- The Futurizts' Weekly Newsletter

- Posts

- I Read LHDN's 2024 Explanatory Notes

I Read LHDN's 2024 Explanatory Notes

Here's what you CAN / CANNOT claim for tax relief.

Every year, LHDN releases Explanatory Notes on how tax reliefs work, including what you can and cannot claim.

It doesn’t answer every tax question out there, but many of the common mistakes and misunderstandings are already addressed in the document.

I’ve gone through the BE 2024 Explanatory Notes (the 2025 version isn’t out yet).

Here are 13 things you should know before filing your taxes in March.

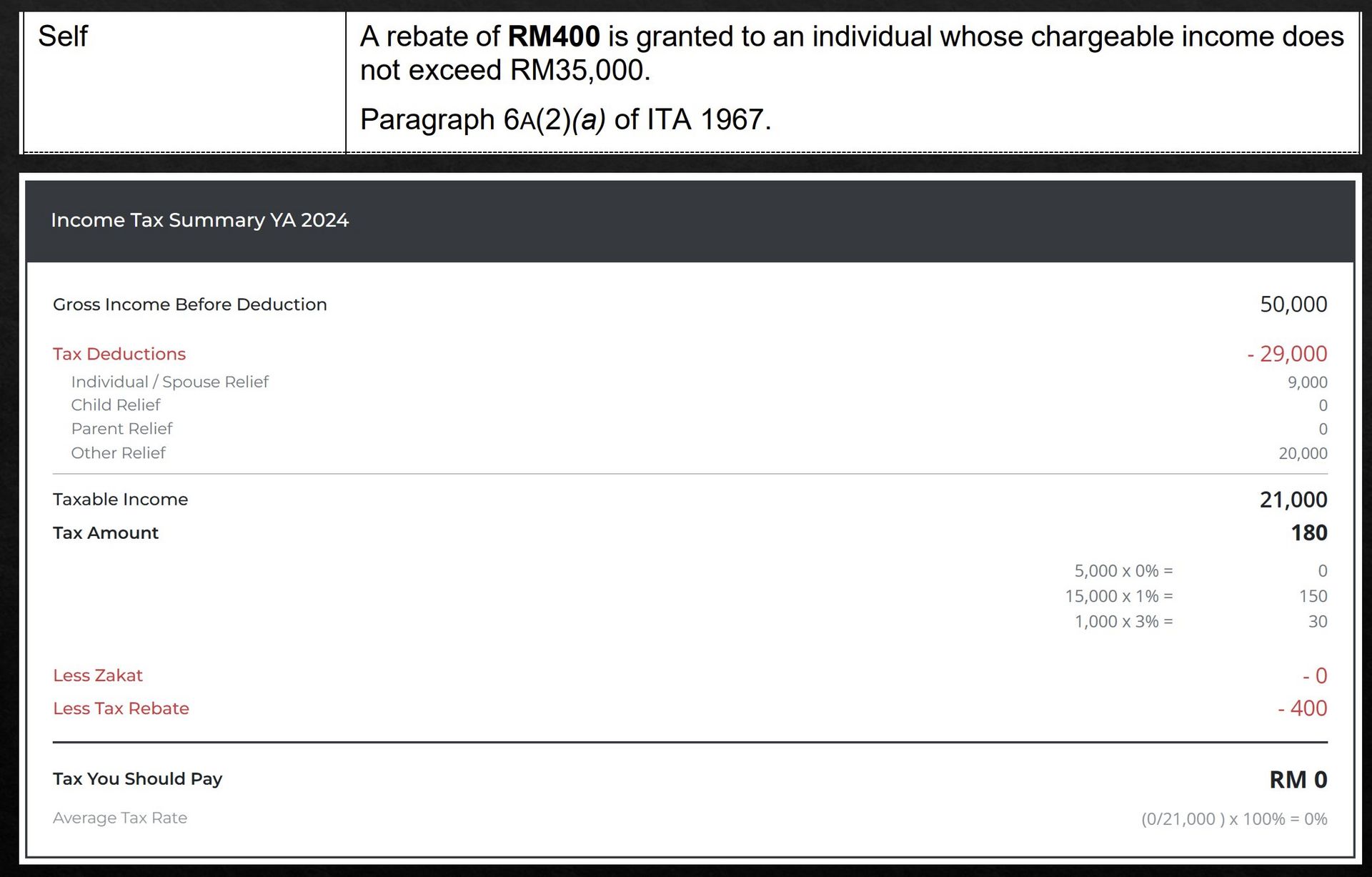

1. The RM400 Tax Rebate Is Often Misunderstood

If your chargeable income does not exceed RM35,000, you are entitled to a RM400 tax rebate.

Key point: This applies to chargeable income, not gross income.

You can earn RM50,000 and still qualify for this rebate, if your tax reliefs legitimately reduce your chargeable income below that threshold.

In this example, after tax deductions (RM29,000) and rebate (RM400), the final tax is RM0.

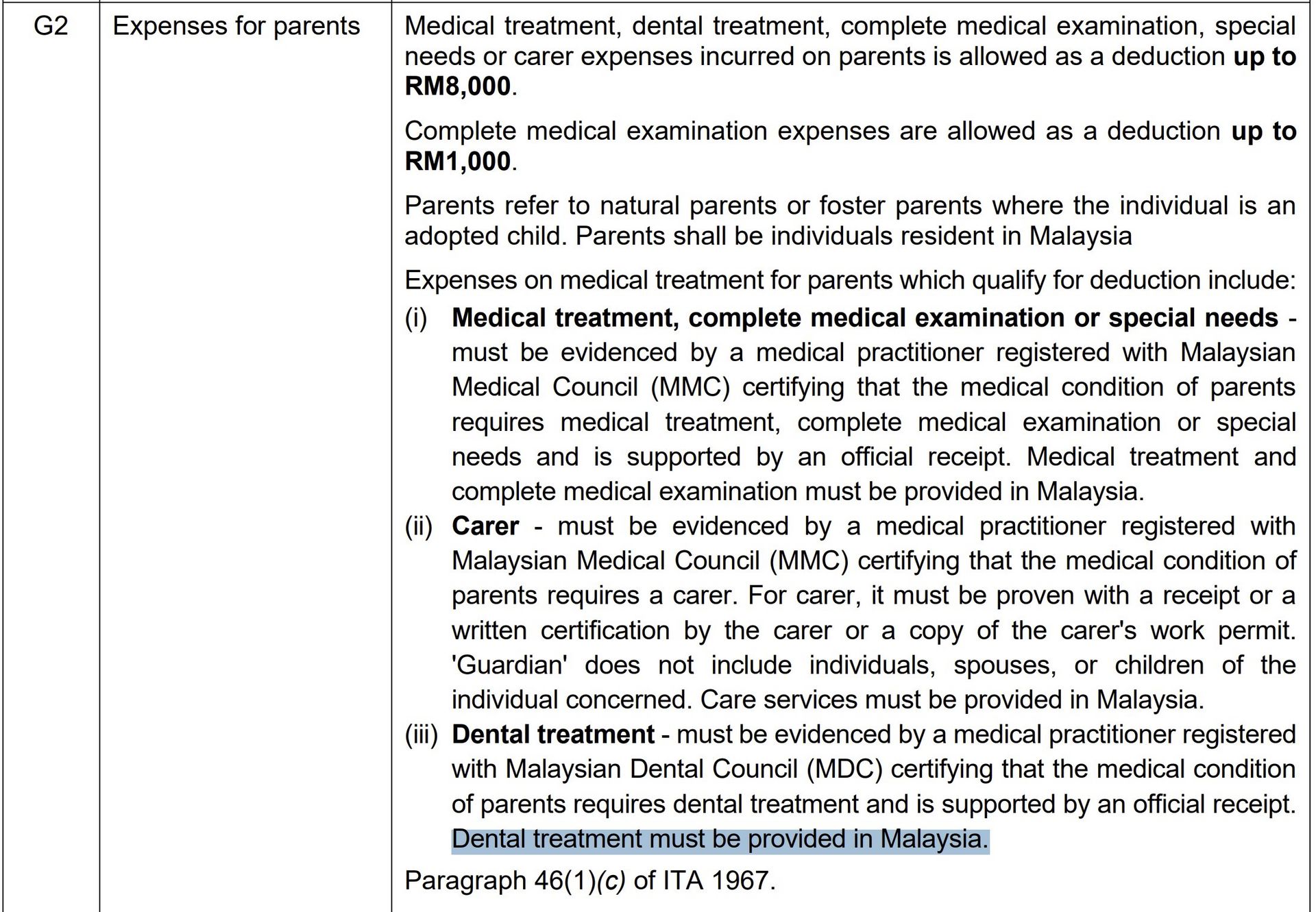

2. Medical Expenses for Parents: Up to RM8,000

You can claim up to RM8,000 for medical expenses incurred on your parents, limited to:

Medical treatment

Dental treatment

Complete medical examination (up to RM1,000)

Special needs or carer expenses

Important conditions:

Parents must be resident* in Malaysia

Treatment must be provided in Malaysia

Dental claims must be for treatment purposes, not cosmetic

*Non-Malaysian parents (e.g. PR, long-term pass holders) who are resident in Malaysia is claimable.

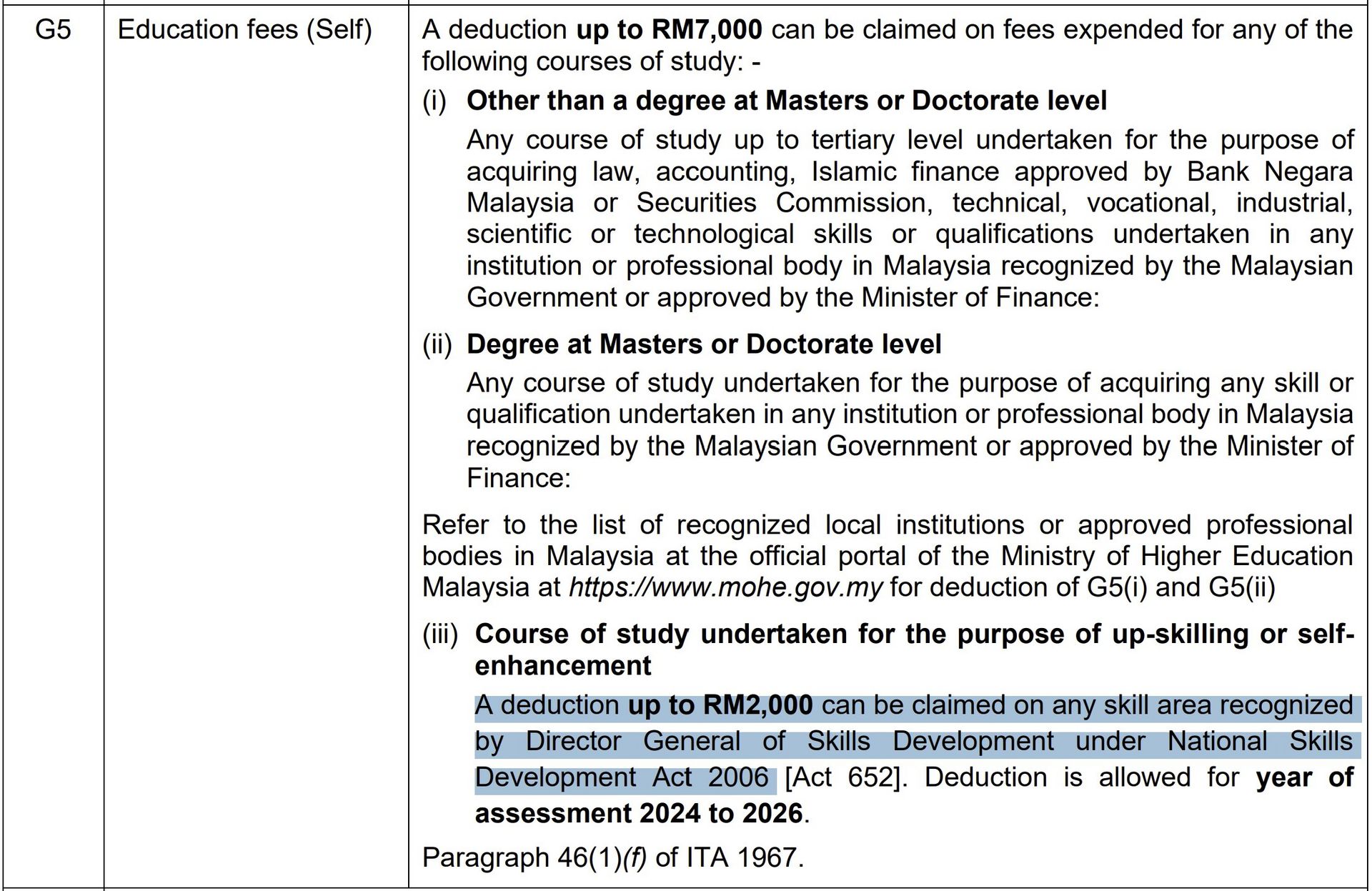

3. Education for Self: Up to RM7,000

Education relief for self is capped at RM7,000, covering:

Courses up to tertiary level

Degree, Master’s, or Doctorate programmes

Upskilling / self-enhancement courses (cap of RM2,000)

Conditions:

Institutions must be located in Malaysia

Approved or recognised* by the Government or Minister of Finance

Courses must fall within LHDN-recognised categories

*For unapproved courses, you can claim them under the lifestyle relief (RM2,500).

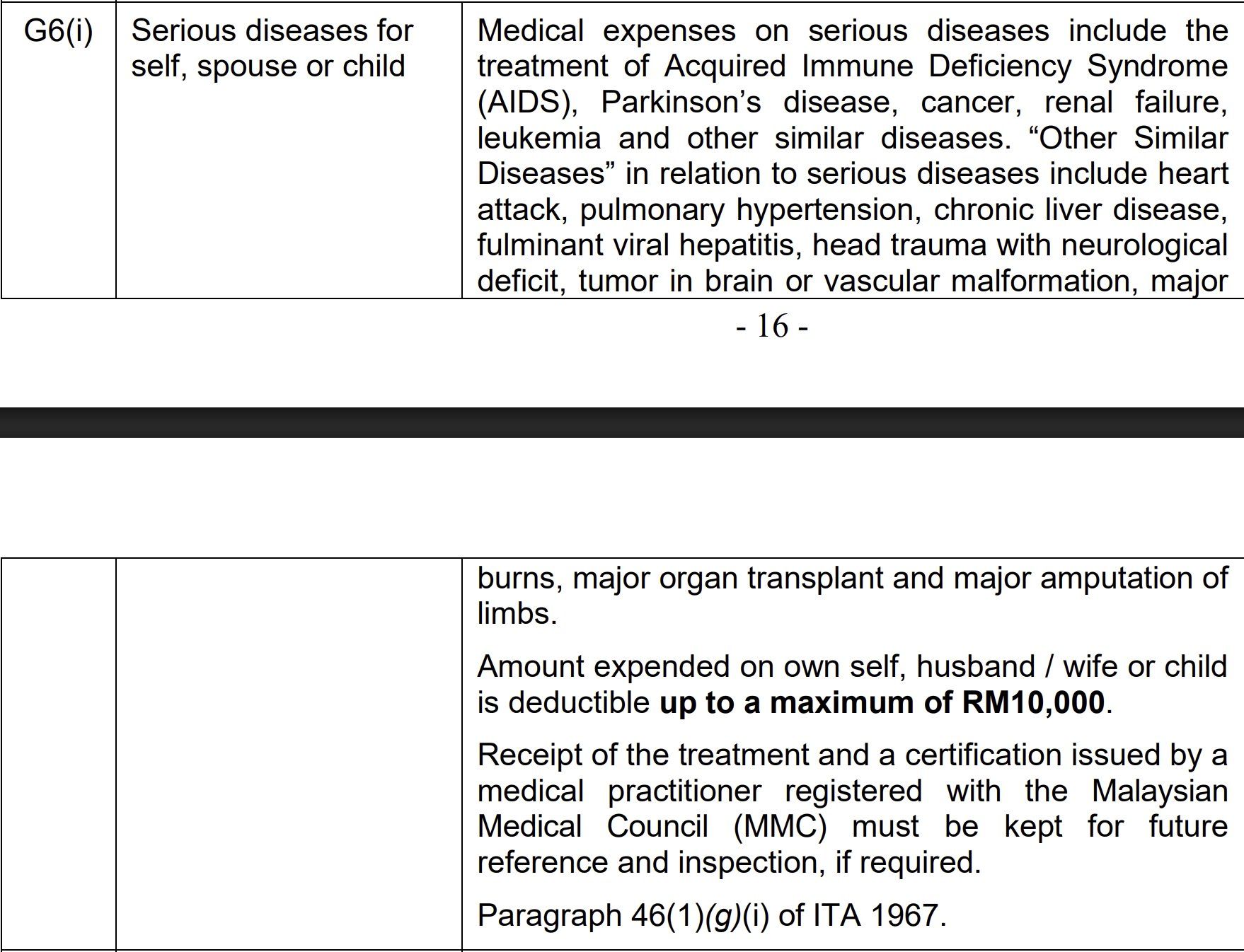

4. Serious Diseases: Up to RM10,000

Medical expenses for serious diseases affecting yourself, your spouse, or your child are deductible up to RM10,000.

Common illnesses do not qualify. ⚠️

Examples:

Fever ❌

Flu ❌

Ankle sprain ❌

Broken arm ❌

This relief is meant for major, long-term, life-altering medical conditions, such as:

AIDS

Parkinson’s disease

Cancer

Heart attack

Liver disease

Amputation of limbs

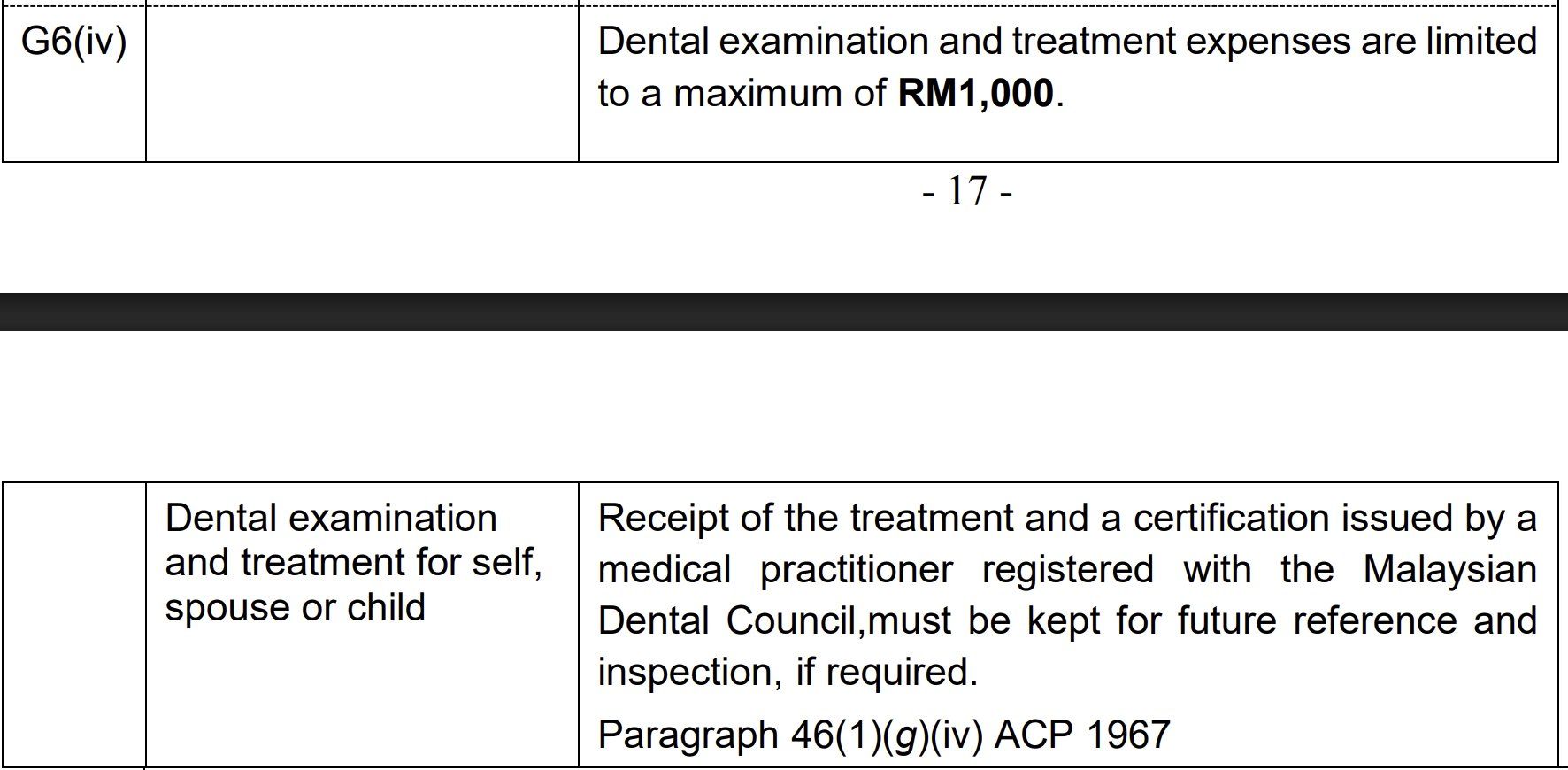

5. Dental Examination & Treatment: RM1,000

You may claim up to RM1,000 for dental examination or treatment for yourself, your spouse, or your child.

Important:

This applies to treatment, not cosmetic procedures

Any claim must be medically justified and properly documented

Clarification: Braces can be claimed only if it is for treatment purposes.

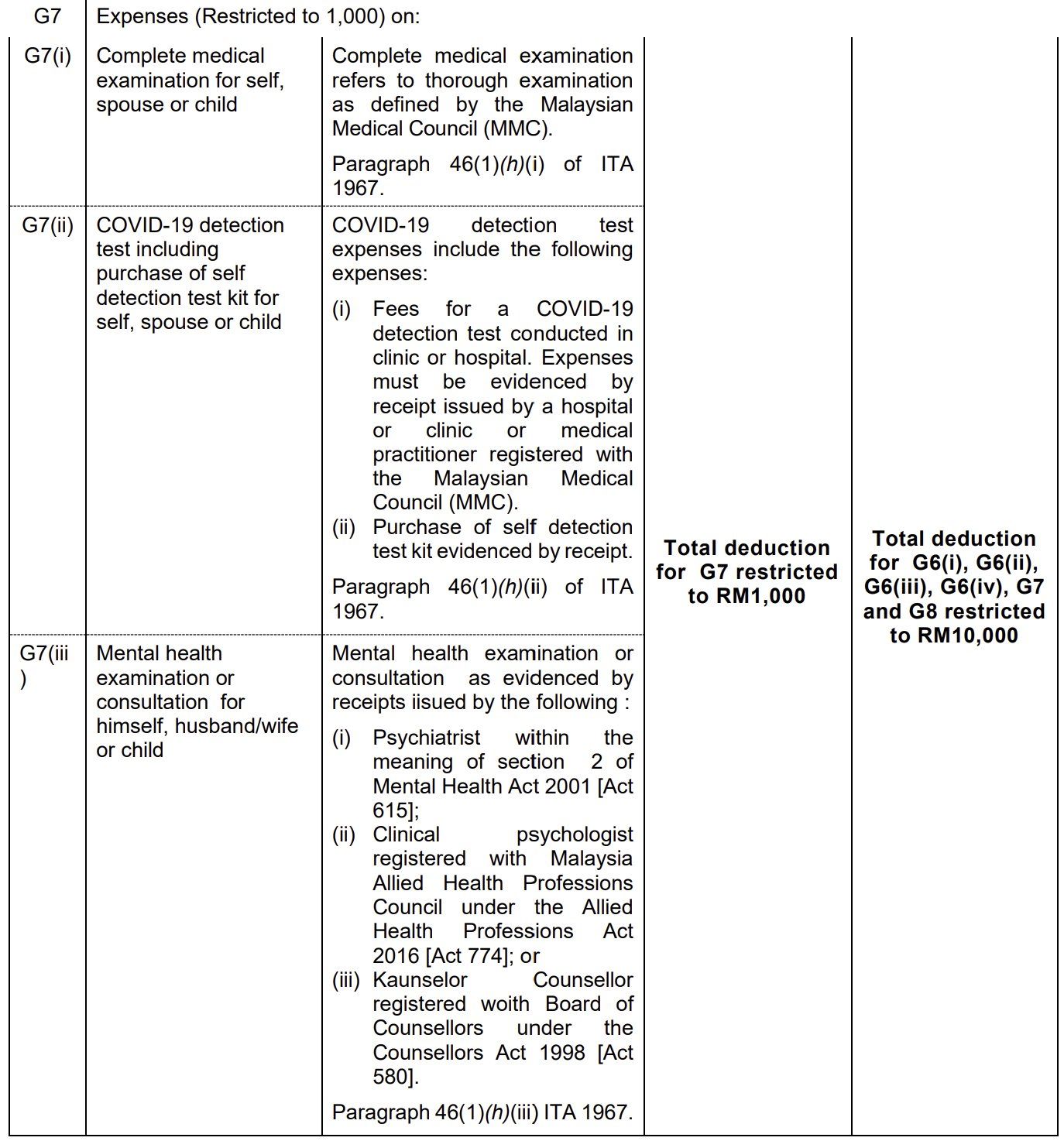

6. Medical Checkups, COVID Tests & Mental Health: RM1,000 Cap

These categories fall under one combined RM1,000 limit:

Complete medical examination

COVID-19 detection tests (including self-test kits)

Mental health examination or consultation

Once this RM1,000 cap is fully used, no further claims can be made under this category, even if expenses exceed it.

According to LHDN’s explanatory notes, these 3 categories have a combined RM1k limit.

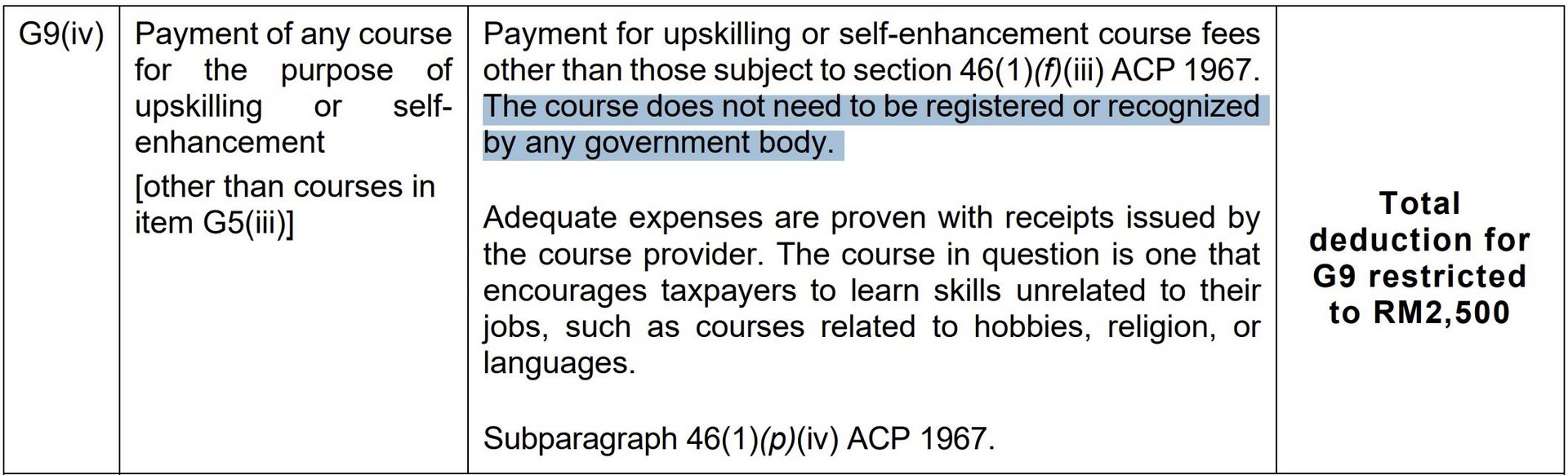

7. Lifestyle Relief: RM2,500

Lifestyle relief is capped at RM2,500 and applies to expenses for yourself, your spouse, or your child.

It includes:

Books, journals, magazines, newspapers (physical or digital, non-illicit)

Personal computer, smartphone, or tablet*

Internet subscription

Self-enhancement courses

*Only applies to these 3 gadgets. Smartwatches cannot be claimed.

For self-enhancement courses:

The course does not need to be registered with any government body

But it should encourage learning in areas such as hobbies, languages, religion, or personal skills

Examples: Japanese language class, cooking class, photography class, udemy class

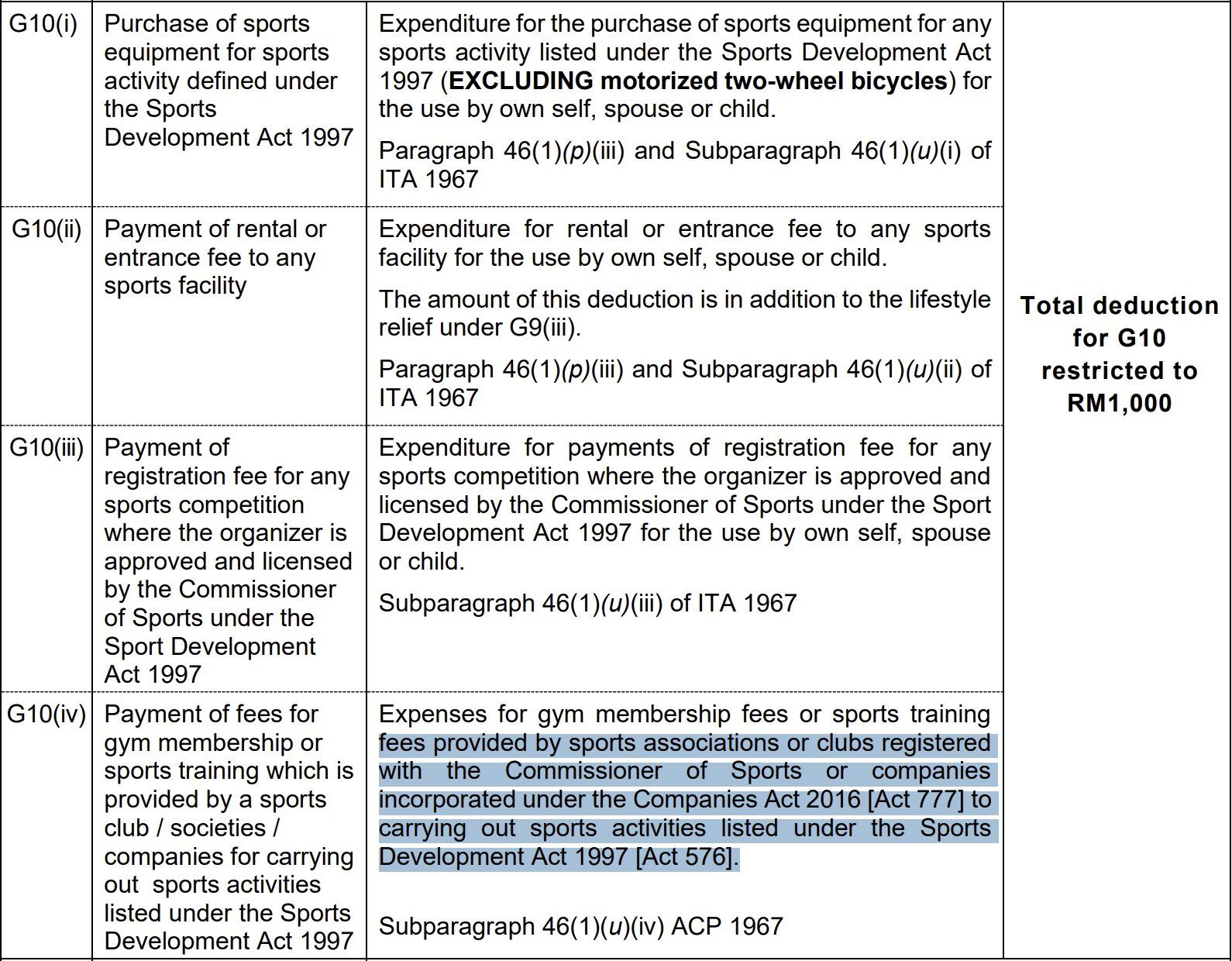

8. Sports Relief: RM1,000

Sports-related expenses are deductible up to RM1,000, but only if the sport is listed under the Sports Development Act 1997.

Eligible expenses include:

Sports equipment

Registration fees

Gym membership or sports training fees

If a sport is not recognised under the Act, the related expenses are not deductible, regardless of popularity (ie. Pilates).

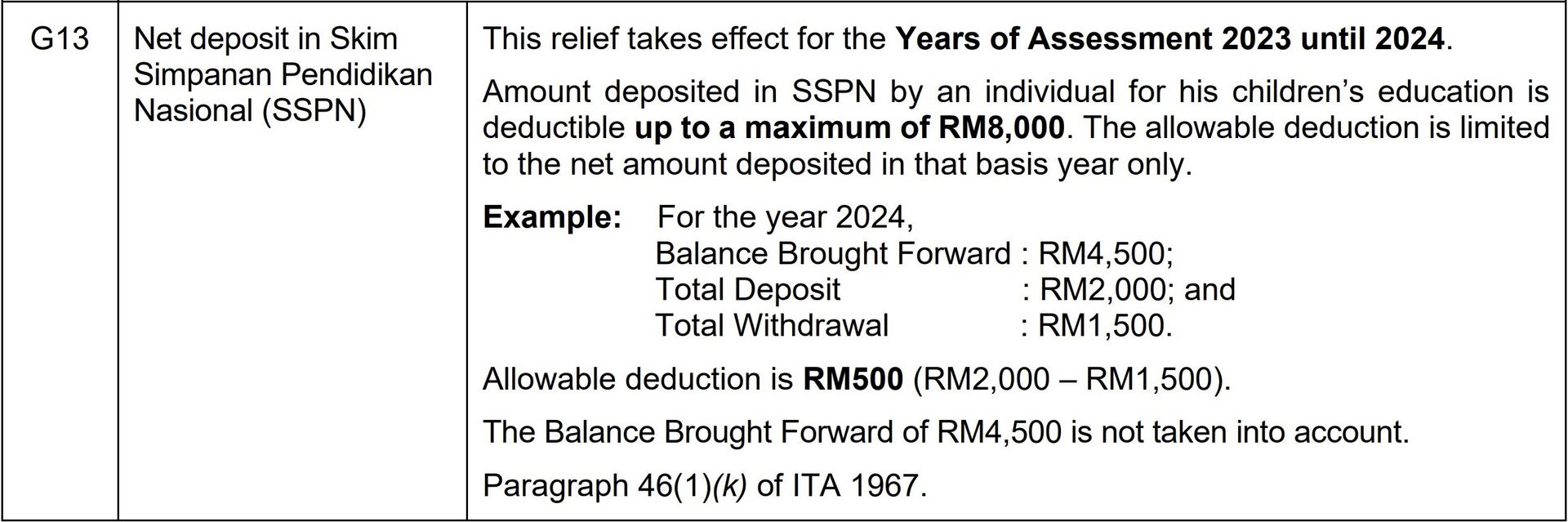

9. SSPN: RM8,000 (Net Deposit Only)

Deposits into Skim Simpanan Pendidikan Nasional (SSPN) are deductible up to RM8,000, but only on a net deposit basis.

Example (YA2025):

Deposit: RM2,000

Withdrawal: RM1,500

Claimable amount: RM2,000 - RM1,500 = RM500

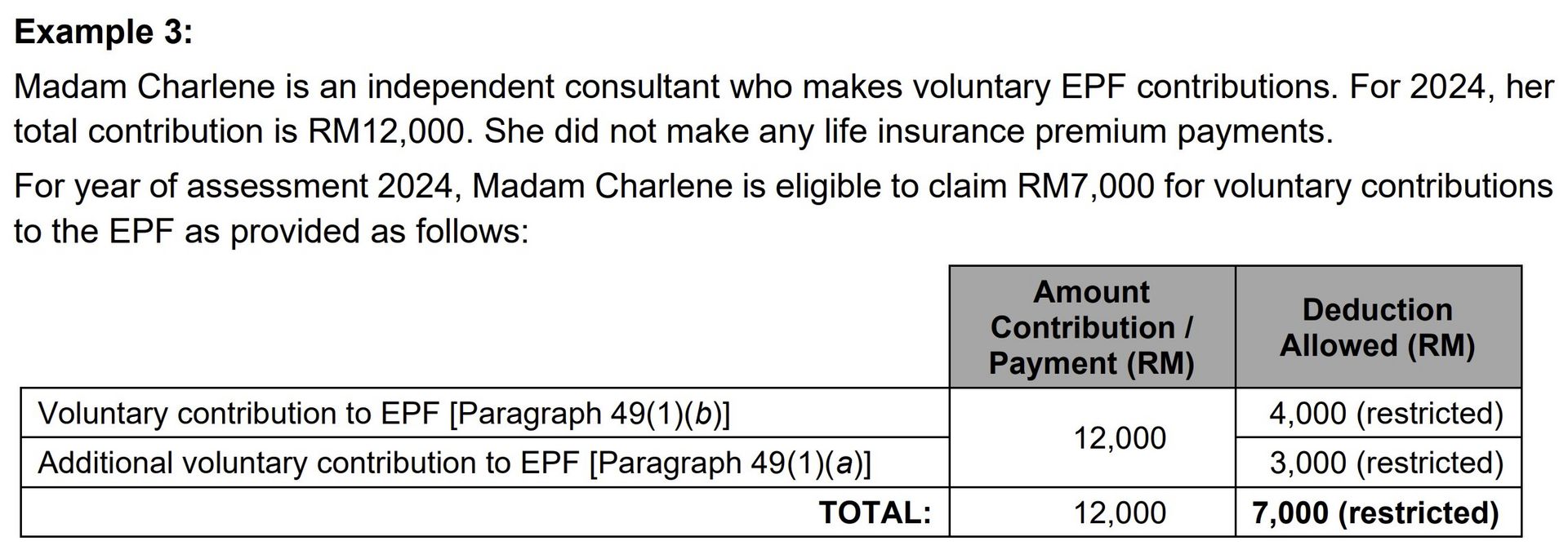

10. EPF & Life Insurance: RM7,000 Total

Relief for retirement and protection is capped at RM7,000, split as follows:

RM4,000: Mandatory and/or voluntary EPF contributions

RM3,000: Voluntary EPF and/or life insurance / family takaful

If you’re self-employed, you can voluntarily contribute up to RM7,000 and receive tax reliefs.

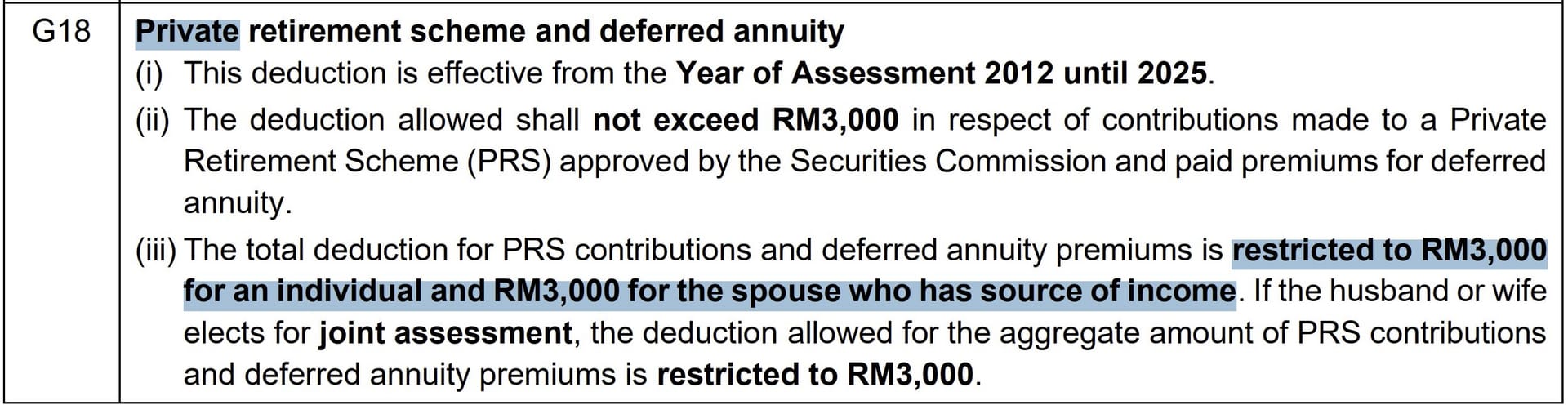

11. Private Retirement Scheme (PRS): RM3,000

PRS relief is capped at RM3,000 per individual.

If both spouses have income, each may claim RM3,000 separately

But under joint assessment, the total allowable relief remains RM3,000, not RM6,000

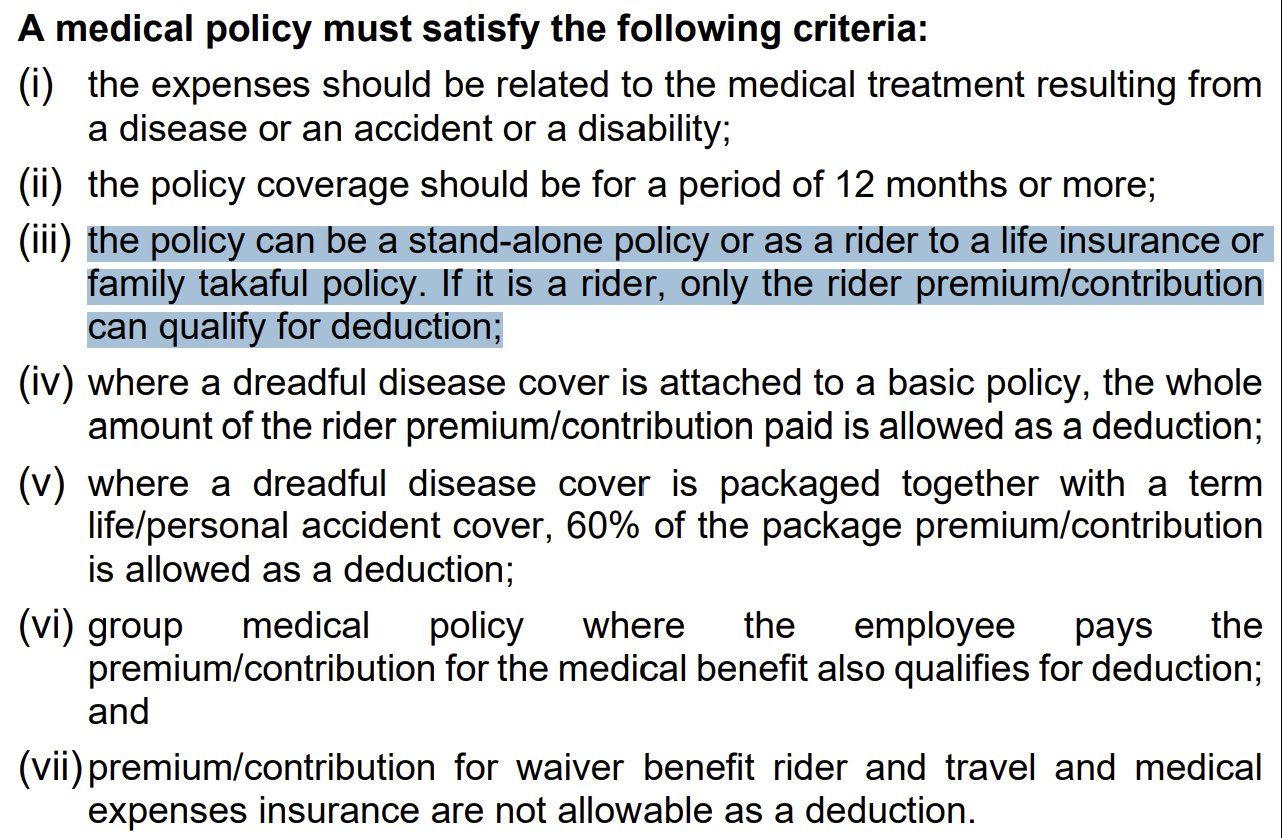

12. Education & Medical Insurance: RM4,000

You may claim up to RM4,000 for education and medical insurance premiums for:

Yourself

Your spouse

Your children

For medical insurance:

Policies may be standalone or riders

If attached as a rider to life insurance, only the rider portion qualifies

13. New Reliefs Announced for YA2025

i) An additional RM2,500 relief has been announced for:

EV charging facilities

Domestic food waste composting machines

ii) First-Time Home Buyer Relief: Up to RM7,000

If you purchased your first residential property, interest relief is available:

Property price ≤ RM500,000 → RM7,000 relief

Property price RM500,001 to RM750,000 → RM2,500 relief

If this was helpful, I’ve actually compiled a 20-page PDF that goes deeper into personal tax reliefs.

It includes:

Clear explanations on what you can / cannot claim

Real examples and audit insights shared by a licensed tax agent

Common mistakes people make (and how to avoid them)

Practical tips on documentation, allowances, and what happens after you file

If you want a copy of the PDF, join our paid WhatsApp group!

Disclaimer: This newsletter is for education only and is not tax advice. The tax landscape changes quickly, and everyone’s situation is different. If you want personalised advice for your own tax filing, please reach out to a licensed tax agent for proper professional guidance before you file.

Reply