- The Futurizts' Weekly Newsletter

- Posts

- Budgeting Techniques I Wish I Knew Earlier

Budgeting Techniques I Wish I Knew Earlier

Everyone has a different way of managing their money.

So it’s difficult for me to tell you a “one size fits all” budget that is guaranteed to make you money, because I don’t know your:

age

life goals

personality

retirement target

wants and needs

You may say “I want RM3 million to retire” or “I need a landed property and I’ll be happy,” while some may say “I just want to have enough money everyday without worrying about putting food on the table.”

Each person’s goals and aspirations are very different, so a budget that works well for me, may not work for you.

Therefore, it’s important to take whatever I’m sharing within this article with a grain of salt and figure out your own best way to budget your money.

One big tip to make sure that your budget secures your future is by setting a specific percentage of your income to set aside (ie. 10%, 20% or more) during the start of the month.

The rest, is entirely up to you on how you want to allocate it.

The 50-30-20 Budgeting Rule as a starting point.

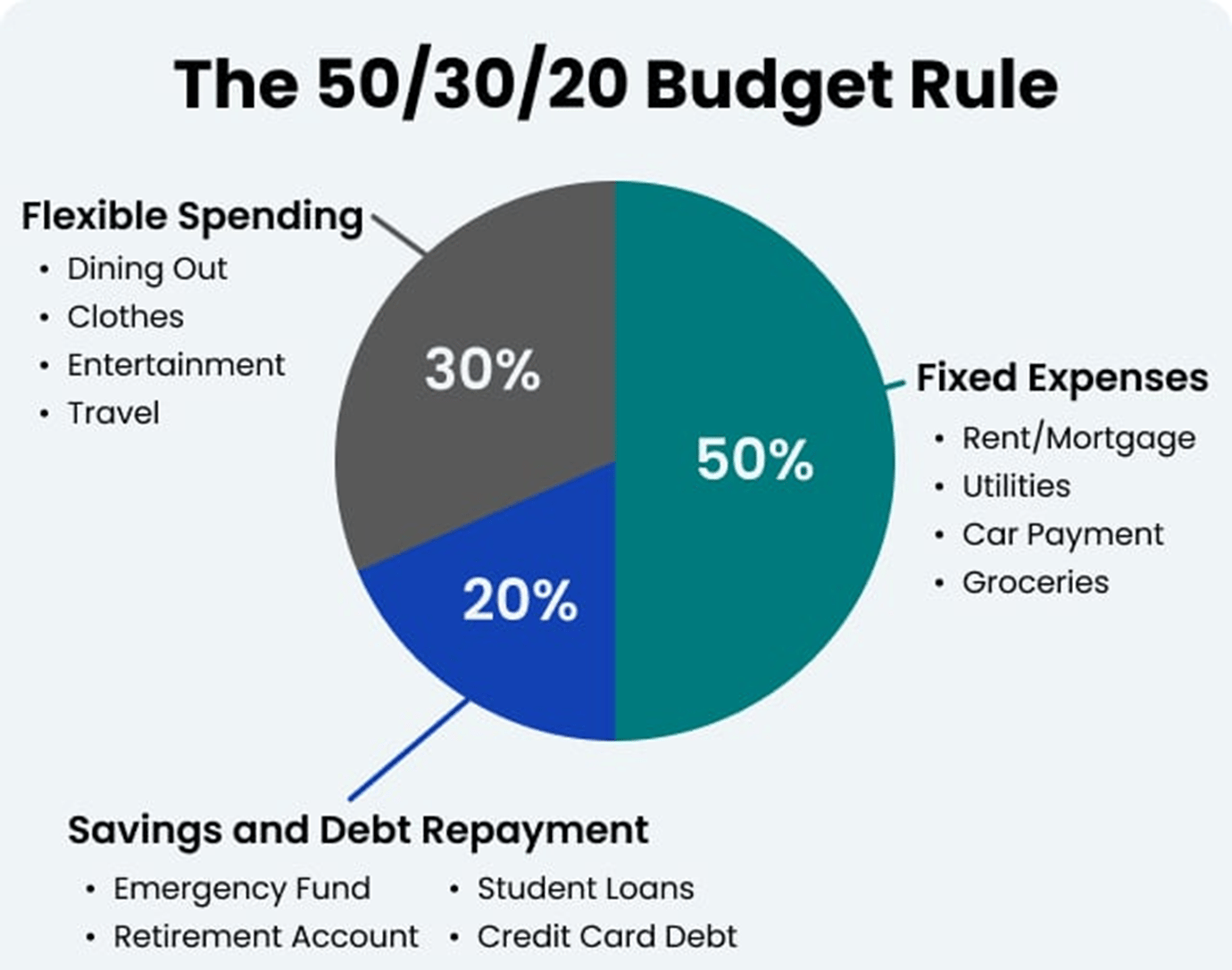

This rule is simple and covers all the fundamentals. It allows you to save for the future while living in the moment:

50% of income for needs

30% for wants

20% for savings

I used to follow this budgeting technique with a passion, but as months passed, I found this method quite rigid because you’d have to clearly define your wants and needs, which isn’t always straightforward.

For instance, when shopping for groceries, salmon could be considered as a want, but what about other stuff like beef or butter?

Usually, beef is much more expensive compared to chicken — and if groceries are a need, do you just stick to the cheapest?

Also, when it comes to butter, is it “right” to treat yourself to a higher quality butter or should you just buy the cheapest?

This is where the 50-30-20 rule gets quite confusing, and rightfully so, because everyone’s wants and needs cannot be clearly segregated. It’s a thin line — some things may be a necessity to you, while a want to others.

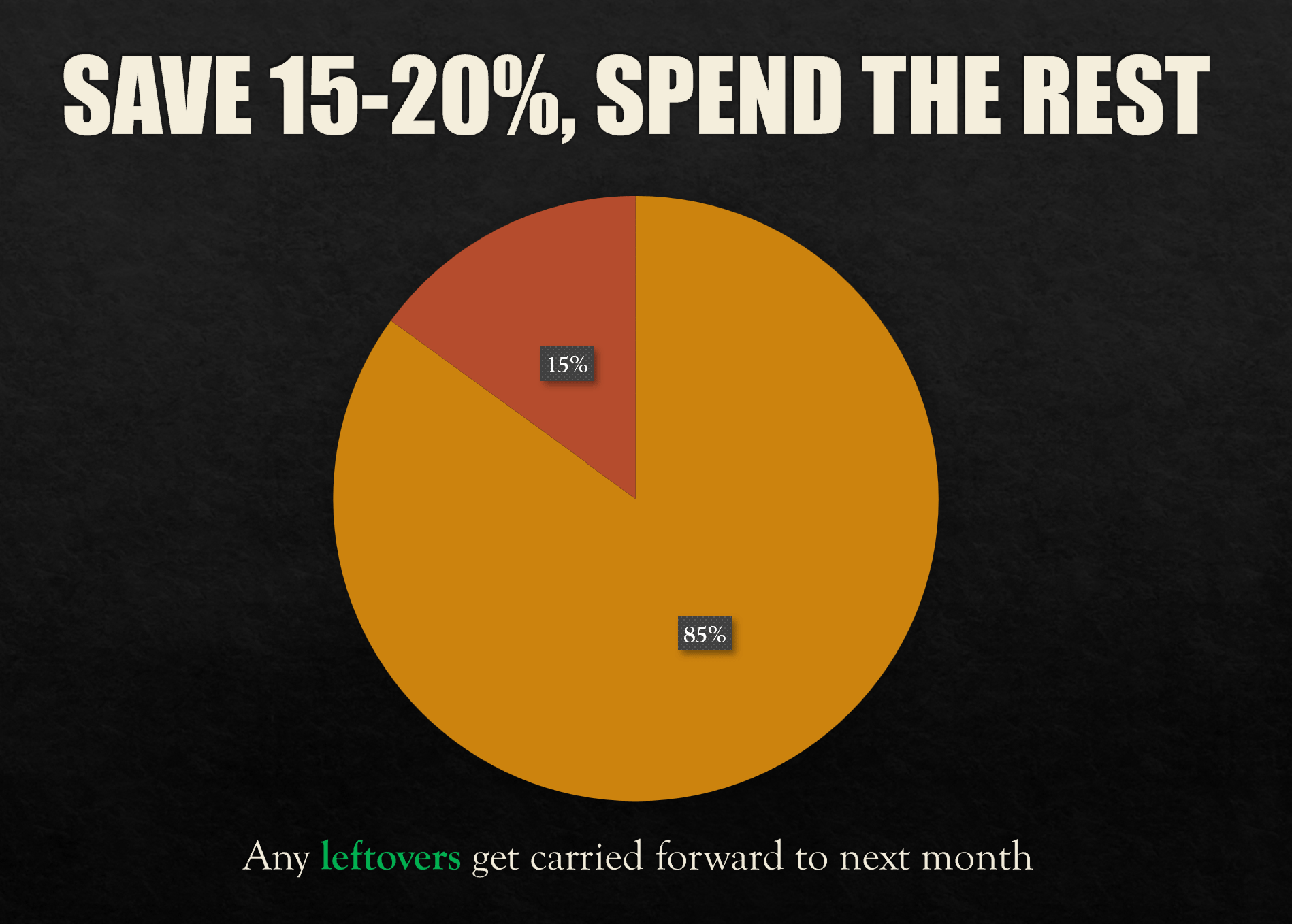

Because of this, I just save 15-20% of my pay and spend the rest.

When my salary comes in, I immediately send part of it to a place I won’t see to generate profit (ie. cash apps, ASB/ASM).

Any remainder during the end of the month gets carried forward to the next month, and I repeat the same process.

Several guidelines I follow on spending on specific categories

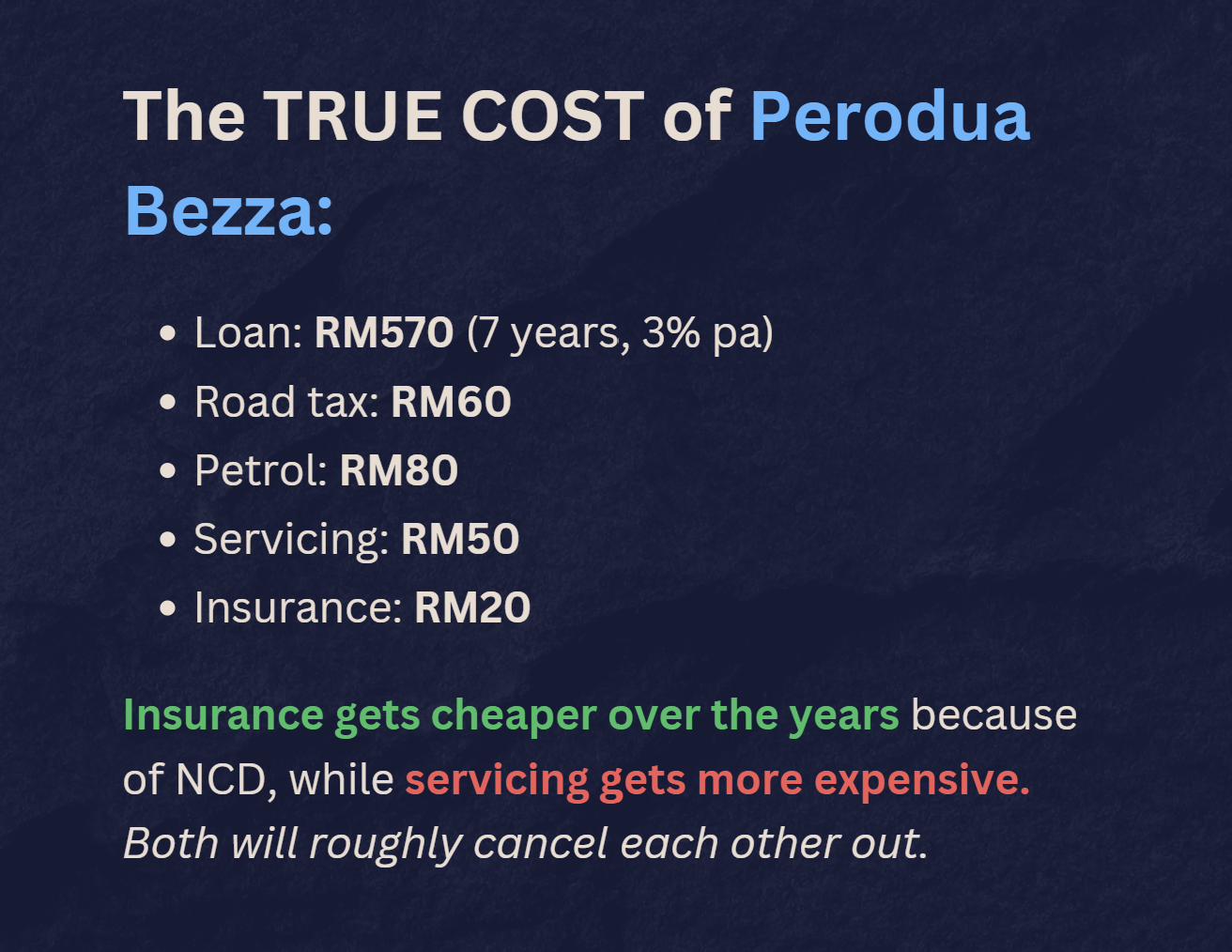

1) Transport - not more than 20% of my income.

There is a general rule of thumb saying that your monthly car instalments should not exceed 20% of your pay.

I take this a step further and ensure that this entire category, which covers fuel, toll, parking, maintenance, car insurance, etc., remains below 20% of my income.

Very often, owning a car is not only about paying the monthly instalments.

For the car loan tenure, I would typically choose a 7 year tenure — to balance between paying too much monthly instalment and interest.

2) Housing and utilities - not more than 30% of my income.

The general rule of thumb states that your rent/mortgage should not exceed 30% of your salary.

Again, I take this a step further by making sure that all my housing needs (ie. electricity, wifi, etc.) are below 30% of my income.

I’m currently renting a 715 sq ft apartment at RM1,500 per month and use the PEWWA checklist to include other necessities:

P arking (RM120)

E lectricity (RM280-300)

W ifi (RM105)

W ater (RM10)

A ircond servicing (RM20)

Including these 5 things, the total monthly cost of my housing adds up to RM2,035. I round it up to RM2,100 just to have a comfortable buffer.

3) Use savings pots to save towards a goal and control your spending.

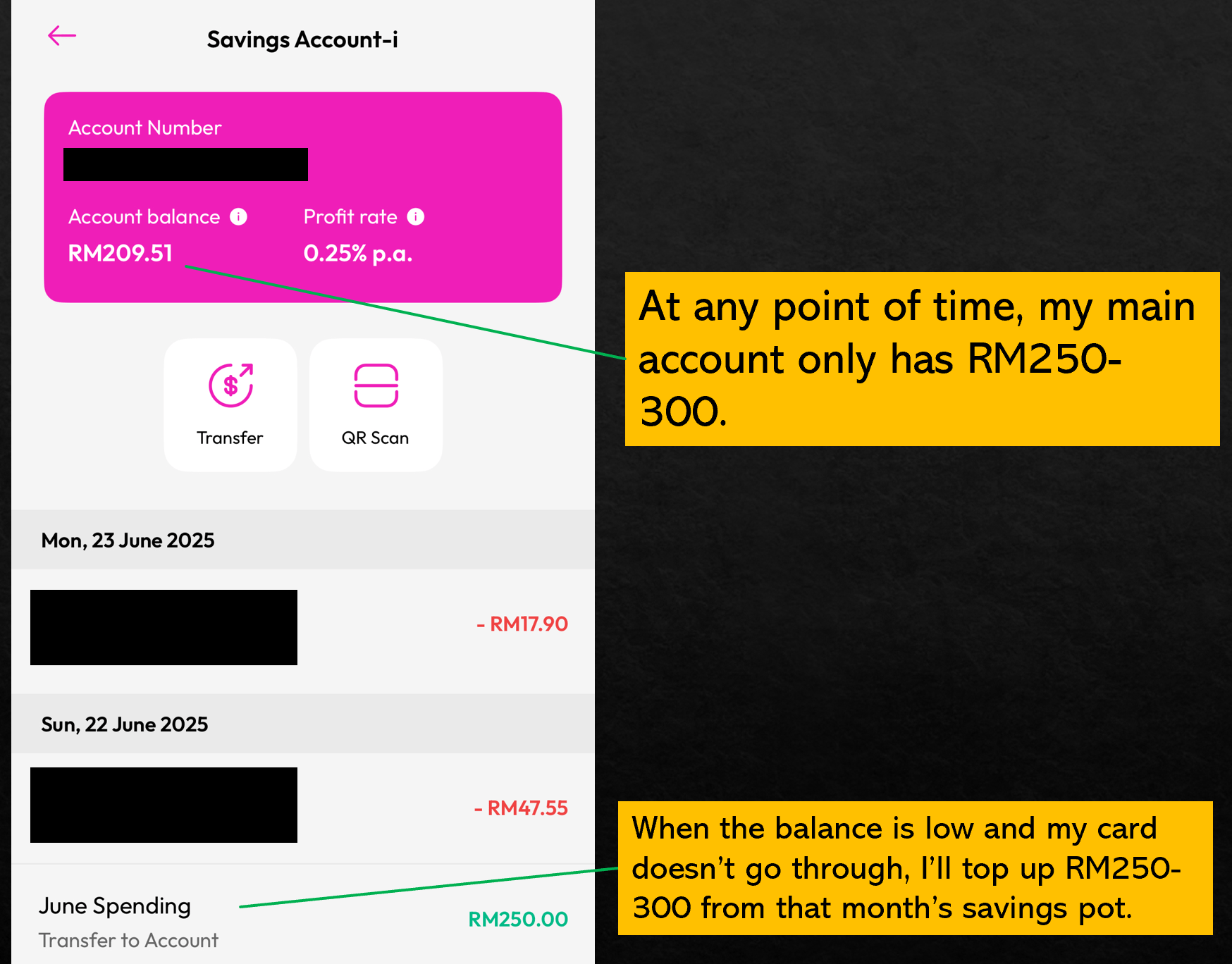

One method that I use to control my spending is through Savings Pots in digital banks.

I create a new pot every month and store most of the month’s spending there, only withdrawing a fixed sum every week.

When my card doesn’t go through, that’s a signal that I’ve spent too much for the week.

To control things even further, I only withdraw RM250-300 at once from my savings pots.

So, if there’s a transaction more than this value, it will prompt me to think twice.

If I really need it, I would have to withdraw the additional sum from that month’s savings pot.

To me, this method removes the need to keep track of every single cent you spend.

You also won’t see the “full sum” in your main account, which some people may be tempted to splurge.

All four digital banks (AEON Bank, GXBank, Rize, and Boost) support savings pots, but GX and AEON are the most user-friendly.

But what if the app that supports savings pots offers very low earnings (ie. GXBank 2% pa)?

In that case, I only store a small sum there, but for other digital banks (Rize, AEON, Boost), their profit rate is 3-3.08% pa (which is ok lah).

For context, I would sacrifice 0.50-1% profit to use an app with lower earnings but still supports savings pots.

It helps me organize my short term savings better, rather than lumping everything into one giant sum and remembering how much is for what.

Thanks for reading till the end!

DISCLAIMER: The information contained in this newsletter is for informational and educational purposes only. Nothing herein shall be construed to be financial, legal, or tax advice. The opinions of this newsletter are solely that of the publisher.

We get it, your time is valuable and you hate sifting through the web for information.

So let us do the work for you.

By joining our WhatsApp group, you’ll receive financial updates - best FD rates, currency movements, and more on a daily basis.

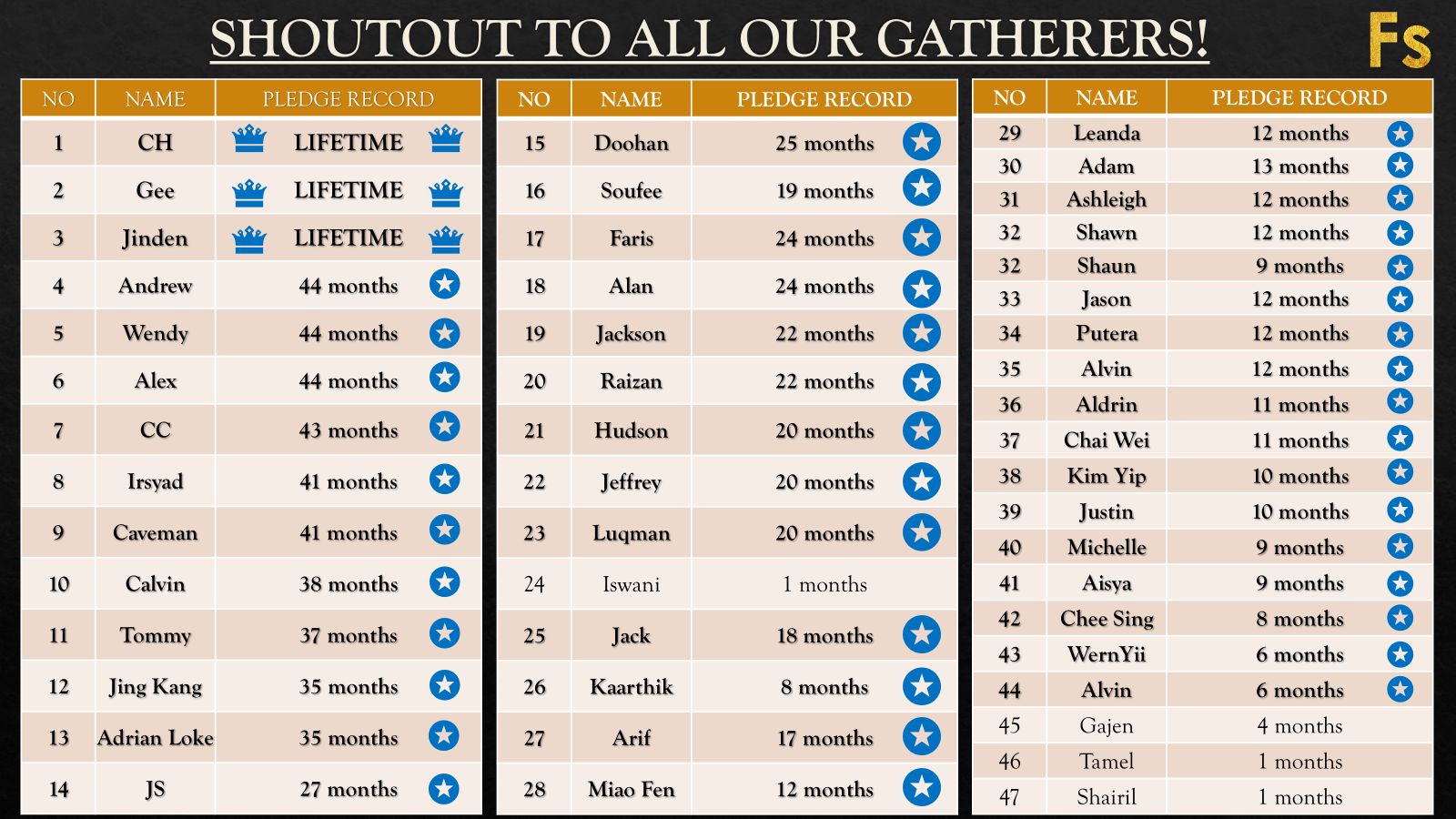

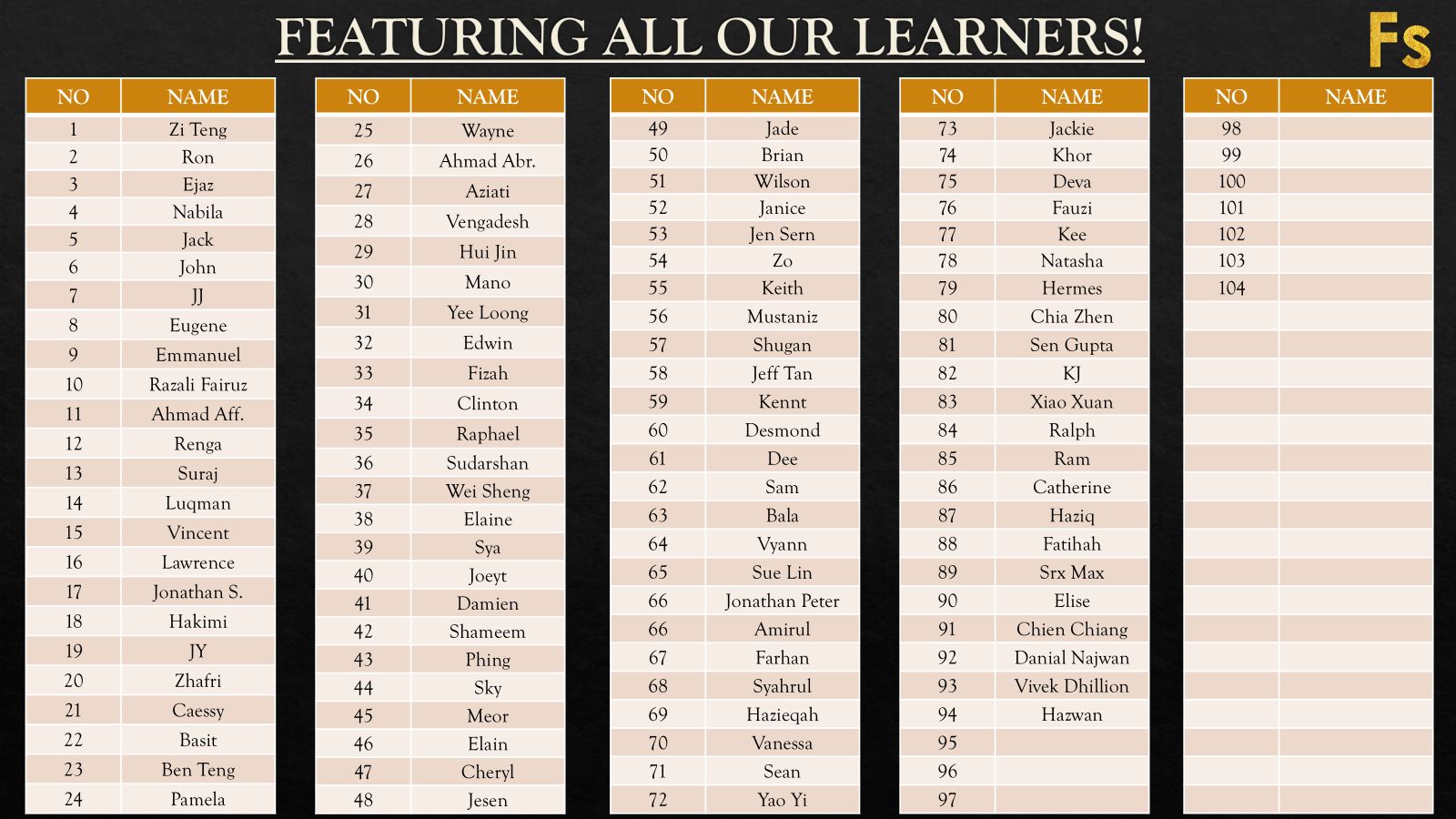

✅ 300+ people have joined.

✅ We don’t spam.

✅ It’s only RM4/month.

Reply