX crisis.

iii) Luno's preferred lending partner, Genesis Trading, halts withdrawals in the wake of FTX's downfall. Should Malaysians be worried?

iv) Inflation sensation. UK's CPI in October hit a 41-year high of 11.1%. The Bank of England says the country is facing the longest recession ever since records began.

Scroll down to read the details.

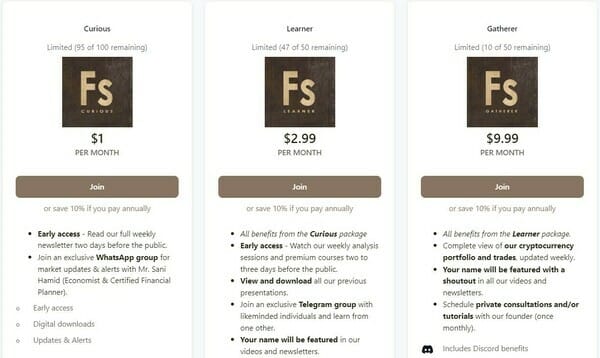

Get early access to our newsletter and miss nothing from the markets. Join our journey towards financial literacy today.

Our private announcement group will keep you updated with market movers and urgent matters. For only $1/month, you’ll receive the newsletter every Sunday night and notifications on important events, some with detailed thoughts from economist Mr. Sani Hamid.

✅ No commitments.

✅ Cancel anytime.

✅ Zero ads, zero shills.

Check out our different packages by clicking on this link.

A summary of what I covered in my previous issue (13th November):

i) Crypto market mayhem. Bitcoin plunges to $15,700 from $20,000.

ii) Another titan bites the dust. FTX collapses and files for bankruptcy. Contagion spread like wildfire. BlockFi halts withdrawals.

iii) mySPR data breach: Selfies and myKad images of 800,000 Malaysians are being sold online at a well-known database marketplace.

iv) October CPI in the US fell to 7.7%, significantly lower than market expectations of 7.9%. Stocks rallied in response.

Read the previous issue here.

The Crypto Market is Stabilizing, For Now...

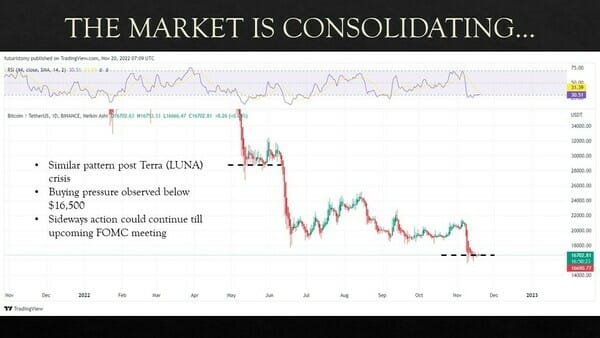

i) Bitcoin has spent the entire week trading sideways, with its value squeezed tightly between $16,500 and $17,000. But the week has been far from peaceful. Contagion continues to spread, and dominos are still falling.

ii) I am expecting Bitcoin to maintain its stability in the upcoming weeks before another major leg down. This prediction is drawn from a pattern I've observed in previous crises.

After the Terra (LUNA) death spiral in May, Bitcoin consolidated for almost four weeks before crashing again.

iii) The next market mover (apart from institutions collapsing) is the upcoming FOMC meeting on December 13. All eyes are on the Fed to decide the market's year-end fate. Many analysts are looking at the Fed to deliver a 50 bps hike rather than 75 bps.

We'll talk more about this when the FOMC meeting nears.

Bitcoin Exchange Outflows Hit an All-Time High of 160k BTC per day.

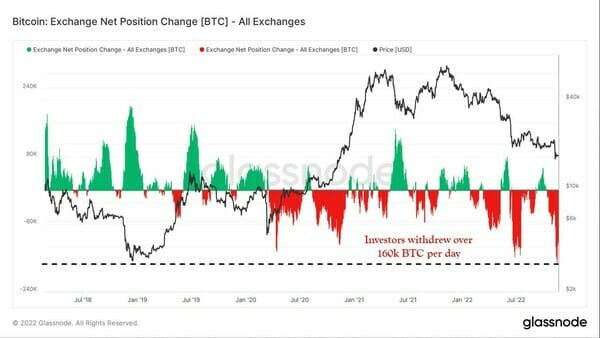

-> The "Exchange Net Position Change" metric from Glassnode is a useful indicator to track the flow of Bitcoin from exchanges.

-> Current investor sentiment has never been this fearful of centralized exchanges (CEXs). At its peak, over 160,000 BTC flowed out of exchanges per day during the FTX crisis, revealing the extent of panic from retail and institutional investors.

-> The pace of the drainage has surpassed the previous all-time high of 133k BTC per day, during the collapse of Celsius and 3AC.

We are 5 months into the Crypto Winter, with still a long way to go.

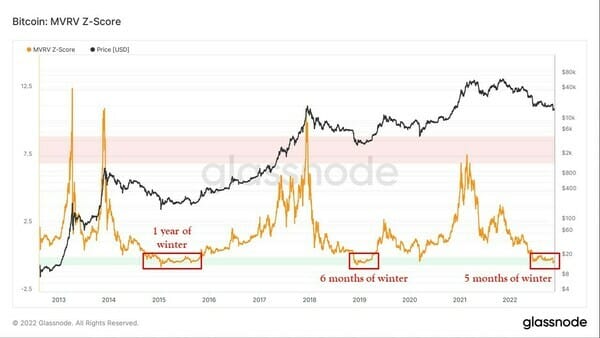

-> The MVRV Z-Score from Glassnode determines Bitcoin's "fair" value. When the indicator drops to the lower band in green, Bitcoin is considered undervalued. Conversely, if the indicator touches the upper band in red, Bitcoin is deemed to be overvalued.

-> During severe bear markets and crypto winters, the MVRV Z-Score could stay within the green band for an extended duration, as seen in 2015 and 2019.

-> The current score shows that Bitcoin is clearly undervalued. But do not take this as a signal to go all in and bet your whole farm, as historic evidence suggests that we are just dipping our toes into the crypto winter.

Just because an indicator is accurate in the past, does not mean it will be accurate in the future.

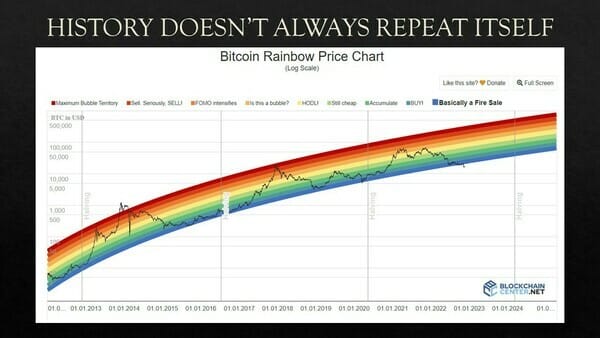

-> Many inexperienced investors tend to rely heavily on one indicator to buy/sell.

-> This practice is dangerous, as all indicators use historic data to make an educated guess of the future and do not factor in black swan events.

-> A perfect example would be the "Rainbow Chart" (refer below). Bitcoin has fallen out of the lower blue band during the FTX crisis.

Luno's preferred Lending Partner, Genesis Trading halts withdrawals due to the FTX debacle.

-> Genesis is one of the largest crypto institutions. Its lending arm, Genesis Global Capital (GGC), serves institutional clients and had over $2.8 billion active loans as of Q3.

-> In 2021, Genesis posted a yearly "Spot Volume Trade" of $116.5 billion and loan originations of $130.6 billion.

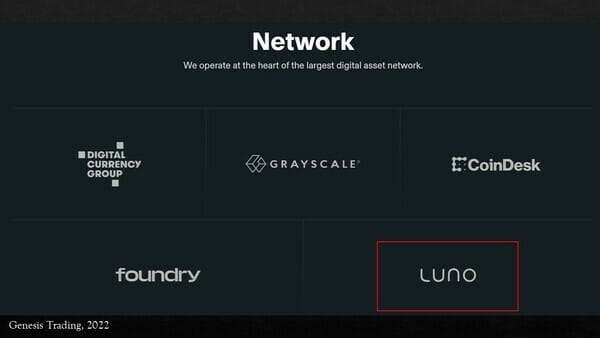

-> The firm has deep ties with big players in the crypto industry. Namely, Grayscale, CoinDesk, Foundry, and Luno.

-> Earlier this year, Genesis lent $2.36 billion to the now bankrupt Three Arrows Capital. Its claim in the hedge fund’s bankruptcy stands at $1.2 billion, making it the largest creditor.

-> On Wednesday, the firm suspended redemptions, citing liquidity concerns in the wake of FTX's collapse. The company reported that its derivatives business had $175 million locked in its FTX trading account.

-> An official stated that Genesis Trading and its lending arm are two separate units, and thus its main business will not be affected.

-> Since Luno is the largest crypto exchange in Malaysia, local users began to express concern over Luno's involvement with Genesis.

Should Malaysians be worried of Luno?

-> We must understand that Luno Global and Luno MY offer different products. Luno Global offers more cryptos (like USDC) and a savings wallet to allow users to earn passive income. Luno MY only allows users to buy and sell crypto, with no option to earn on their holdings.

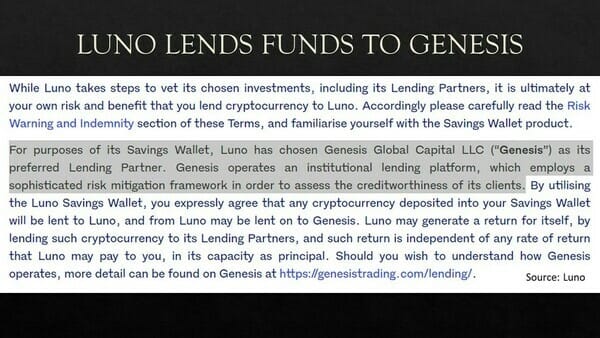

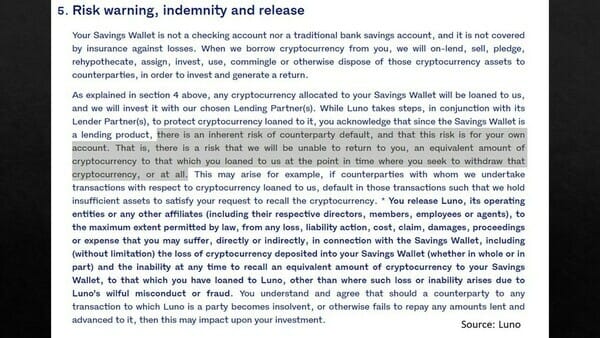

-> Luno Global lends users’ funds to Genesis Trading to generate yield for its savings wallet. As disclosed in their terms, the savings wallet does not function like a bank account and is not insured against losses.

-> Also, Luno specifically stated that users’ funds held in the savings wallet are at risk of counterparty default and that Luno may not be able to refund users in full.

-> On Wednesday, Luno Global published an article about its involvement with Genesis and assured customers' funds are safe and backed 1:1.

But should Malaysians be worried?

I would say no for now. Luno Malaysia is regulated by the Securities Commission (SC) and does not have a savings feature because it is not offered in Malaysia, as confirmed by Luno Global.

We’d like to reassure you Luno’s operations are not impacted by recent announcements, and customer funds are safe and secure.

Additionally, the savings feature is not operational in Malaysia.

You can read more about it here👇

— Luno (@LunoGlobal)

3:49 PM • Nov 16, 2022

However, one huge lesson we've learned from the plethora of crises in the crypto market is to NEVER TRUST ANYONE BUT YOURSELF. Users should never put all their eggs in one basket and learn to practice self-custody (ie. storing your crypto in a cold wallet).

For those who are wondering how to withdraw funds out of Luno into your own wallet, here's a quick guide from @BitcoinMalaya:

🧵 Step-by-step: how to withdraw your #bitcoin from LUNO to self-custodial wallet, e.g. @TrustWallet.

Heard people chanting:

“move your coin to self-custody”, “not your key, not your coin”?Here we go 👇🏽

— Bitcoin Malaya (@bitcoinmalaya)

11:44 AM • Sep 8, 2022

Inflation in the UK hit a 41-year high of 11.1%. Bank of England says country is facing the longest recession since records began.

-> Driven by supply chain disruptions spurred by the war in Ukraine, UK is currently experiencing an insane increase in prices.

-> CPI came in at 11.1% in October, exceeding analysts' expectations of 10.7% and significantly higher than September's reading at 10.1%.

-> The Office for National Statistics (ONS) reported an 89% increase in electricity bills for households compared to a year ago.

-> Earlier this month, the Bank of England (BoE) stated that the country is facing the longest recession since records began, with the downturn expecting to last till 2024.

-> To curb inflation, the BoE raised interest rates at a record pace. This year alone, rates were hiked eight times, with the most recent hike at 75 basis points - the largest increase since 1989.

Quick summary

i) The current sentiment is extremely negative. Investors are rapidly withdrawing crypto out of exchanges. Institutions with shady business models will gradually be exposed of their schemes in the upcoming weeks as the contagion spreads.

ii) Another crypto institution has fallen due to the FTX crisis. Genesis Trading was considered one of the biggest firms, similar to 3AC.

iii) Luno Global is putting out fires and has managed to keep things calm for now. Malaysian users should not be worried because Luno MY is deemed to be unaffected, but self custody should never be ruled out.

iv) Inflation is not over. UK's CPI in October came in much hotter-than-expected.

v) Cash is king in the current environment. It is a good hedge against volatility and stabilizes your portfolio.

Disclaimer: I am not a financial advisor. This newsletter is based on my own analysis and research. Do not take any of it as financial advice.

*This newsletter was written at 11.00 AM on 20th November 2022 and completed at 4.45 PM the same day.

To read our newsletter on the day it is published, subscribe to Patreon membership for as little as $1 a month!

Reply