- The Futurizts' Weekly Newsletter

- Posts

- What is ASB, ASM, & ASNB?

What is ASB, ASM, & ASNB?

And how can Malaysians invest in it?

Amanah Saham Bumiputera (ASB) and Amanah Saham Malaysia (ASM) are unit trust funds managed by Amanah Saham Nasional Berhad (ANSB).

Established in 1979, there are currently 16 types of funds offered by ASNB, each with a varying degree of risk. But for today’s purposes, we’ll focus on the ones with the lowest risk: ASB and ASM.

ASB and ASM are Fixed-Price Unit Trust Funds.

Each unit of the fund is always priced at RM1, giving you the flexibility to plan your investments without worrying about market volatility or price swings.

To be clear, there are four other fixed priced unit trust funds (ie. ASB2, ASB3 Didik, ASM2 Wawasan, and ASM3) that are also fixed at RM1 per unit.

Like ASB and ASM, they have the same investment objectives and deliver similar returns (more about this below).

Variable price funds, on the other hand, are not fixed at RM1 per unit and can fluctuate from time to time.

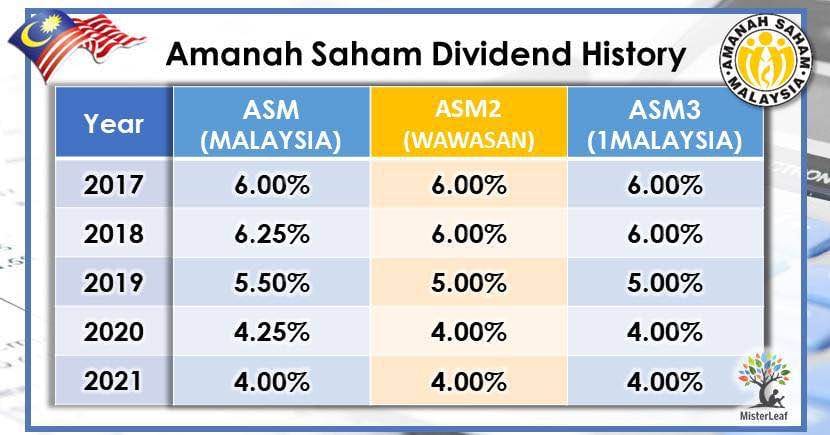

ASB and ASM pay impressive dividends

The payout averaged 5.14% and 4.50% in the past 6 years for both funds, which is more than 2x the annual return of traditional fixed deposits (Maybank’s 12-month FD is currently 2.05%).

Even during the height of the pandemic in 2020, both funds managed to deliver dividends above 4%.

The dividends are exempted from tax!

Your earnings are not taxable and there are also no sales charge or upfront costs when you start investing, unlike other unit trust funds which charge up to 5%.

The payouts from ASB and ASM are declared yearly but the calculation is done monthly based on the lowest balance in your account.

What about withdrawals?

You can withdraw up to 2,000 units (or RM2,000) from ASB or ASM every month through the myASNB app online.

Your money will be credited on the next business day. If unsuccessful, the units will be credited back into your unit trust fund account within 10 business days.

For bigger amounts (>RM2,000), you have to be physically present at an ASNB branch.

What does ASB invest in?

According to the 2022 annual report,

79.26% of the fund was allocated in equities (ie. stocks).

8.09% was in fixed income investments.

11.12% was distributed to other investments.

21.32% of the fund is allocated in Maybank, which means that, for every RM1,000 you have in ASB, roughly RM213 goes to the most valuable company in Malaysia.

So, when you’re investing in ASB, you’re really putting most of your money into dividend paying stocks.

What about ASM?

According to ASM’s 2023 annual report,

83.80% of the fund was allocated into equities.

6.19% was in fixed income investments.

8.04% was distributed to other investments.

Like ASB, ASM’s largest equity holding is also in Maybank, making up 11.29% of the fund. However, going down the list, the top 10 holdings of ASM are slightly different.

What about other funds like ASB 2 and ASM 2 Wawasan?

These funds serve the same function as ASB and ASM with similar annual returns, but their asset allocations are slightly different.

Take ASB 2 for example; its largest holding is also in Maybank, but the percentage is over two times lesser compared to ASB’s holding of 21.32%.

For ASM2 and ASM3, both funds have their largest holdings in Maybank (which is the same as ASM), but the percentages of the top 5 stocks differ slightly.

Return wise, ASB and ASM have pretty much the same performance as its lesser known constituents.

Alright, tell me the risks.

Returns are not guaranteed. ASB and ASM dividends fluctuate based on market conditions and interest rates.

Not insured by PIDM. Since these are considered investments, your money is not protected by PIDM.

Limited availability. ASM* Funds have a non-bumi quota that can make buying the funds difficult if the limit is hit.

*If you didn’t manage to acquire any units from ASM, you can try buying ASM2 and ASM3, since their returns and investment objectives are quite similar.

How Do I Register?

i. Download the myASNB app and enter your personal details.

ii. Take a photo of your IC and be ready to take videos/selfies for verification.

iii. Setup your username and password.

iv. Complete the one-time risk assessment and you’re set!

It took me only 10 minutes to register and get approved.

My Verdict

ASB and ASM are great options for those who have a lower risk preference and seek a steady stream of income.

However, if you're aiming for greater returns, it may be more appropriate to consider other alternatives.

If you’ve made it this far, it means you’re serious in improving your finances.

Everyday, 490+ Malaysians in our paid WhatsApp group receive:

✅ Updates on tax, EPF, savings & investing

✅ Clear comparisons on where to grow money

✅ No ads or sponsorships

Some of the topics may also appear on Instagram, and that’s intentional. Instagram is for summaries. WhatsApp is for more context and clarity.

Disclaimer: Investing in a unit trust fund has its own risks as it is different from opening a deposit account with a financial institution. You should speak with a financial planner before making any investing decisions. ⚠️

Reply