- The Futurizts' Weekly Newsletter

- Posts

- 27 Nov: Bitcoin continues sideways movement, The 'Anwar' effect, Ringgit rallies to 4.45 against USD, Fed to lower rate hikes - Weekly Newsletter

27 Nov: Bitcoin continues sideways movement, The 'Anwar' effect, Ringgit rallies to 4.45 against USD, Fed to lower rate hikes - Weekly Newsletter

This week's top headlines:

i) Bitcoin steadies and trades sideways between $16,000 and $16,500. Upcoming FOMC meeting on Dec 13 will be the next market mover.

ii) The King has selected Anwar as Malaysia's 10th prime minister. The Bursa market and ringgit rallied in response, but will this last?

iii) Recent minutes from the Federal Reserve show lower interest rate hikes 'soon'. US dollar slumps and stocks pump.

Scroll down to read the details.

Get early access to our newsletter and miss nothing from the markets. Join our journey towards financial literacy today.

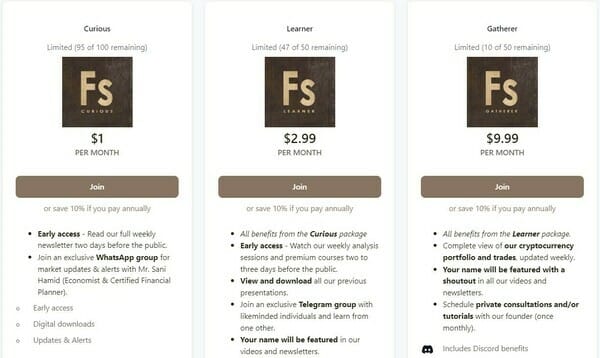

Our private announcement group will keep you updated with market movers and urgent matters. For only $1/month, you’ll receive the newsletter every Sunday night and notifications on important events, some with detailed thoughts from economist Mr. Sani Hamid.

✅ No commitments.

✅ Cancel anytime.

✅ Zero ads, zero shills.

Check out our different packages by clicking on this link.

A summary of what I covered in my previous issue (20th November):

i) The crypto market stabilizes. Bitcoin consolidates at $16,500 and trades sideways for the entire week.

ii) Outflows from exchanges hit an all-time high of 160k Bitcoins per month during the height of the FTX crisis.

iii) Luno’s preferred lending partner, Genesis Trading, halts withdrawals in the wake of FTX’s downfall. Should Malaysians be worried?

iv) Inflation sensation. UK’s CPI in October hit a 41-year high of 11.1%. The Bank of England says the country is facing the longest recession ever since records began.

Read the previous issue here.

Bitcoin continues its sideways movement, awaiting catalysts to move its price.

i) Bitcoin has once again stayed within its tight range, barely skirting astray from $16,000 and $16,500 for the entire week. Although we saw a brief 5% dip to $15,500 on Monday (21 Nov), bulls were keen to defend the two-year low support and managed to push Bitcoin back above $16,000.

ii) As covered in my previous issue, the prediction for Bitcoin's future movement remains the same. I believe that BTC will continue to trade sideways for another 1-2 weeks as it waits for catalysts to move the market.

iii) The upcoming FOMC meeting scheduled for Dec 13 is definitely an event that investors will closely monitor, as the Fed's speech will pave the market's fate for the end of the year.

Long-Term Holders and Whales are Shaken by the Fall of FTX.

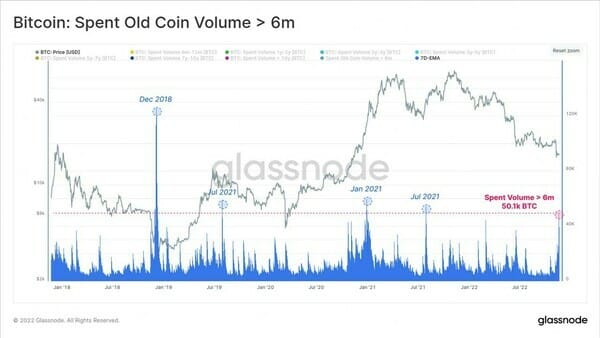

i) The recent on chain data unveiled by Glassnode demonstrates the lack of confidence from whales and long-term holders.

ii) The total supply of Bitcoin held by whales fell significantly. Their holdings have declined by almost 85,000 BTC since the FTX crisis - one of the largest declines this year.

iii) The chart below shows that even the "Diamond Hands" are starting to surrender to market woes. Tracing back to the Terra (LUNA) death-spiral in May, long-term holders have offloaded more than 100k Bitcoins for three consecutive months, making the current decline notable, but still not the worst we've seen.

Bitcoins held for more than 6-months were revived during the market turmoil. The spent volume has matched the previous highs in 2021 and 2020.

On Nov 17, over 130.6k BTC held for more than 6 months were dumped on the market, revealing the significant uncertainty amongst long-term investors, prompting them to shuffle their coins.

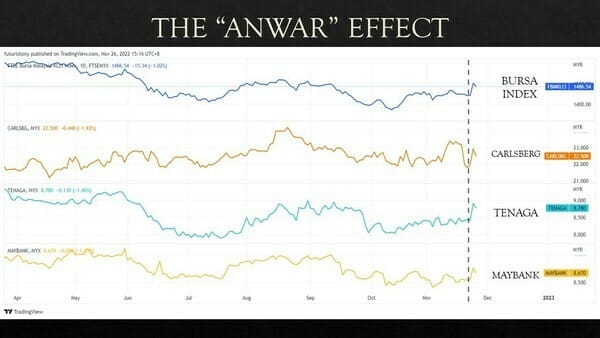

Anwar is Malaysia's 10th Prime Minister. Bursa market and ringgit rallies in response.

i) It was nearly a week after Malaysia's 15th general election (GE15) resulted in a hung parliament. Both Perikatan Nasional (PN) and Pakatan Harapan did not have enough seats to secure the simple majority of 222 parliamentary seats.

ii) The political uncertainty weakened the Malaysian market and our ringgit. Before Anwar was appointed, the ringgit slid to RM4.59 against the US dollar. "Sin" stocks like Carlsberg (CARLSBG), Genting (GENTING), and Magnum (MAGNUM) were bleeding heavily as Perikatan Nasional (PN) was favoured to secure the simple majority through collation of other coalitions (like BN, GPS, etc).

iii) In an abrupt turn of events, then-prime minister Ismail Sabri of Barisan Nasional (BN) stated that his party will not support any coalition, PN or PH.

iv) The arbiter of deciding the nation's 10th prime minister fell to the Yang di-Pertuan Agong. On Thursday (Nov 24), the King consented to appoint Anwar Ibrahim as Malaysia's next leader.

v) Given that Anwar has also served as finance minister previously, many are confident that his market-friendly approach will spur Malaysia's growth.

vi) The Malaysian market and ringgit rallied in response. Many leaders from around the world congratulated Anwar's appointment, including His Holiness Dalai Lama.

The Bursa market surged over 3% on Thursday. Blue-chip stocks like Maybank (MAYBANK), Public Bank (PBBANK), and Tenaga (TENAGA) were up 4% on average.

"Sin" stocks like Genting (GENTING) and Carlsberg (CARLSBG) surged by 6%.

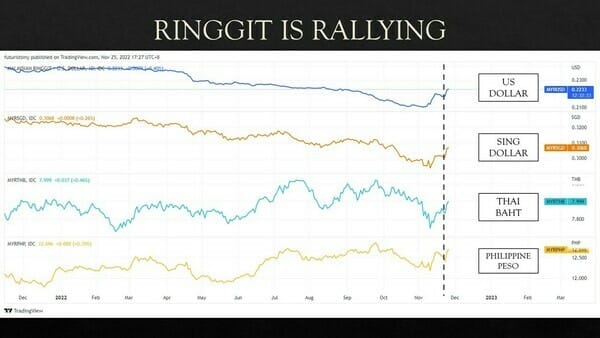

Meanwhile, the ringgit, which suffered losses due to political uncertainty, soared to a 3-month high of RM4.45 against the US dollar before closing at RM4.47 on Friday.

It is now up over 2% against major currencies like the Singapore dollar, Thai Baht, and Philippine Peso since Thursday.

Sani Hamid: Malaysian markets are expected to re-attach themselves to global macro trends after euphoria settles.

Sani Hamid, an economist and certified financial planner, noted the rally in Malaysia's equities, bond market, and the ringgit, but stated that this should not be classified as a bottom signal, as "global macro factors continue to dictate".

As a result we saw the relief rallies across equities, currencies and even the bond market (10Y).

2. The rallies are expected to last maybe another session or so, but we do not expect it to signal a bottom given that global macro factors continue to dictate.

— Sani Hamid (@sanihamid)

4:23 AM • Nov 25, 2022

Mr. Hamid also said that the "honeymoon period" will end when the coalition members start to fight amongst themselves. The Malaysian market should thus re-attach itself to the global trend once the temporary euphoria from Anwar's appointment settles.

4. PM Anwar’s offer to be inclusive wrt to accepting PN into the Unity Govt is a tricky proposition as it will entail managing a coalition of parties that until now, don’t see eye-to-eye.

Honeymoon period will come to an end at first sign of infighting between coalition members.

— Sani Hamid (@sanihamid)

4:23 AM • Nov 25, 2022

5. Malaysian markets are expected to re-attach themselves to global macro trends after euphoria settles.

While there are many more pieces of the jigsaw that have to fit, at least, a key piece has been put in place.

— Sani Hamid (@sanihamid)

4:23 AM • Nov 25, 2022

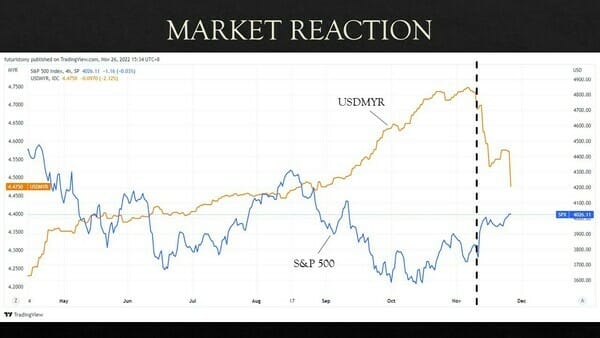

Recent minutes from the Fed show smaller rate hikes coming 'soon'.

The Fed’s Minutes of Meeting, unveiled at 3AM MYT on Thursday, showed that the committee would switch to smaller rate increases ‘soon’.

Prior to the release, markets were already expecting the Fed to soften its current stance, and the minutes reinforced that.

Investors are now 76% certain that the Fed will step down to a 50-bps hike during the next FOMC meeting in December as inflation softens.

However, the minutes showed that interest rates will probably peak higher than what investors had previously anticipated.

The market reaction to this announcement was as plain as day. US equities regained strength while the US dollar tumbled.

Quick summary

i) Long term holders for Bitcoin are in the mode of net distribution at the moment. Withdrawals from centralized exchanges are still near the all-time high of 170k BTC/month. Sentiment remains at extreme fear.

ii) $15,600 seems like a great support for bulls to defend, but the upcoming market mover (FOMC meeting) will determine if Bitcoin will hold. The market should trade sideways till then.

iii) PM Anwar’s appointment has renewed the interest of Malaysians and international investors to our local market. But this is by no means a bottom signal because the fundamentals have not changed.

iv) The temporary euphoria might last till early next week. When the dust settles, the ringgit and Bursa market should re-attach themselves to the global macro trend.

Disclaimer: I am not a financial advisor. This newsletter is based on my own analysis and research. Do not take any of it as financial advice.

*This newsletter was written at 12.00 PM on 27th November 2022 and completed at 4.45 PM the same day.

To read our newsletter on the day it is published, subscribe to Patreon membership for as little as $1 a month!

Reply