- The Futurizts' Weekly Newsletter

- Posts

- Why Malaysia May Finally be a High Income Country

Why Malaysia May Finally be a High Income Country

Wage hike, subsidy reforms, and ringgit strength are steering us in the right direction but...

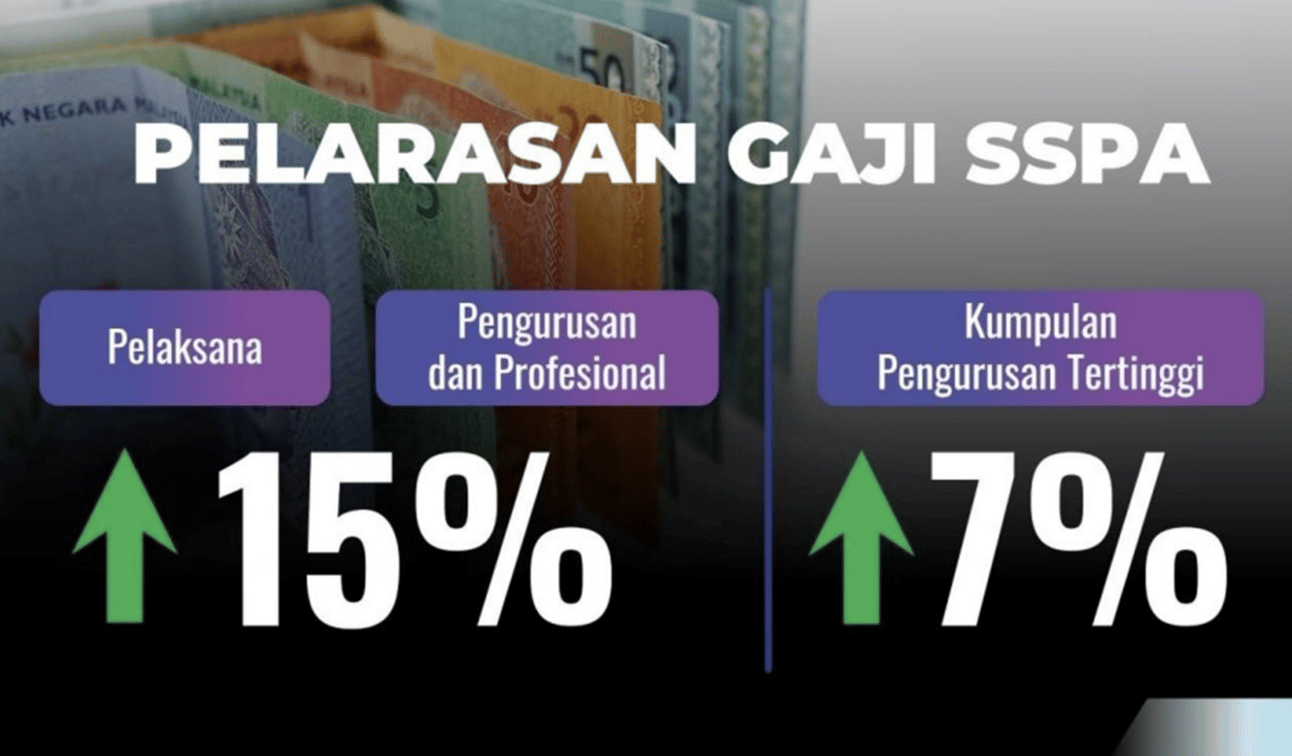

On Friday, PM Anwar announced a 7-15% pay hike for civil servants.

It is the largest increase ever in the country’s history.

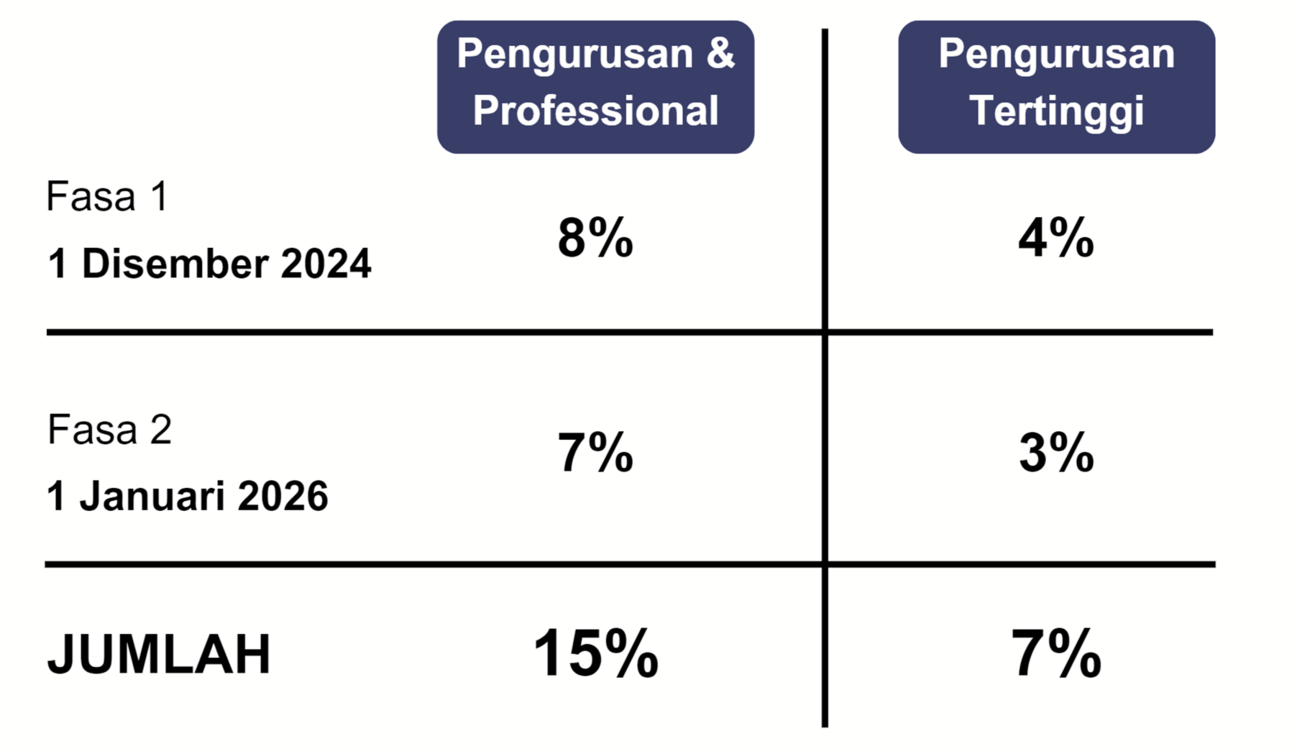

Under the new Public Service Remuneration System (SSPA), civil servants in the top management will receive a 7% wage hike.

Meanwhile, those categorized as implementers, managers, and professionals will see a 15% pay increase.

Considering the country’s challenging economic situation, Anwar said that the salary increments will be broken into two phases, with phase 1 beginning on Dec 1.

The increments will only apply to servants who have opted for the new SSPA scheme.

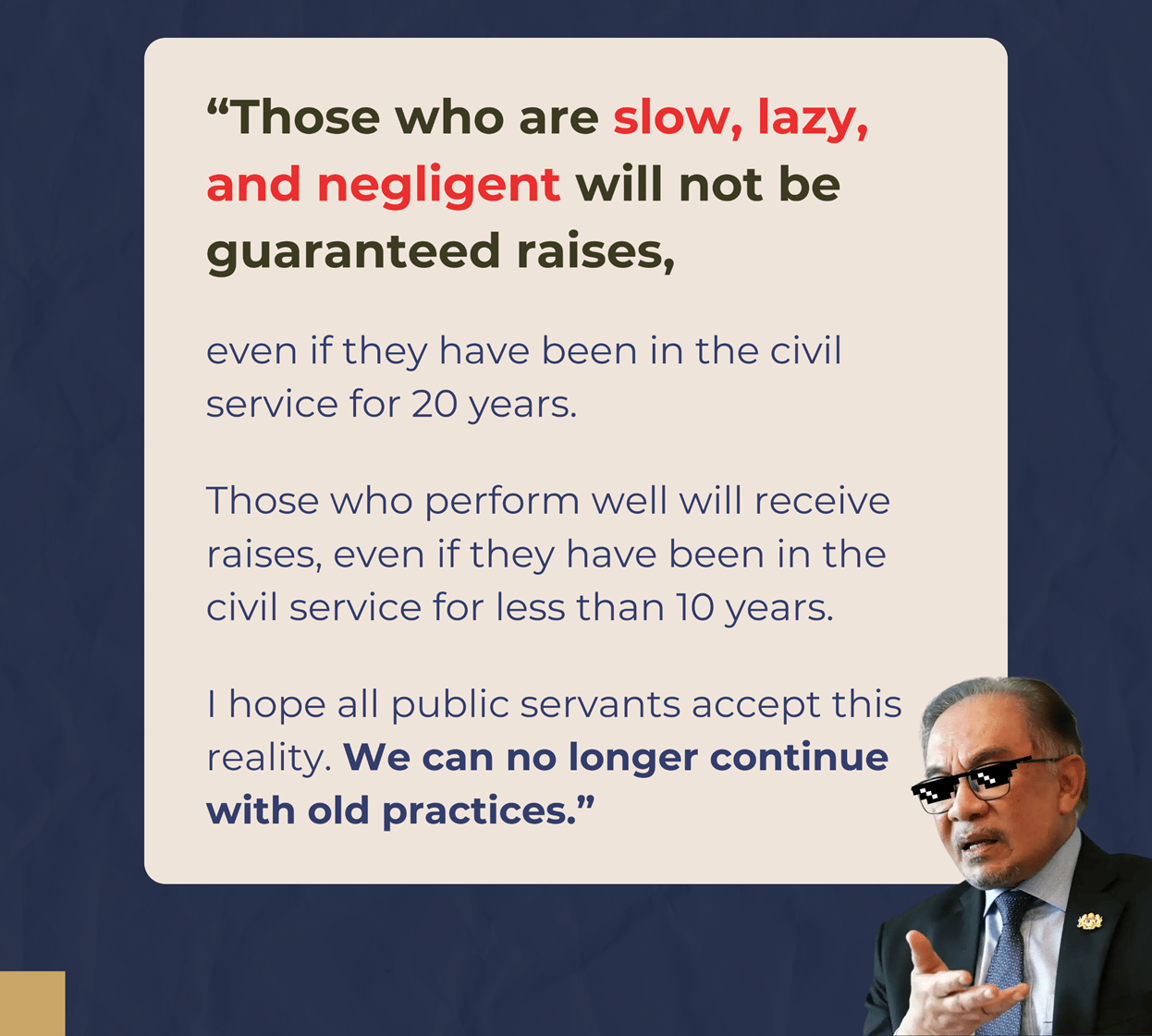

The prime minister also said the wage hikes will only apply to those that are hardworking and have performed well.

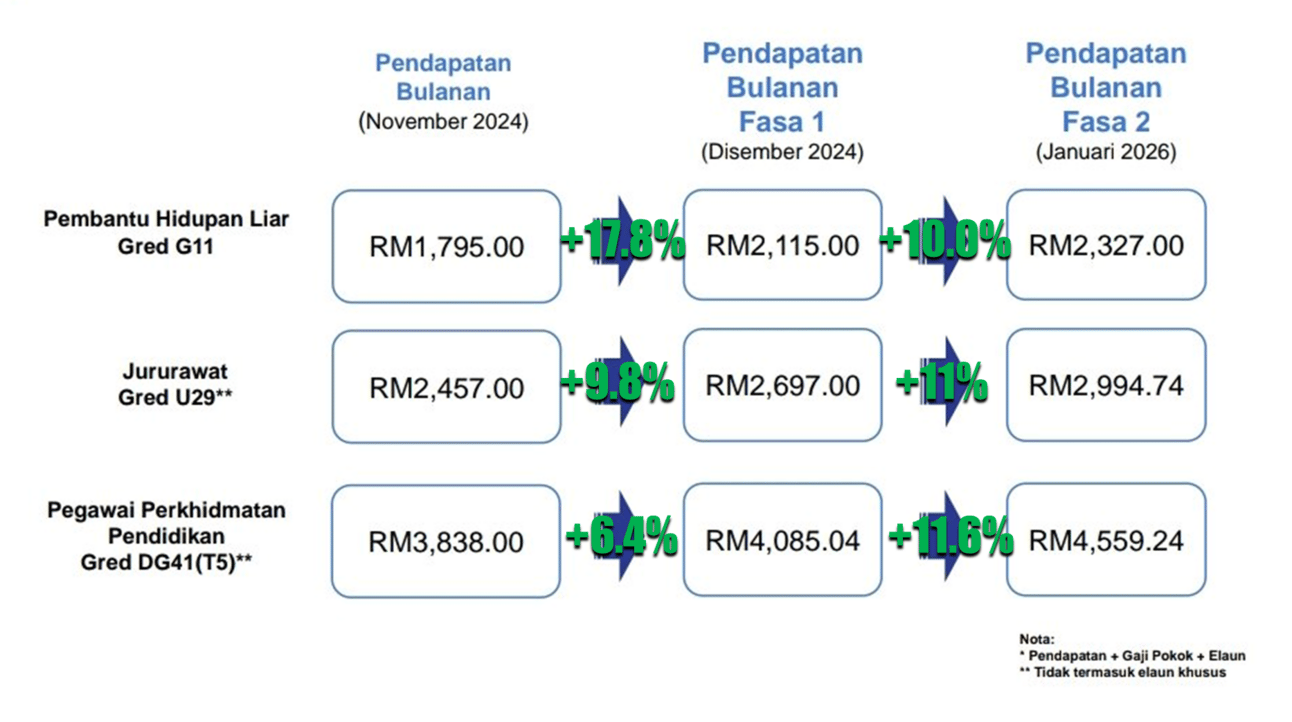

From the table below, a nurse who previously earns RM2,457 will see their salary jump to RM2,697 by December, which is a 9.8% increase.

This is much higher than what was announced, as it includes allowances and further salary adjustments.

Therefore, the true increase in income could vary from 16.8-42.7%, depending on sectors and other factors.

There are currently 1.6 million civil servants in the country, according to Bernama.

The last time their salaries were revised was 12 years ago, which saw a 13% hike then.

In May, Anwar raised the minimum pay for civil servants to RM2,000, from RM1,765 previously.

How will this affect inflation?

While the announcement has been lauded by citizens, some are worried that the steep wage hikes will drive up prices.

I think it won’t.

Anwar has allocated RM10 billion for the salary increase, to be gradually distributed over the next few years.

Not all citizens will spend their extra pay on goods and services. Some may use it to invest, while others may use it to pay off their debts.

Therefore, it’s too early to say that this move will drive up prices.

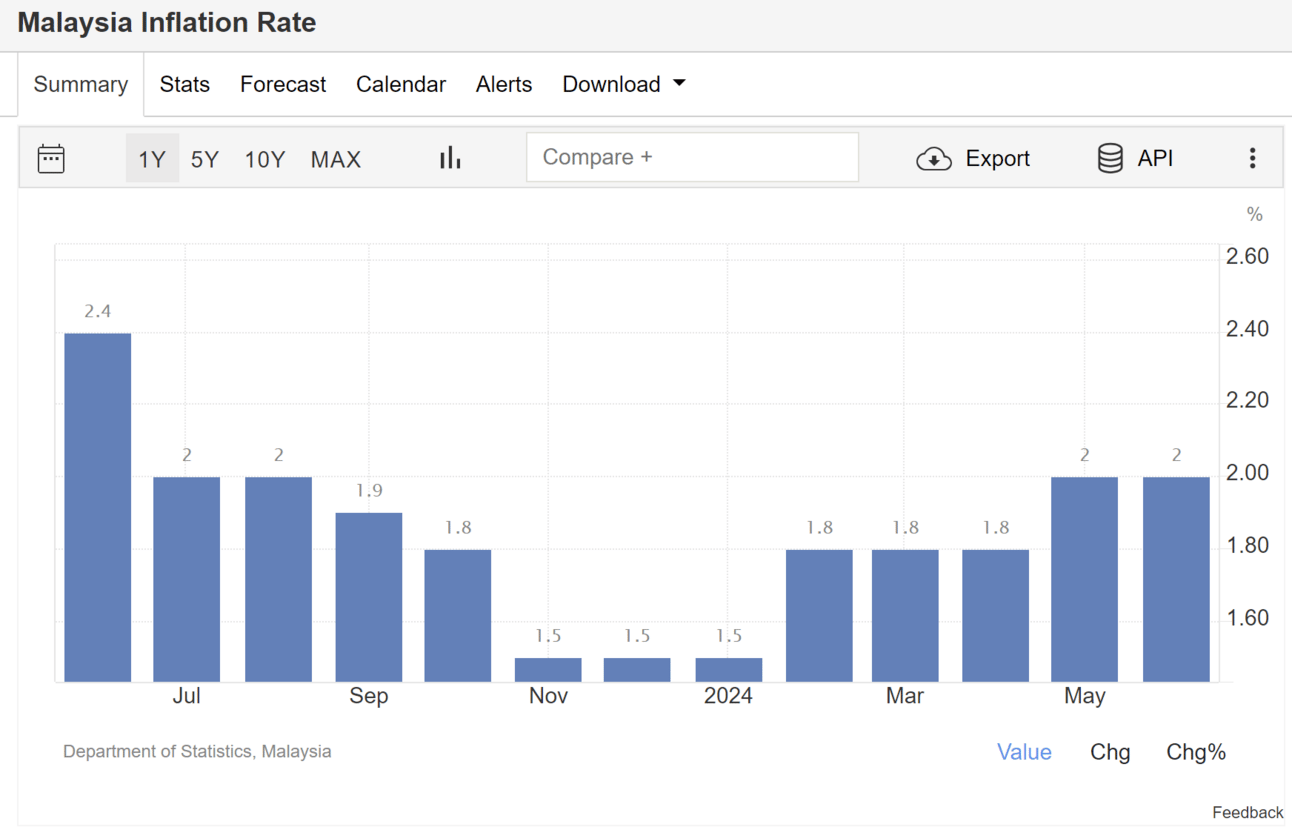

To give you an example, EPF’s Account 3 restructuring saw RM7.81 billion withdrawn as of June, but it has barely impacted Malaysia’s inflation rate, which came in at 2% for May and June.

In fact, the current inflation numbers are well within Bank Negara Malaysia’s expectations. The governor also said that Malaysia’s headline inflation is unlikely to exceed 3% for the rest of the year.

Where is the money for the salary hikes coming from?

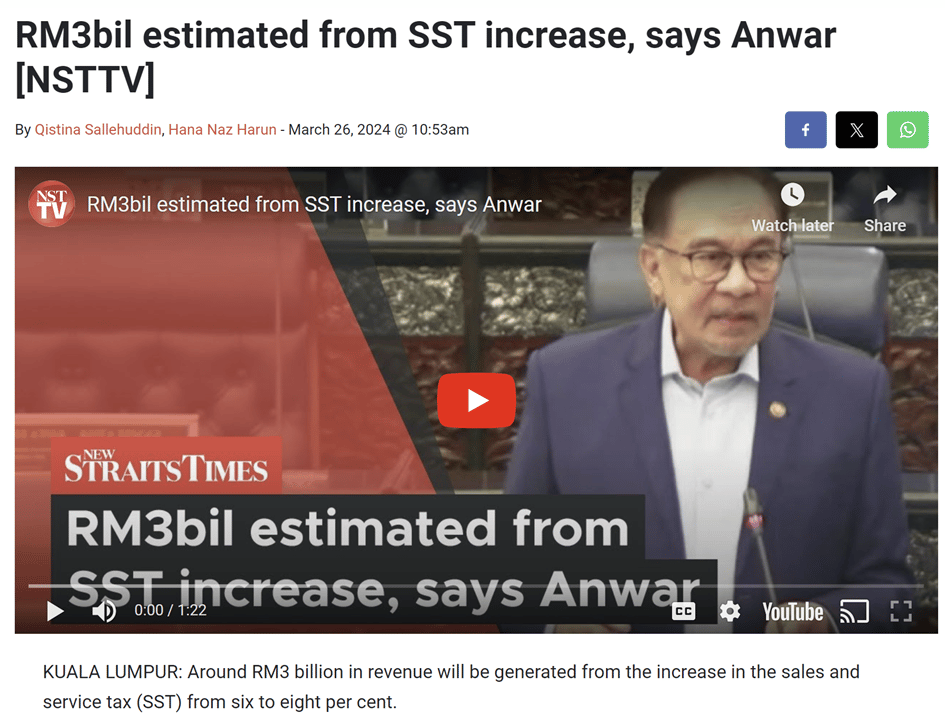

Remember the 2% SST hike earlier this year and the removal of diesel subsidies in June?

These two reformations, though initially criticized, have given the government significantly more revenue to spend on areas that truly matter.

According to Anwar, the SST increase will generate an additional RM3 billion for the administration, while the transition to targeted subsidies for diesel is expected to save the administration RM4 billion annually.

It is these reasons, plus the wave of good news we’ve seen, that are driving up the ringgit and Malaysia’s bright future.

Considering the ringgit’s current trajectory, it is entirely possible for the local note to hit RM4.20 by year-end.

Our National Debt: A Ticking Time Bomb That Could Reverse Progress.

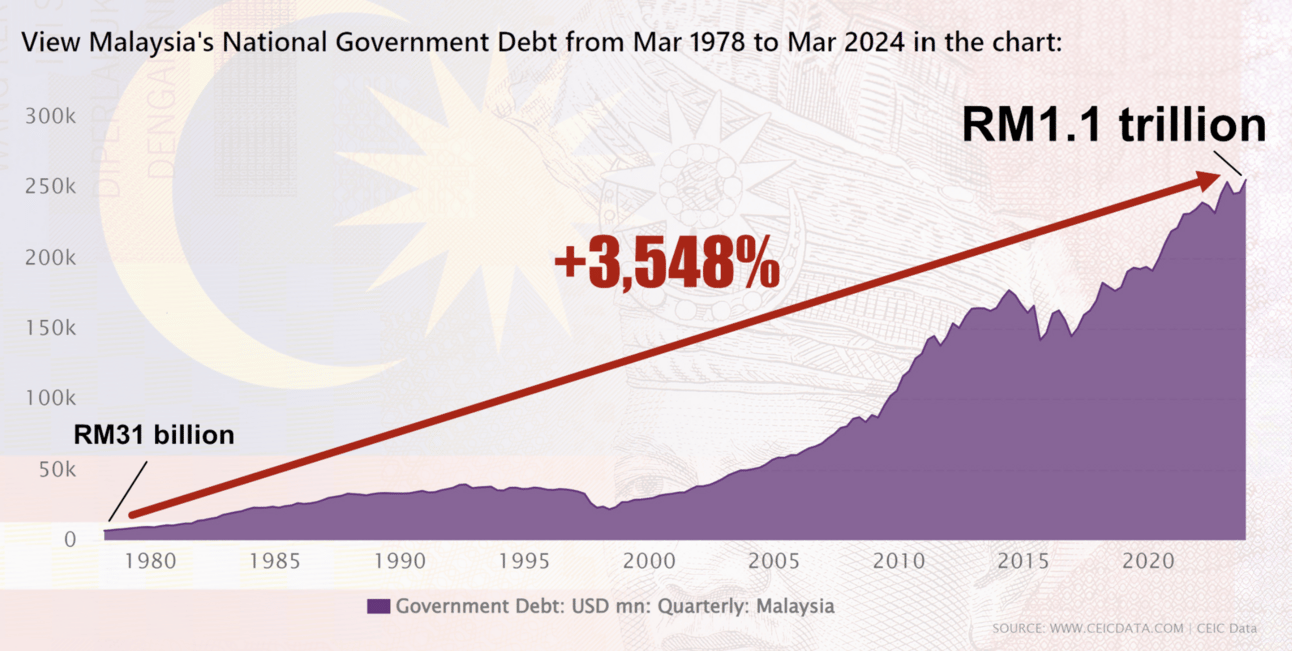

In 1978, Malaysia’s national debt stood at RM31 billion.

Now, it has ballooned to RM1.1 trillion, a 35-fold increase in just 46 years.

How does a country get into debt anyway?

A country gets into debt when the government spends more than it earns.

To cover this gap, the government borrows money by issuing bonds, taking loans from international institutions like the International Monetary Fund (IMF), or borrowing from other countries. Over time, this borrowing accumulates, leading to national debt.

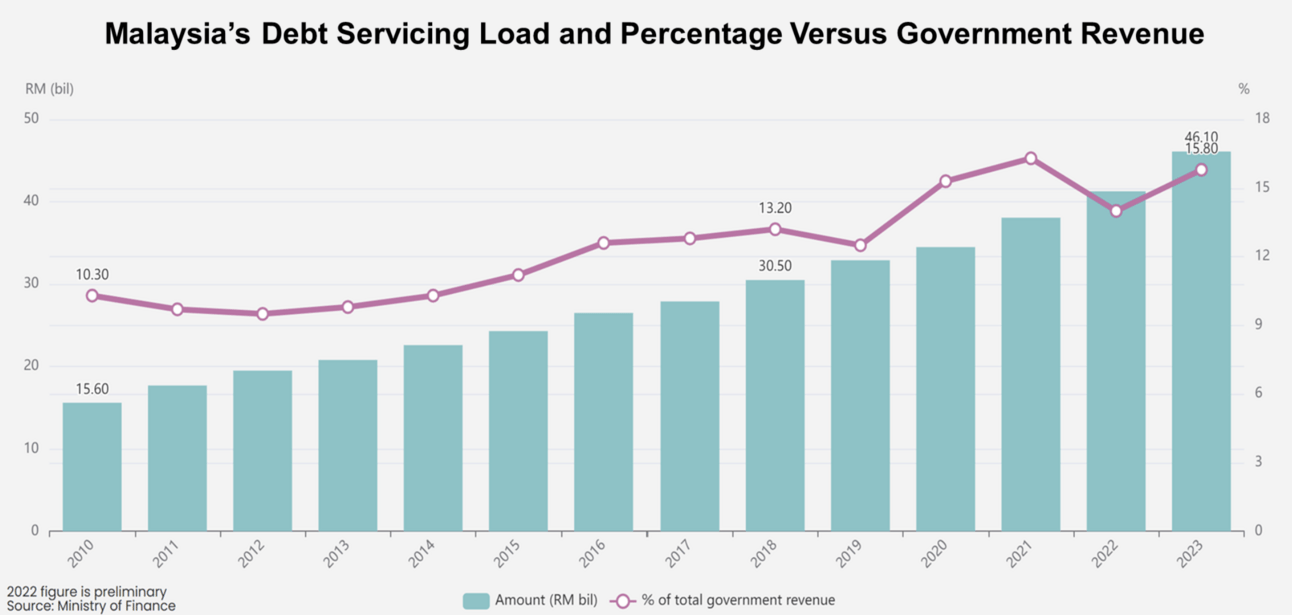

This year, Malaysia’s debt servicing load is expected to hit RM46.1 billion, or 16% of the government's total revenue.

Think of it this way: 16 cents of every ringgit we pay in taxes will go to servicing the national debt.

In fact, the debt servicing load has grown much faster than the government’s revenue and has tripled in the past 13 years.

For Budget 2024, the government's two largest allocations are:

The Education Ministry: RM58.7 billion.

The Health Ministry: RM41.2 billion.

Our debt servicing load (RM46.1 billion) has already exceeded spending for healthcare.

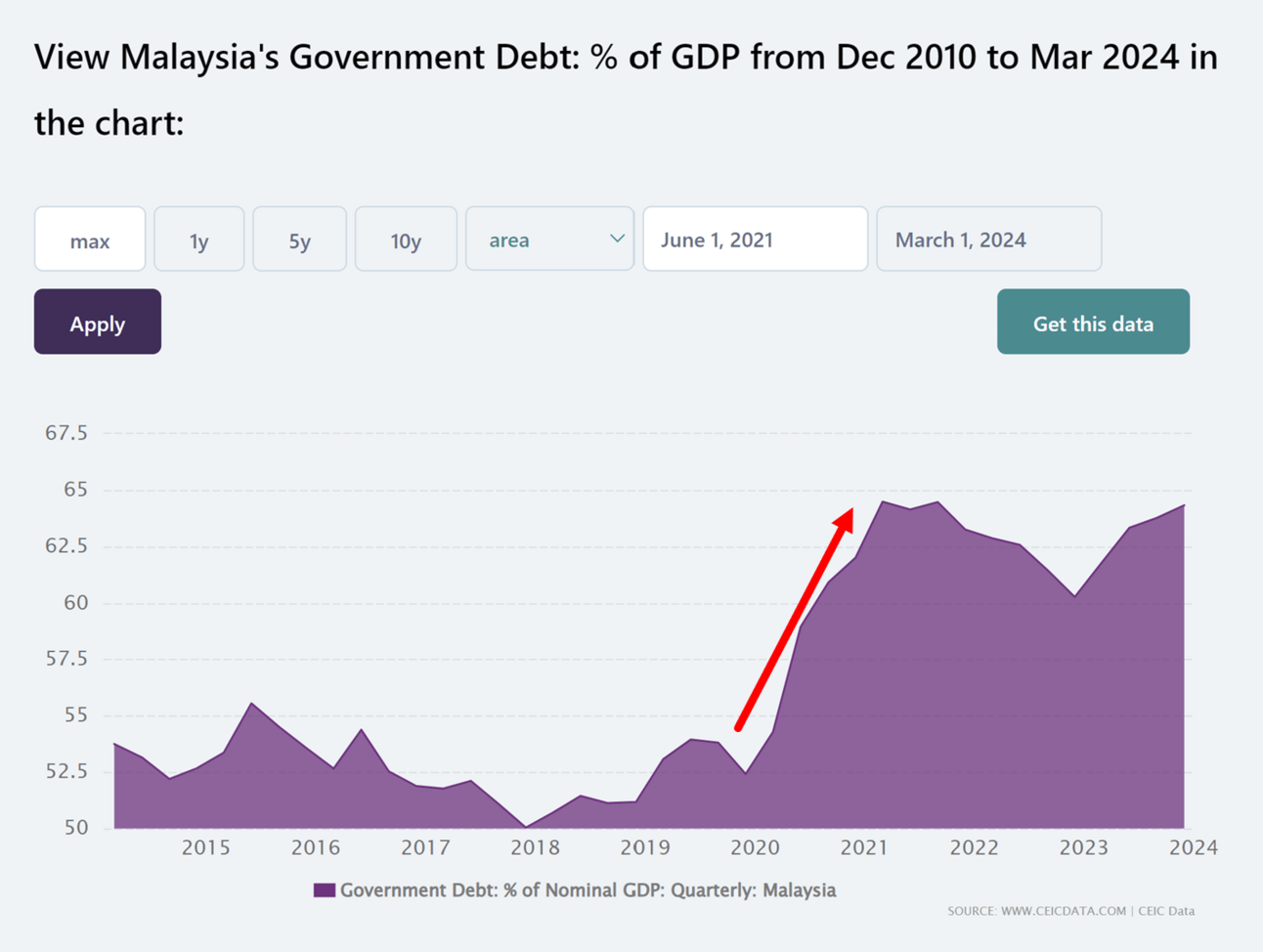

Prior to the pandemic, our debt-to-GDP ratio held steady at 50-52.5%.

But Covid exacerbated government spending, which spiked the ratio to 65.6%.

Debt-to-GDP can also be interpreted as the number of years it would take to repay our debt using GDP.

With Malaysia’s ratio of 65.6%, it will take almost 66 years to pay back our national debt.

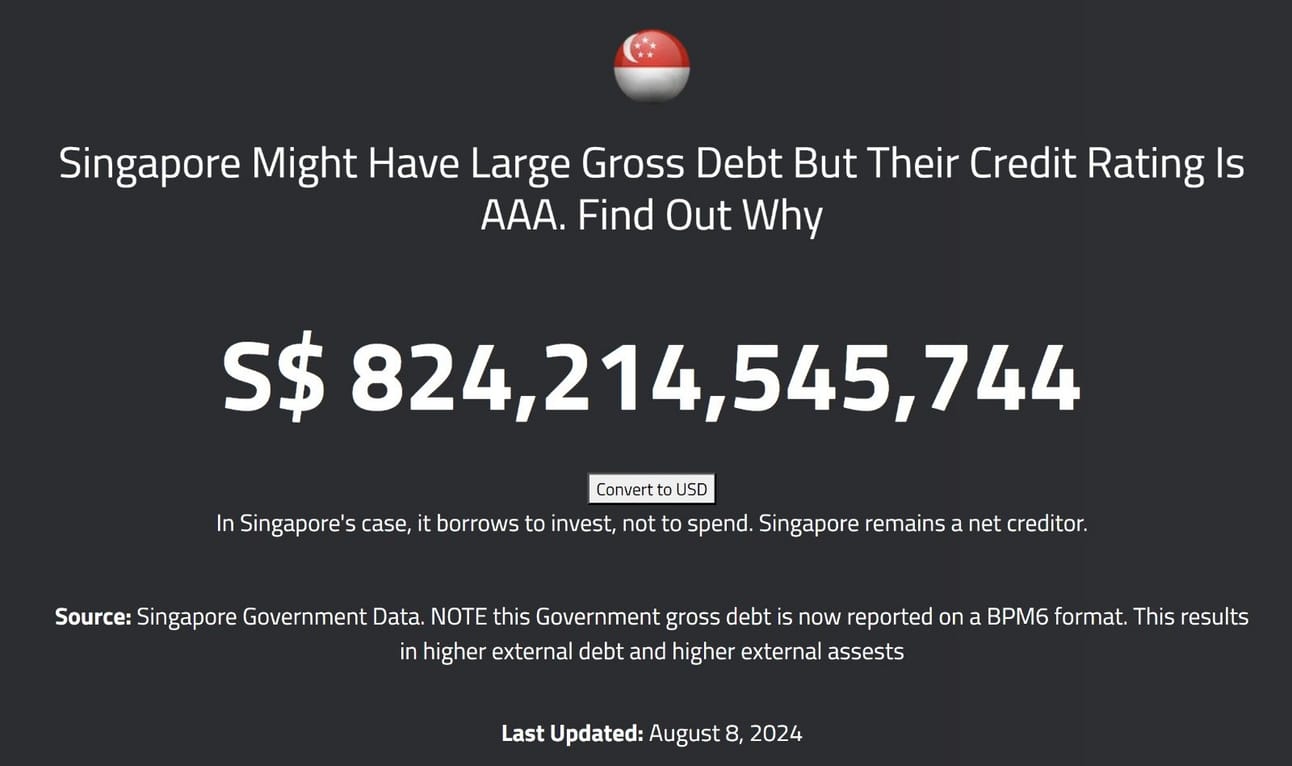

A high debt-to-GDP ratio is not necessarily a bad thing.

Singapore, for instance, has a debt-to-GDP of 176.55%, but their credit rating is still AAA.

That’s because the tiny nation is a net creditor. It borrows money to invest in other countries, not to spend.

How the national debt affects you (and your kids).

As the country’s debt grows, the government will have to allocate a larger portion of its budget to pay interest.

This means more of our hard-earned tax money goes to servicing debt, instead of spending on things that truly matter (education, healthcare, infrastructure, etc.).

At some point, the government will resort to increasing taxes, or worse, they’ll borrow more.

But someone has to pay back all these mounting debts. And who else is there to do it other than the future generation?

We’re literally borrowing from our future to satisfy current needs.

That’s all for this week’s newsletter.

Disclaimer: The information contained in this newsletter is for informational and educational purposes only. Nothing herein shall be construed to be financial, legal, or tax advice.

Learned something? Then join our WhatsApp group for more.

You’ll receive financial updates - best FD rates, cash app comparisons, currency & market movements, etc. on a daily basis.

✅ 200+ people have joined.

✅ We don’t spam.

✅ It’s only $0.25/week.

✅ Pay monthly, cancel anytime.

Reply