- The Futurizts' Weekly Newsletter

- Posts

- Potential Stocks to Buy in the Malaysian Market?

Potential Stocks to Buy in the Malaysian Market?

Here are the top picks according to research firms.

The Malaysian market is on a roll.

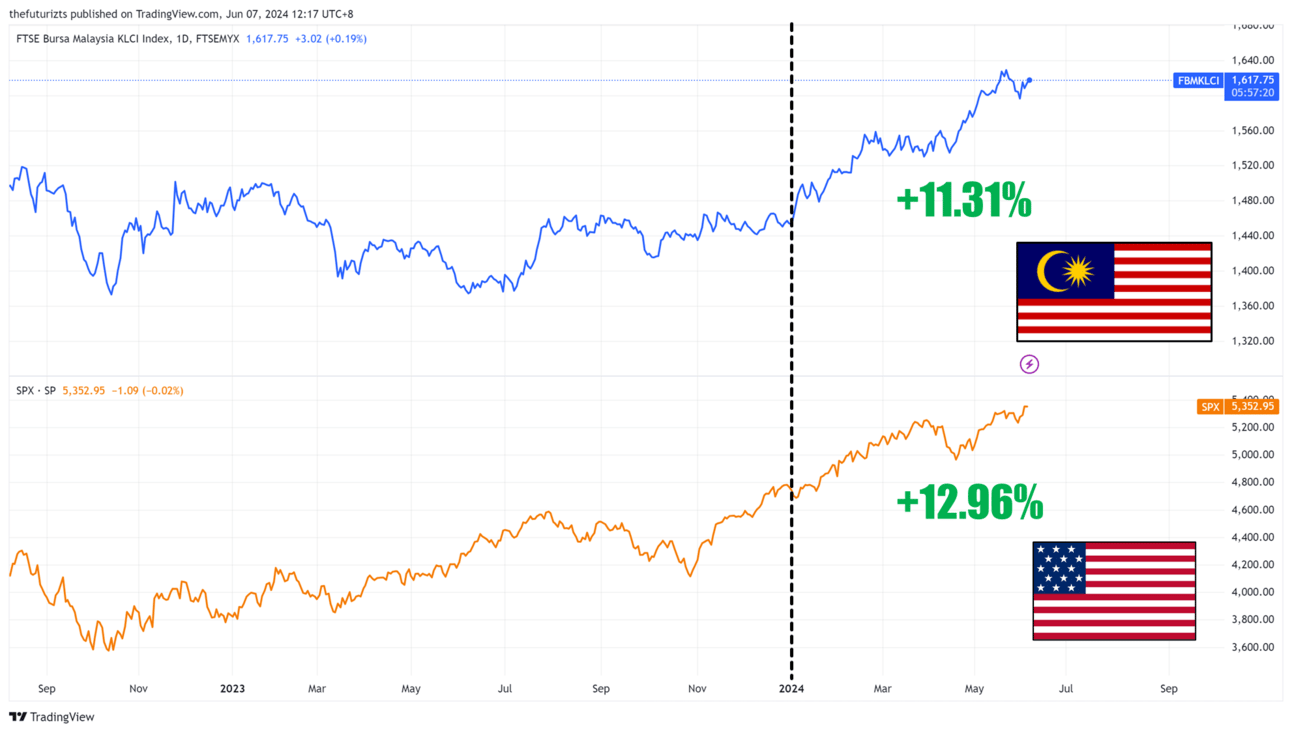

The benchmark index (FBMKLCI) closed at 1,618 points on Friday (Jun 7), just 15 points shy from its 3-year high of 1,632 points.

On a year-to-date basis, the FBMKLCI is up by 11.31%, trailing closely behind the US market (+12.96%).

This stellar performance has beat the majority of predictions made by analysts and research firms in January.

Most notably, Maybank Investment Bank (Maybank IB) expected the FBMKLCI to end the year at 1,610 points. But just 6 months in, the benchmark index has already surpassed its forecasts.

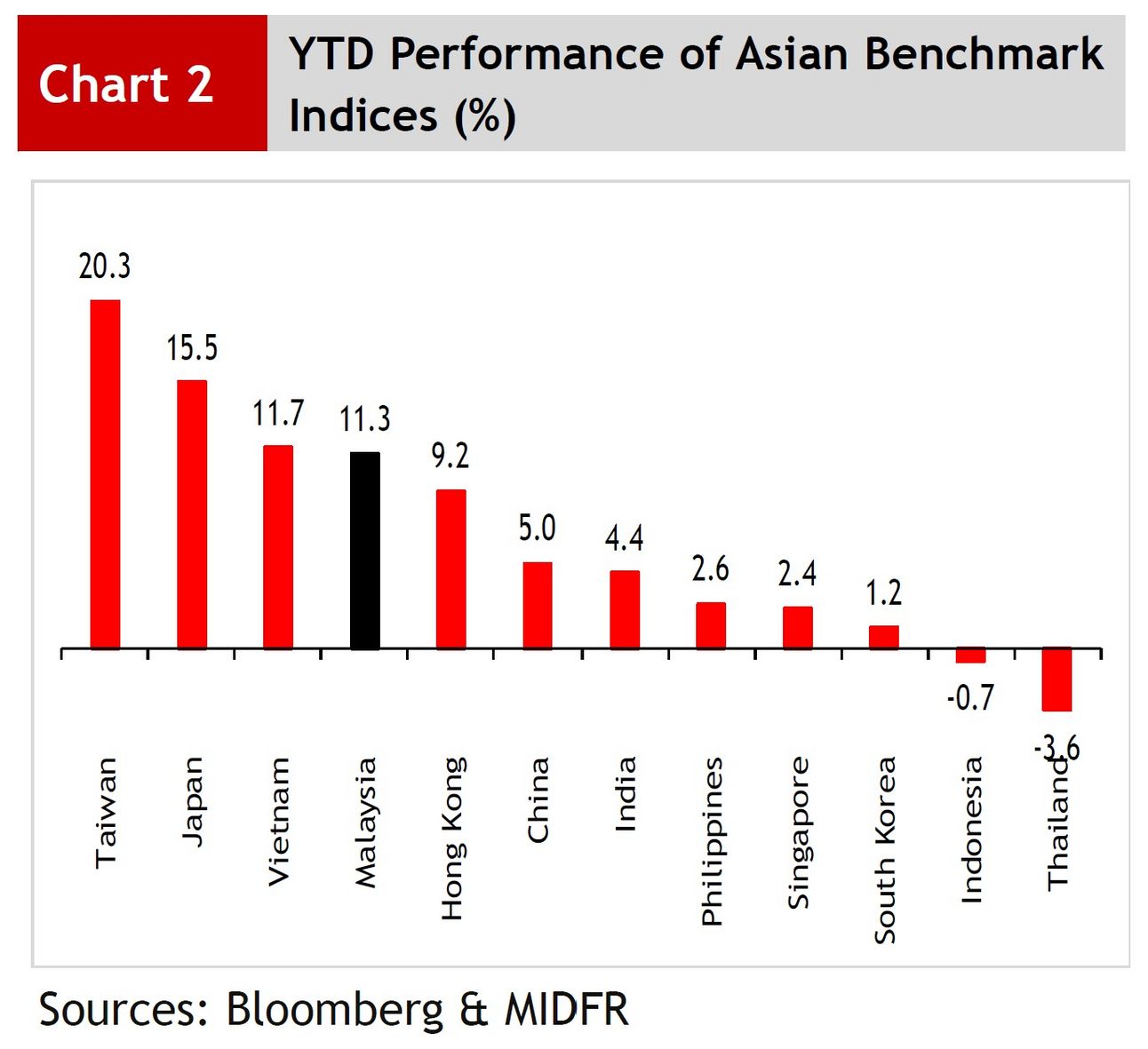

We are now the fourth-best-performing market in the region, firmly ahead of China, Singapore, and South Korea.

Maybank IB upgrades FBMKLCI year-end forecast to 1,680 points.

Driven by optimism in earnings growth, global interest rate cuts, the Johor-Singapore special economic zone (JS-SEZ), and ringgit strength, Maybank IB is confident that the local market will continue its upward trajectory.

It expects all sectors (except media) to deliver higher earnings for the rest of the year, as core profits of almost all sectors rose by 20.1% y-o-y during Q1 2024.

With the promising indicators, other research firms such HLIB Research, Kenanga Research, and MIDF Research have also raised their year-end projections of the FBMKLCI to the 1,700 region.

Stocks to Watch (and Buy?)

Maybank IB has maintained overweight* calls on a few sectors, namely:

Banks

Gloves

Gaming

Aviation

Consumer

Oil and Gas

Construction

Renewable energy and technology

*An overweight rating means that a sector (or a stock) deserves a higher valuation and is likely to perform better in the future.

Looking at specific stocks, Maybank IB has added these picks to its top buy list:

SD Guthrie (SDG) Previously known as Sime Darby Plantation

Share price: RM4.34

YTD Performance: -1.07%🔻Sime Darby (SIME)

Share price: RM2.94

YTD Performance: +15.94%🔺Gamuda (GAMUDA)

Share price: RM6.05

YTD Performance: +32.27%🔺Dialog Group (DIALOG)

Share price: RM2.48

YTD Performance: +19.92%🔺Top Glove (TOPGLOV)

Share price: RM1.10

YTD Performance: +21.58%🔺MYEG Services (MYEG)

Share price: RM1.07

YTD Performance: +32.69%🔺AirAsia X (AAX)

Share price: RM1.52

YTD Performance: -18.17%🔻SAM Engineering & Equipment (SAM)

Share price: RM6.56

YTD Performance: +65.81%🔺🔺

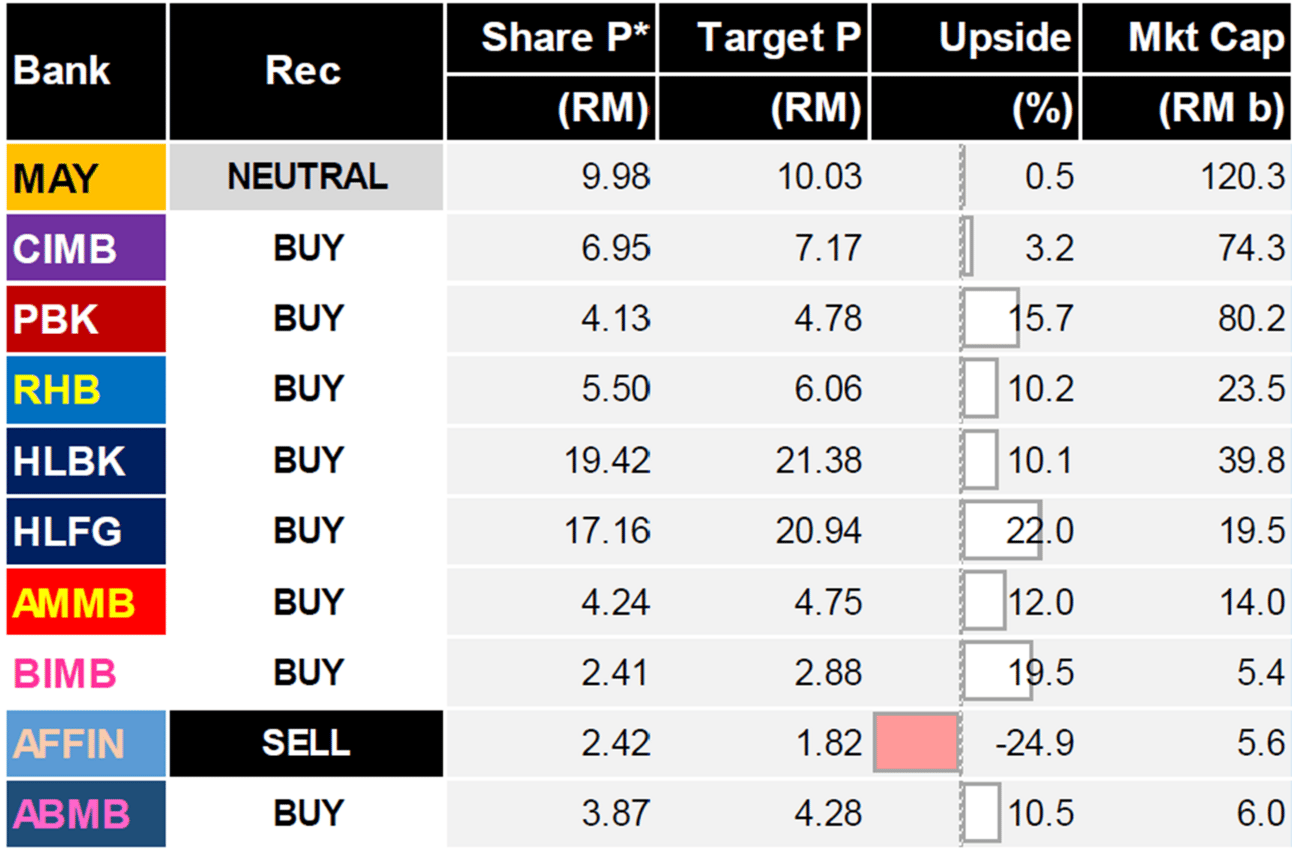

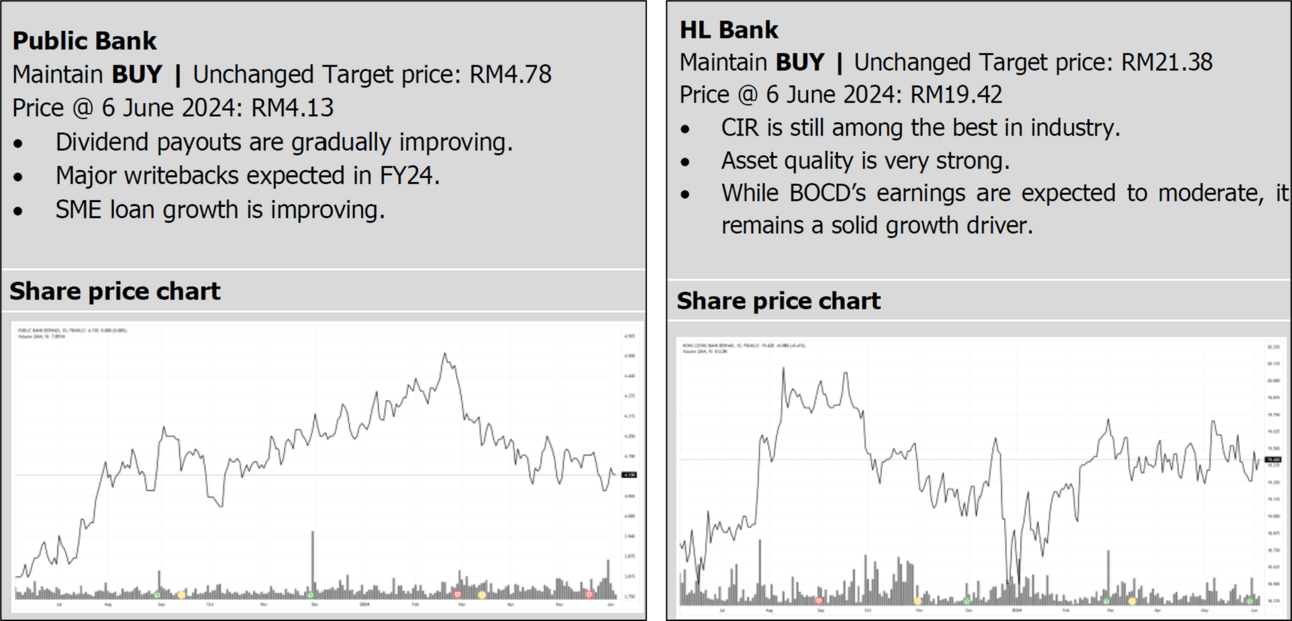

MIDF Research: Banks remain Solid Dividend Picks.

MIDF Research believes that the local financial sector has good dividend picks and a few players remain undervalued.

“Initial worries concerning CY24’s performance were overblown. Hence, we upgraded our call earlier premised on a stronger topline and balance sheet growth outlook,” it said in a report.

MIDF’s top buy calls* are Public Bank (PBBANK) and Hong Leong Bank (HLBANK), with their target prices at RM4.78 and RM21.38, respectively.

Considering Public Bank and Hong Leong Bank’s current price of RM4.13 and RM19.42, this represents a 15.74% and 10.09% upside if the research firm’s forecasts come to light.

*The buy call from MIDF means that it expects the total return to be >10% over the next 12 months.

In fact, MIDF is so bullish on the banking sector that it has 9 buy calls out of 11 banks and only 1 sell call, which is for Affin Bank. 😮

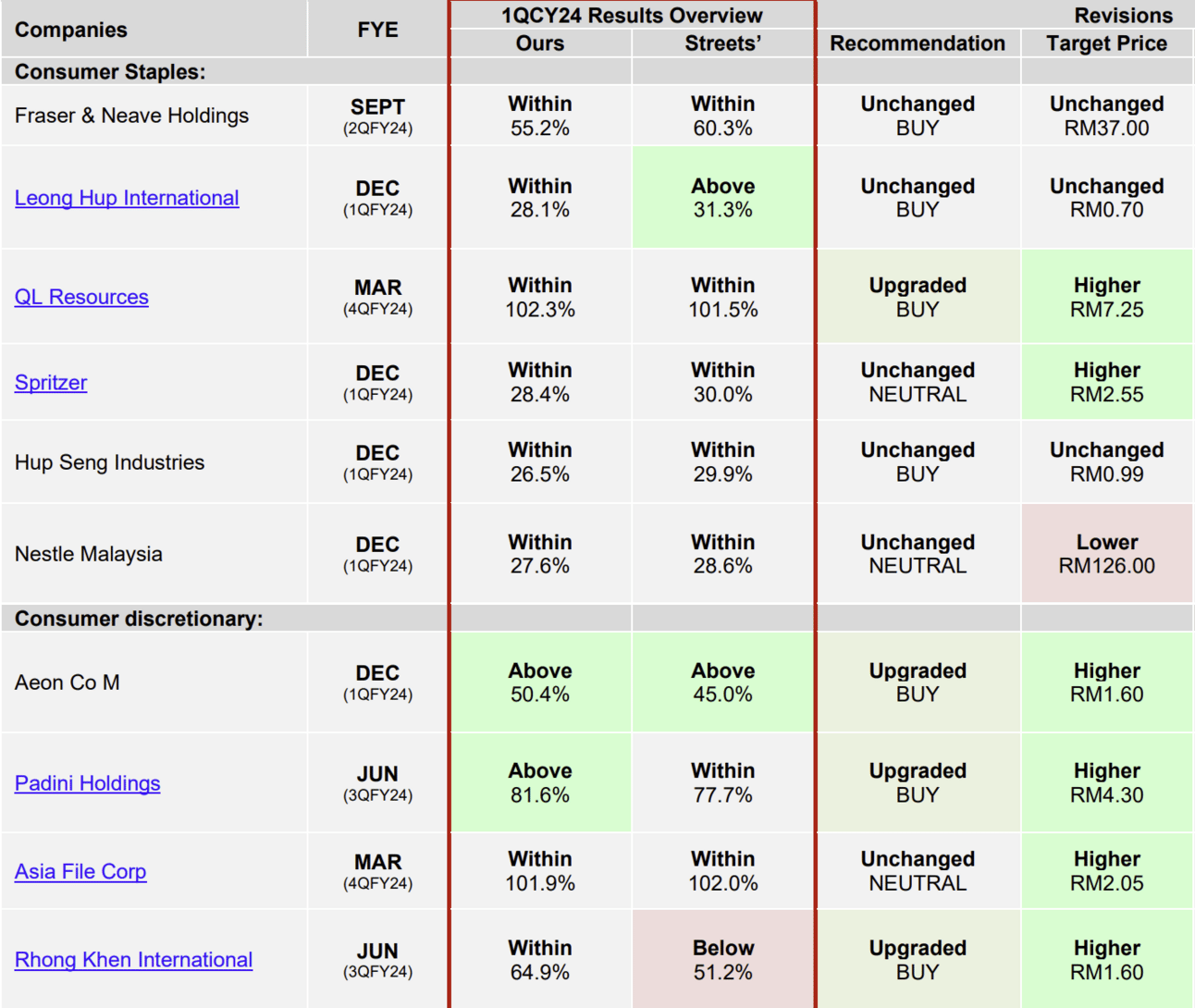

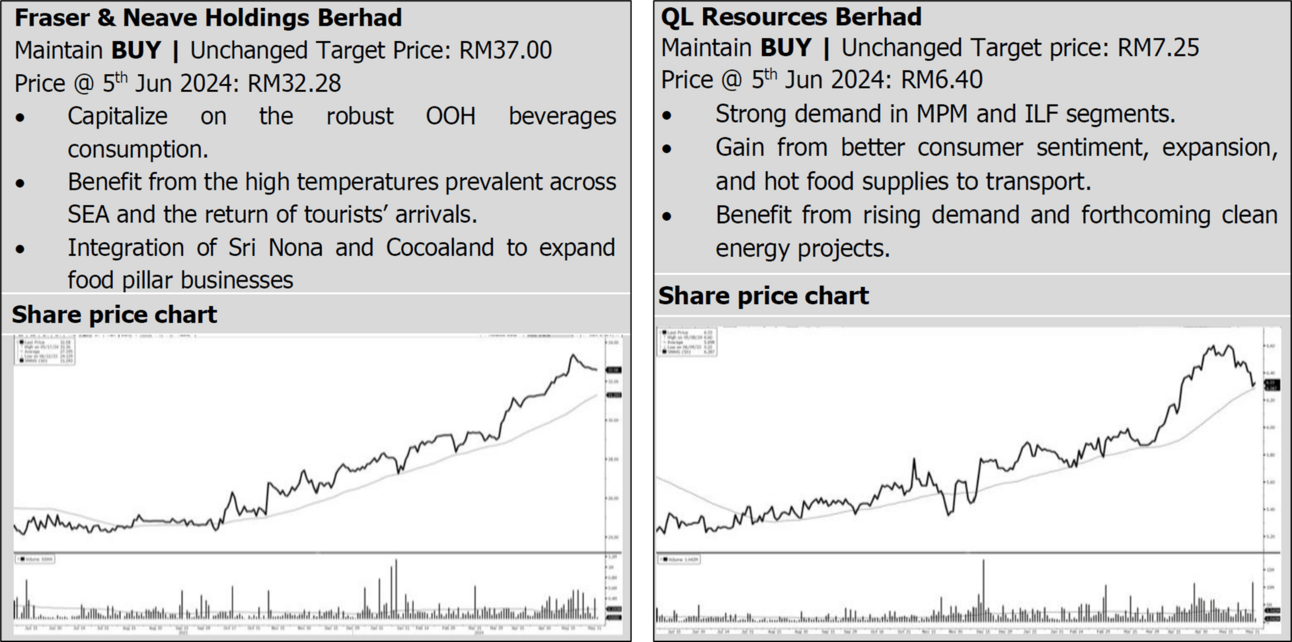

MIDF Research: Solid Outlook for Consumer Sector, Earnings within Expectations.

Moving onto the consumer sector, MIDF has strong buy calls on Fraser & Neave Holdings (F&N) and QL Resources Berhad (QL).

It expects easing inflationary pressures to support domestic spending, as it has persisted even with the new SST increase from 6% to 8%.

“Based on DOSM, retail trade gained positive momentum (+7.1% y-o-y; +2.1% m-o-m) to reach RM62.8b in March 2024. This was mainly supported by increased retail spending in most stores,” it said.

At the current price of RM32.38 and RM6.40 for F&N and QL Resources, the potential upside for both picks are 14.62% and 13.28%, respectively.

Apart from F&N and QL Resources, MIDF has buy calls on most of the consumer staples and consumer discretionary companies, as listed below:

MIDF Research: Maintain Positive on Property Sector

Demand for the property sector is expected to improve on the back of higher loan approval and an uptick in loan application.

“According to data released by Bank Negara Malaysia (BNM), total loan application for purchase of property increased to RM52.9b (+15.2% y-o-y) in April 2024 after two consecutive declines in February and March 2024,” it said.

This is mainly driven by the positive outlook for properties and Bank Negara Malaysia (BNM) maintaining the OPR at 3.0%.

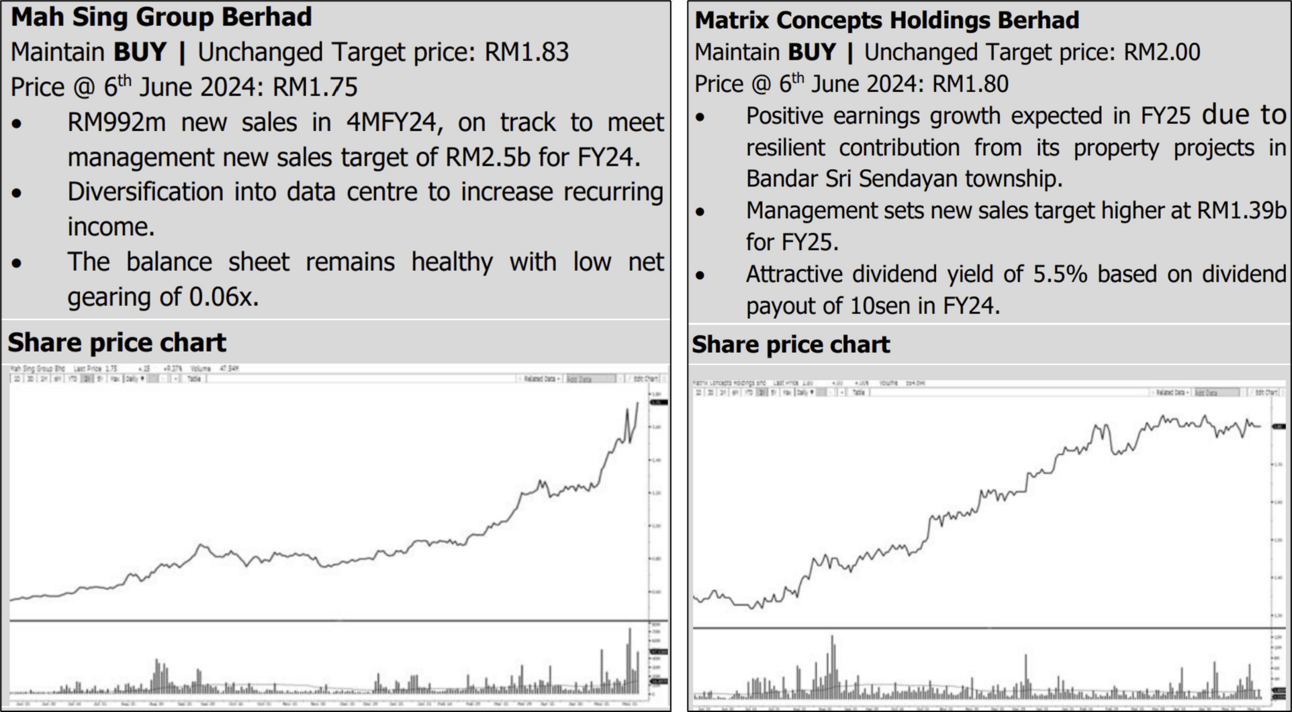

MIDF’s top picks are Mah Sing Group (MAHSING) and Matrix Concepts Holdings (MATRIX), with their respective target prices at RM1.83 and RM2.00.

As of 6 June, MAHSING was trading at RM1.75 (+4.57% potential upside) while MATRIX was valued at RM1.80 (+11.1% potential upside).

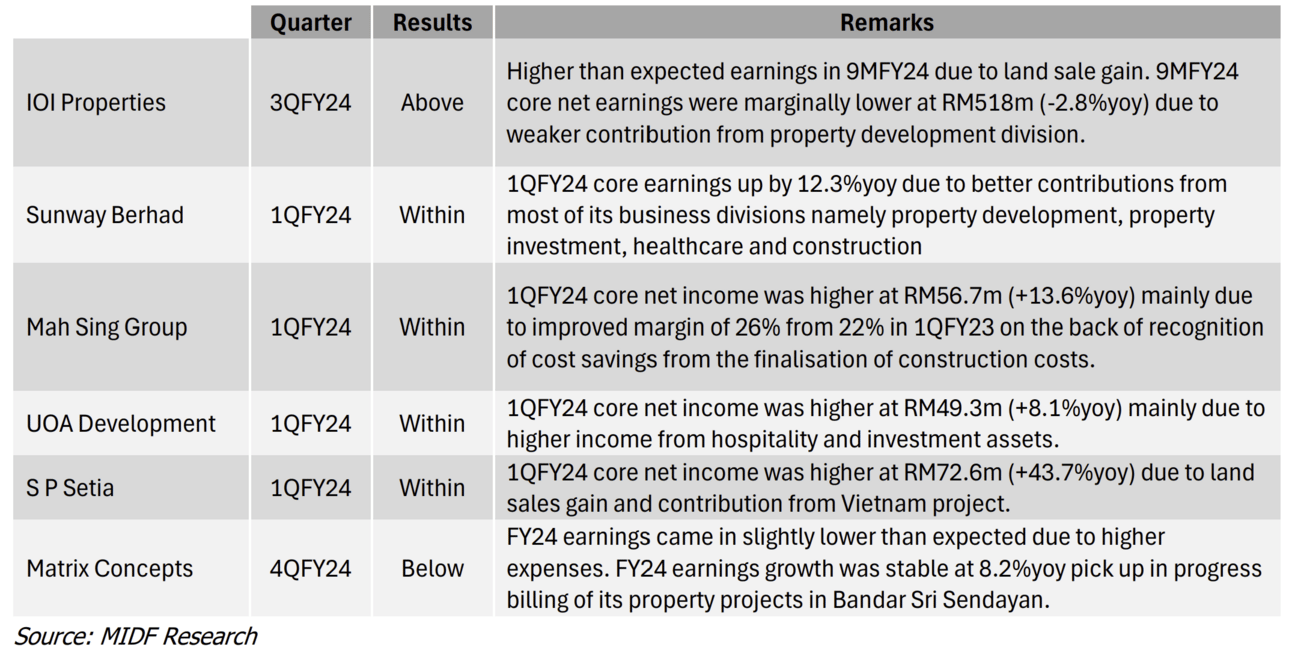

During the first quarter of 2024, the earnings of four out of six property companies came within MIDF’s expectations.

The overall earnings growth was positive, driven by “higher recognition from property projects as [the] labour shortage issue was resolved.”

The improvement in property sales has also supported better earnings. MIDF expects buying interest in this sector to remain healthy moving forward.

Thanks for reading till the end. That’s all for this week’s newsletter!

Just One More Thing…

If you enjoyed what you’ve read, then consider joining our private WhatsApp group to stay updated on all things Malaysian finance.

You’ll receive financial updates - best FD rates, currency movements, cash app comparisons, and more on a daily basis.

✅ 200+ people have joined.

✅ We don’t spam.

✅ It’s $0.25/week.*

✅ Pay monthly, cancel anytime.

*Most people who joined will try the First 7 days for Free before committing to any payment.

Disclaimer: This article has been interpreted based on the data from multiple sources, most notably Maybank IB and MIDF Research. It does not fully reflect the information shared by the sources.

You should be fully aware that this article is for information purposes only and is not an offer to buy or sell any securities.

Reply