- The Futurizts' Weekly Newsletter

- Posts

- How long does it take to double your money?

How long does it take to double your money?

Let's talk about The Rule of 72.

Investing is a lot like planting a seed.

You put in the effort and water it regularly, but you can’t exactly predict when the seed will sprout into a plant.

If you invest RM5,000 today, you may wonder how long it will take before it doubles in value.

Fortunately, you can estimate this growth by understanding how compound interest works and The Rule of 72.

“Earning interest on interest.”

Compound interest is the interest earned from both the principal amount and the accumulated interest from previous periods.

This will make any sum grow faster than simple interest, which is calculated only on the principal amount.

The curve starts off slowly but rises exponentially in the later years, highlighting the importance of starting early.

This concept is simple enough, but the calculations can sometimes be complicated.

Say Hello to The Rule of 72

The Rule of 72 is a straightforward way to determine how long it takes for an investment to double in value by dividing 72 with a fixed annual return rate.

Take EPF as an example. The retirement fund has netted an annual return of 6% for the past 14 years.

Dividing 72 by 6 gives 12.

Therefore, it will take you 12 years for the current funds in your EPF account to duplicate itself.

The Rule of 72 also applies to inflation.

You can find out how long it takes for the value of your ringgit to be slashed in half.

Say you have RM50,000 in your bank account right now. At a mere 2% inflation rate, it will take 36 years for that balance to be worth 50% less.

Sure, that's a long time.

But considering how inflation has risen to 4-5% in the past few years of the pandemic, you’ll probably have a rough idea right now of how much our money has deteriorated.

The Rule of 72 is Convenient, but it has Flaws.

It can only measure the doubling time of a single investment, assuming that you do not add additional contributions in the future.

Almost no one invests like this.

The vast majority of people regularly add to their investments from time to time, thus you would need to use a compound interest calculator to estimate your future returns.

Five Timeframes to Save and Invest Your Way to RM100,000.

The middle column is manually saving without investing, while the right is saving and investing the sum into an asset that compounds 5% annually.

What asset pays 5% per year?

EPF. The retirement fund has paid an average dividend of 6% for the past 14 years.

However, going all-in on your savings to the EPF may not be feasible for everyone, as you can only withdraw the sum at the age of 55.

The strategy I adopt is to ensure that I meet the minimum monthly contribution to achieve RM100,000 by a specific age.

Let’s say my target is to reach RM100k by 32 with no initial capital (I am 26 this year), I would need to contribute somewhere between RM1,025 to RM1,515.

Taking into account the mandatory contributions from both myself and my employer, I would only need to top up the difference to achieve this goal by 32.

Are there any other assets apart from EPF that pays steady dividends?

Touch n’ GO+ (3.53% pa)

Versa Cash-i (Promo Rate: 4.00% pa)

Rize (Promo Rate: 4.00% pa)

ASB & ASM (4-6% pa)

Fixed Deposits (3.80-4.20% pa)

Check out this link for the best places to save and grow your money right now.

A steep goal is challenging, but it only gets easier afterwards.

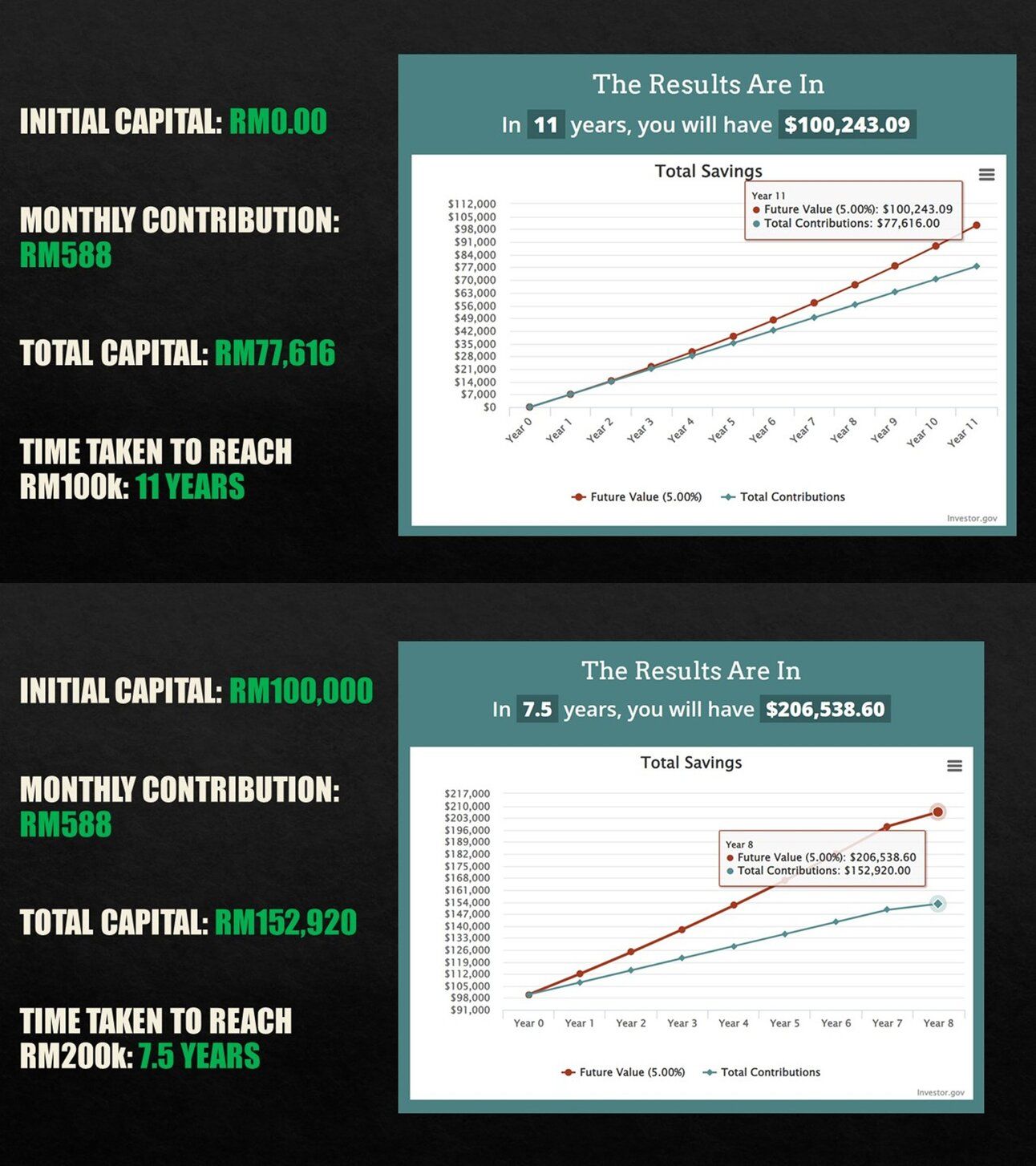

If you spent 11 years to hit your first RM100,000 and maintain the monthly contribution of RM588, you'll achieve the next RM100k in only 7.5 years.

How can I double my investments faster?

Create a budget.

Increase your income.

Cut unnecessary expenses.

As you work, your salary will increase and you'll receive bonuses.

It may be tempting to upgrade your lifestyle and increase your wants, but doing this too often is bad.

Always ensure that your "upgrade" is sustainable, and that you save more as your earnings increase.

Hey thanks for reading till the end.

We get it, your time is valuable and you hate sifting through the web for information.

So let us do the work for you.

By joining our WhatsApp group, you’ll receive financial updates - best FD rates, currency movements, and more on a daily basis.

✅ 102 people have joined, and only 2 unsubscribed (so far).

✅ We don’t spam.

✅ It’s $0.25/week.

✅ Pay monthly, cancel anytime.

DISCLAIMER: The information contained in this article is for informational and educational purposes only. Nothing herein shall be construed to be financial, legal, or tax advice. The opinions of this article are solely that of the publisher

Reply