- The Futurizts' Weekly Newsletter

- Posts

- Bitcoin and Gold - My Retirement Strategy

Bitcoin and Gold - My Retirement Strategy

I've been investing in both assets since 2021, and I'm one step close to my retirement number.

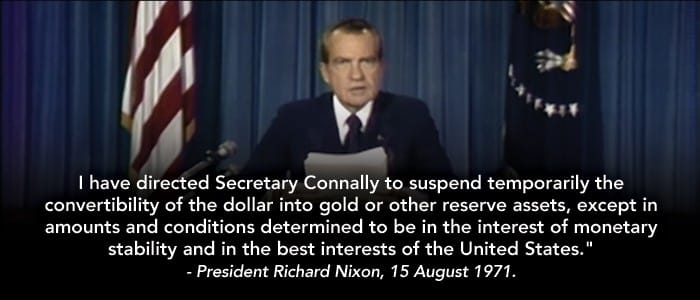

IN 1971, Richard Nixon, the then president of the United States, ended the dollar’s convertibility to gold.

He outlined three main goals:

Lowering the unemployment rate

Stemming the rise in inflation

Protecting the US dollar from international money speculators

Little did he know, this move would seed the beginning of an era of inflation that nobody has ever seen.

Before 1971, the value of the US dollar was tied to gold at a fixed rate of $35 per ounce.

This system was established under the Bretton Woods Agreement of 1944, which aimed to create a stable international monetary system after World War II.

Under this design, other countries would peg their currencies to the US dollar, while the dollar itself was backed by gold.

This meant that foreign governments could exchange dollars for gold at any time, which gave the dollar strong credibility as the world’s reserve currency.

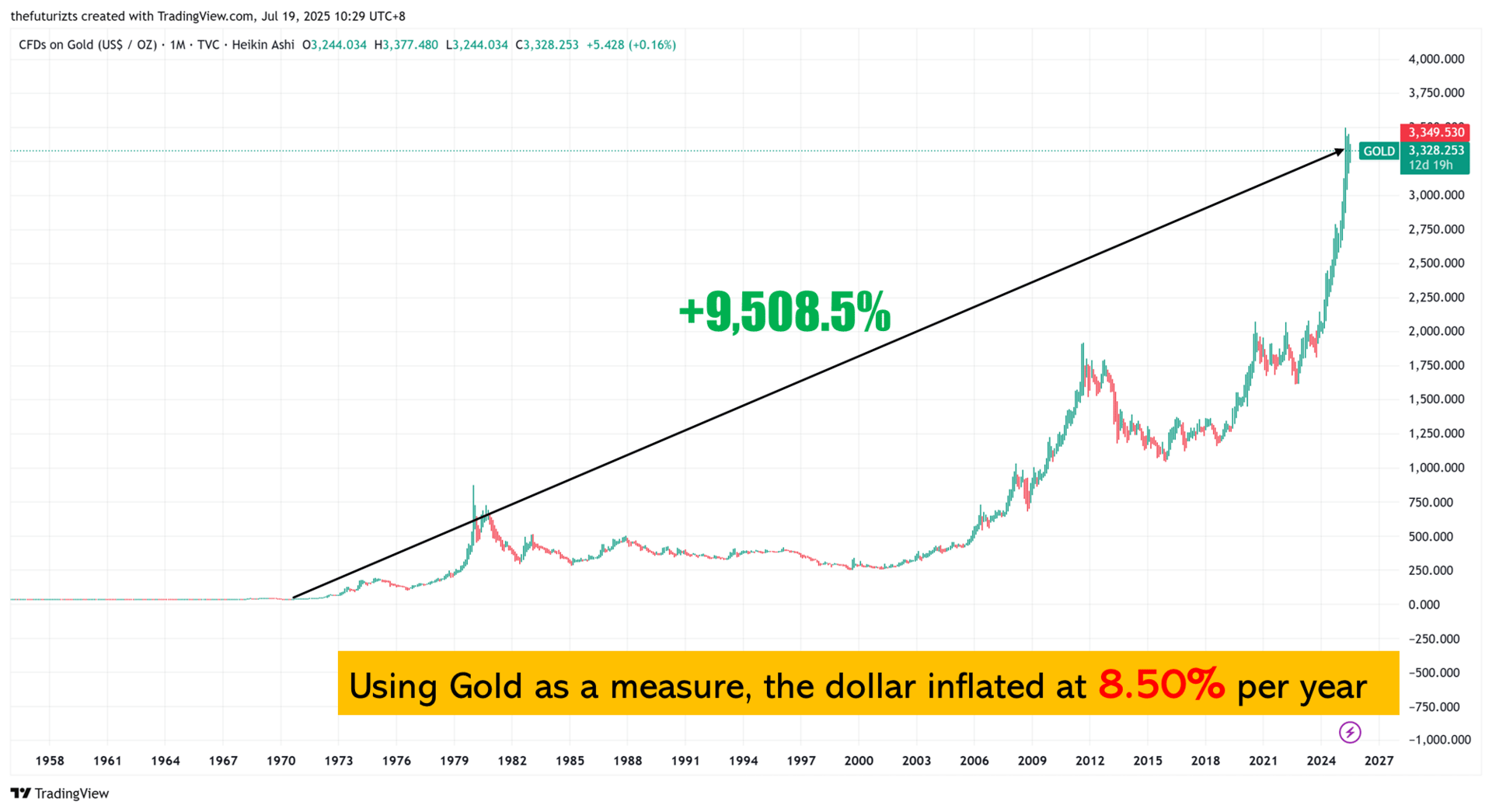

Now, over 50 years after Nixon ended the dollar’s convertibility, gold has shot up by more than 9,500%, showing the true extent of the currency’s devaluation.

With gold now priced at around $3,300 per ounce, the US dollar has effectively depreciated by about 8.5% per year when measured against gold.

This is a far cry from the “official inflation” figures that governments like to report. And for Malaysia, the situation is either just as bad or even worse when it comes to the ringgit.

Of course, measuring inflation using gold isn’t entirely fair, because gold itself can fluctuate. But it gives a much clearer picture of how much currencies have truly lost value against hard assets over the years.

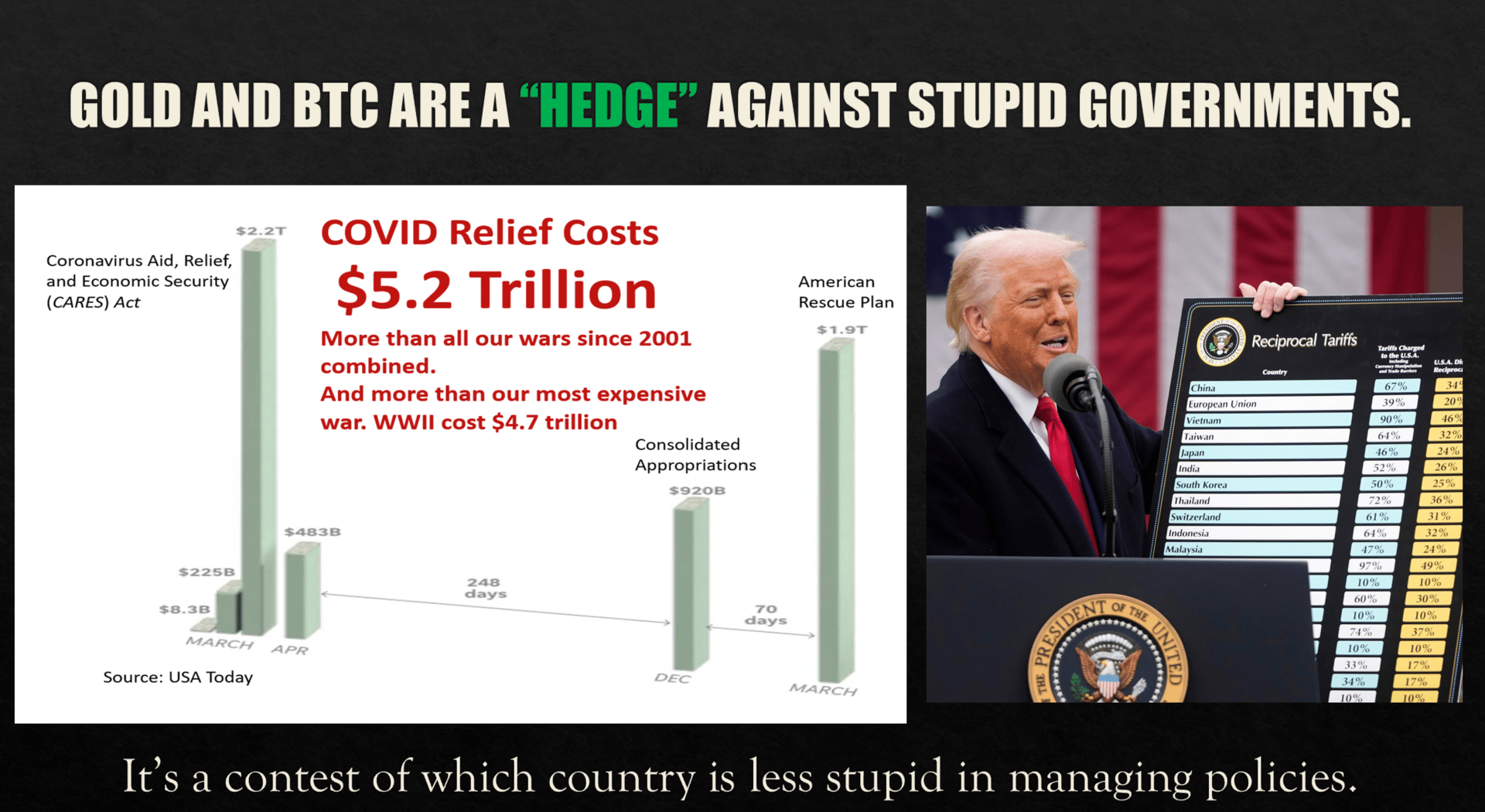

This is exactly why I invest in both Bitcoin and gold — to protect my portfolio from “stupid” governments that keep printing money and devaluing their currencies.

My strategy for Bitcoin and Gold

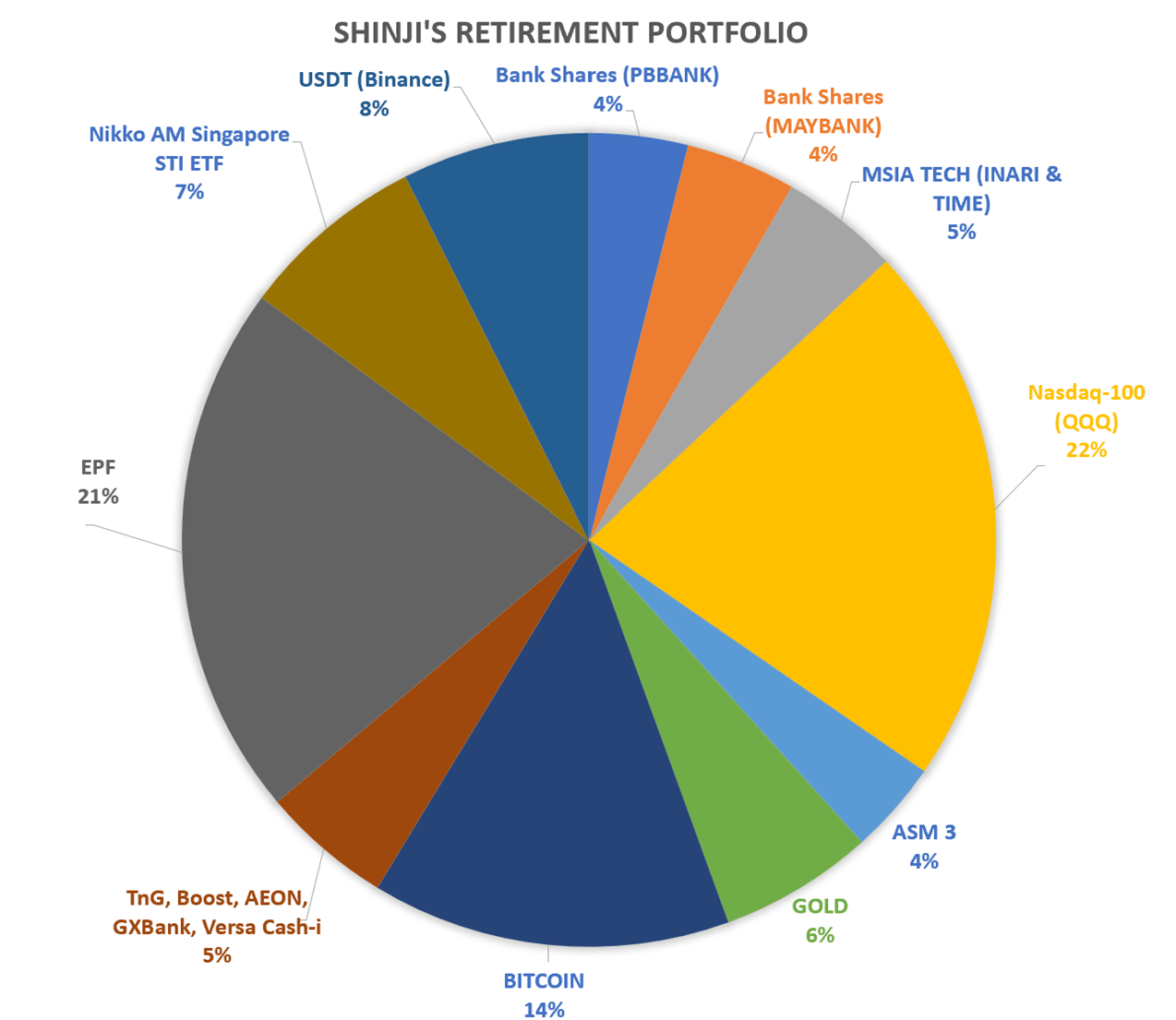

At any given time, I aim to keep at least 15–20% of my retirement portfolio in Bitcoin and gold.

Right now, my exact allocation is 14% in Bitcoin (BTC) and 6% in gold. I try to maintain these percentages over time by:

Converting gains into other assets whenever I become overexposed (for example, if Bitcoin exceeds 20%).

Buying more Bitcoin or gold whenever the allocation drops below my target range.

This is how my retirement portfolio looks like, including EPF

This strategy ensures that I’m not too fazed by overall market movements and focus on my target allocations.

You can follow a similar approach by:

Fixing a percentage for each asset in your portfolio (for example, 20% US stocks, 15% Malaysian stocks, 10% Bitcoin, etc.).

Gradually adjusting your portfolio to match those target allocations over time.

Rebalancing whenever necessary to avoid overexposure or underexposure to a particular asset.

Therefore, if you’ve done a piechart of your portfolio and found that 70-80% of it is in EPF, that’s a signal that you’re overexposed in “safe” assets, and should be focusing on risky ones (ie. BTC, Gold, stocks and ETFs).

How about Dollar Cost Averaging (DCA)?

DCA is still the best strategy if you’re just beginning to dip your toes into both assets and if you don’t have much capital to commit.

In fact, I regularly DCA into US ETFs (specifically QQQ) and aim to increase it to ~25% of my portfolio. Only then, will I start to regularly buy Bitcoin and gold.

But Bitcoin and gold are at all time highs now…

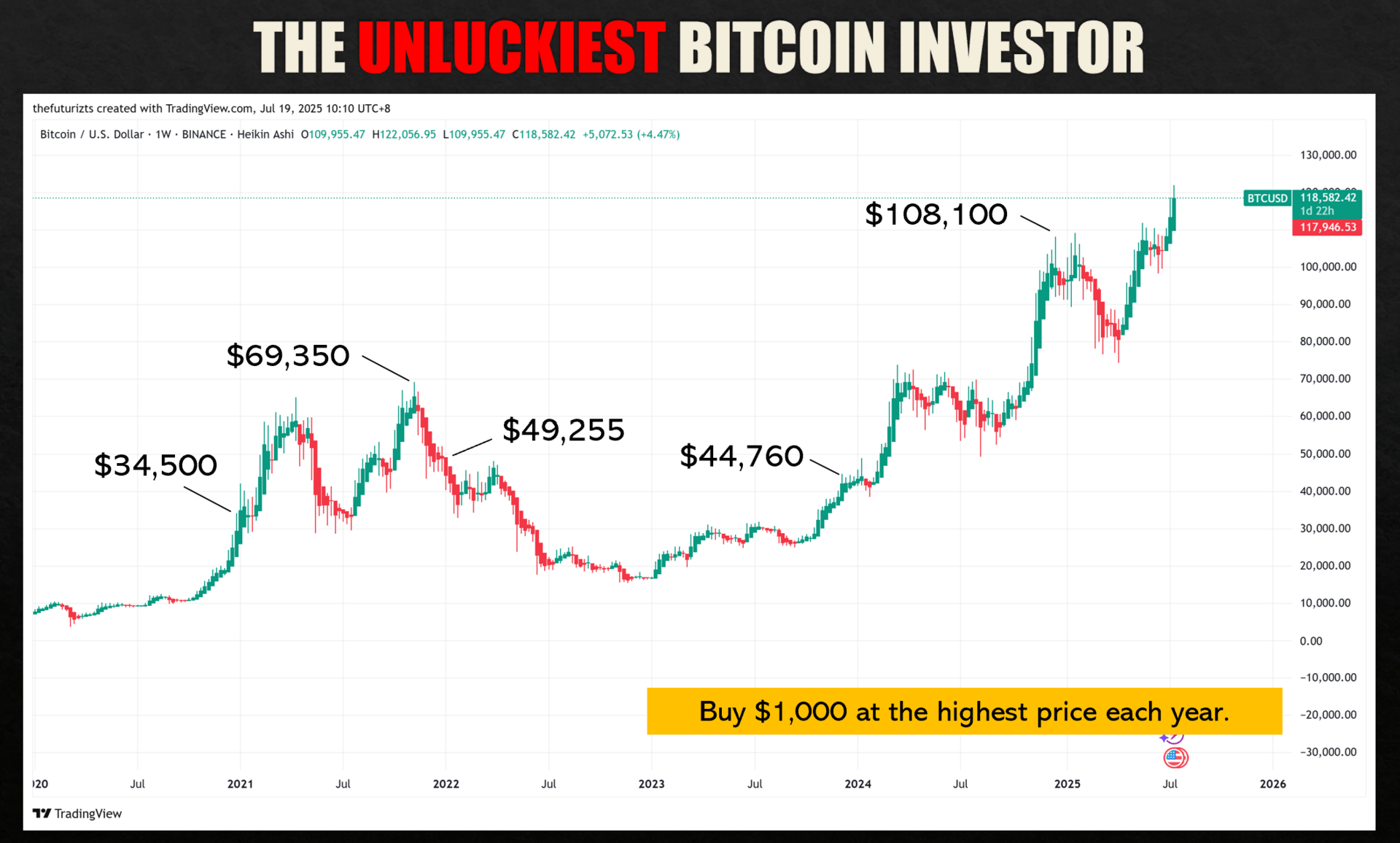

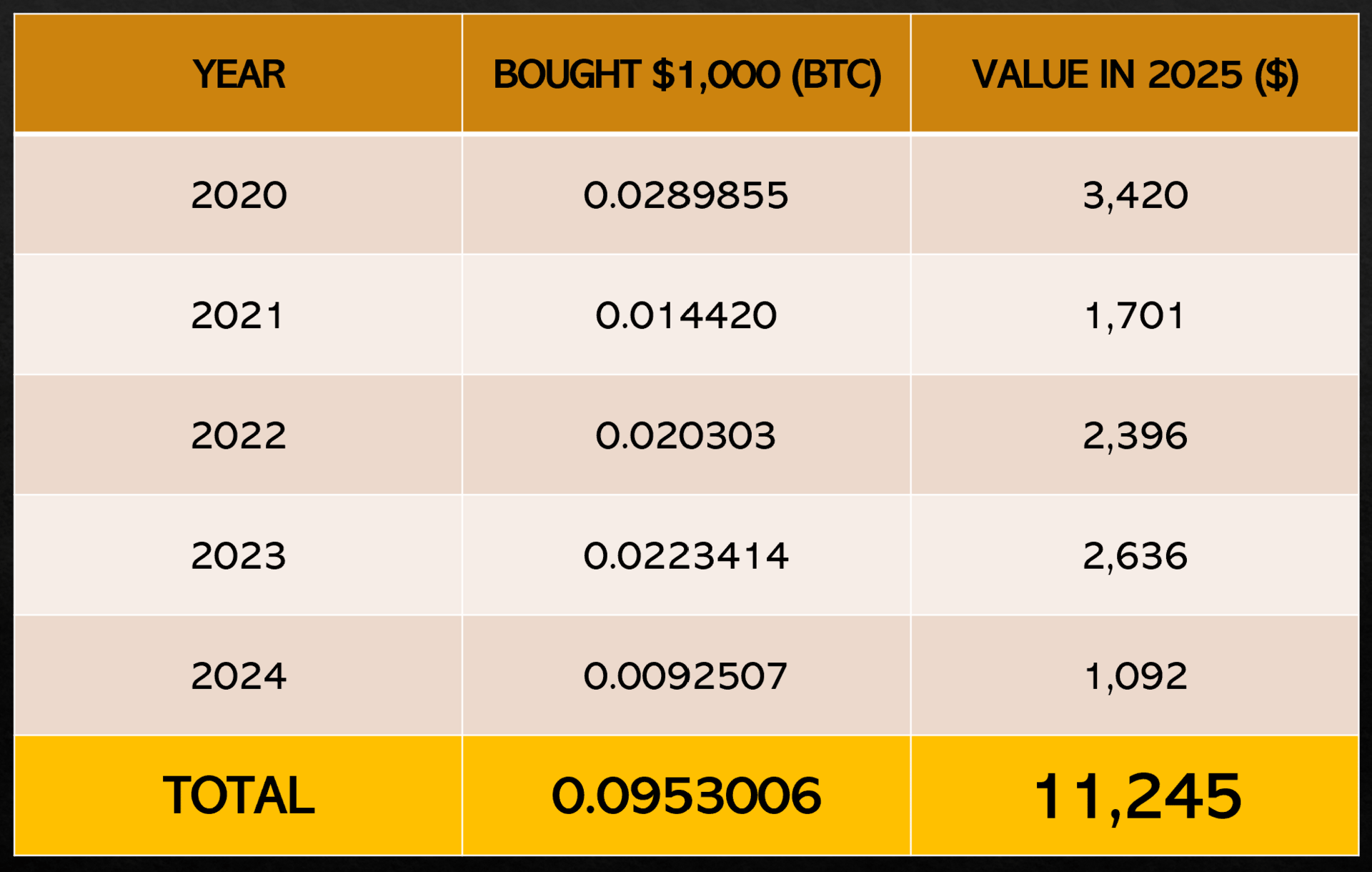

Let’s say you’re the unluckiest Bitcoin investor over the past 5 years.

Regardless of all the advice out there about DCA or consistent financial habits, you only buy Bitcoin at its highest price every single year.

Even with such terrible timing, if you had simply held onto your Bitcoin, you would have more than doubled your capital in these 5 years.

If even the unluckiest investor can still make a 2x profit, it says a lot about how pointless it is to try timing the market perfectly.

So stop speculating, and start allocating.

Where and how to invest in BTC and gold?

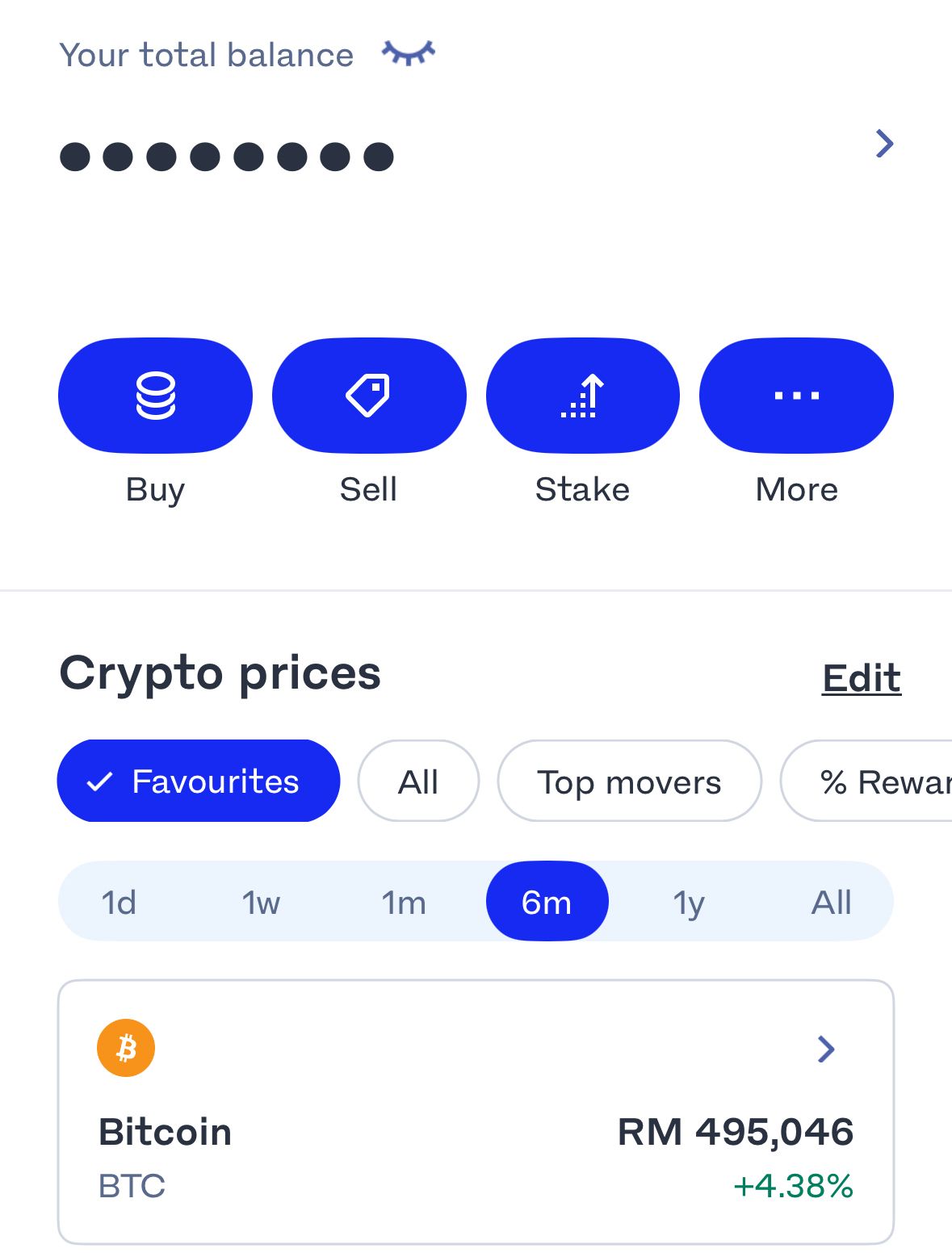

I’m using Luno to invest in Bitcoin.

Start from RM1

Regulated by the Securities Commission

Shariah-compliant (Bitcoin)

Deposit instantly using TNG e-Wallet or banking methods

Withdraw in 2-3 business days

For gold, I’m using Versa Gold.

Shariah compliant

Relatively low fees (0.33% per year)

Start from RM100

Backed by physical gold (min. 95% of the fund)

Versa Gold is not the option with the lowest fees, but because I’m already a regular user of Versa, it’s very convenient for me to switch my funds (from Versa Cash to Versa Gold) in the app.

Thanks for reading till the end!

DISCLAIMER: The information contained in this newsletter is for informational and educational purposes only. Nothing herein shall be construed to be financial, legal, or tax advice. The opinions of this newsletter are solely that of the publisher.

Thanks for reading till the end!

Join our WhatsApp group to receive financial updates - best FD rates, currency movements, and more on a daily basis.

✅ 280+ people have joined.

✅ We don’t spam.

✅ It’s only RM4/month

✅ Pay monthly, cancel anytime.

Reply