- The Futurizts' Weekly Newsletter

- Posts

- I Made 52% Profit in US Stocks Since 2024: My Simple Investing Strategy 🚀

I Made 52% Profit in US Stocks Since 2024: My Simple Investing Strategy 🚀

This is how I invest in Apple, Meta, Google, and other growth stocks.

What do Apple, Nvidia, Microsoft, Meta, and Google have in common?

They are all brands of products you use every day

It’s impossible to run away from them

All of them belong to the US.

In fact, of the top 10 most valuable companies in the world, 8 of them are from America.

Source: CompaniesMarketCap

It’s no surprise that the US is the most productive economy in the world.

Their stock market is multiple times bigger than ours, their currency is stronger (although not as strong as the year before), and their companies dominate every major tech category you can think of.

My investing philosophy is simple: If I like the product, I’ll invest in the company.

iPhones are from Apple

The laptop that I used to write this article is from HP

I find sources from Google

I watch videos on YouTube (which is owned by Google)

And the list goes on.

This is one of the primary reasons why I chose to invest in the US — because I want exposure to companies that make products for everyday citizens.

There’s just one issue about this: There are so many products out there.

It wouldn’t be feasible for me to invest in ALL of these companies individually. Well I could, but it would be tiresome to manage.

“There must be a fund that invests in the entire US market” I thought…

Lo and behold, there is, and it’s called ETFs.

What ETFs actually are (and why I invest a lot in them).

Think of an Exchange Traded Fund as a basket of stocks that you can buy with a click.

Instead of choosing individual companies, you buy the whole basket.

This means that, rather than getting exposure from a single stock, you can get exposure to hundreds of stocks.

The most well-known ETFs include:

Vanguard S&P500 ETF (VOO): Invests in the S&P 500 Index, representing 500 of the largest US companies.

Vanguard Information Technology ETF (VGT): Measures the performance of stocks in the US tech sector.

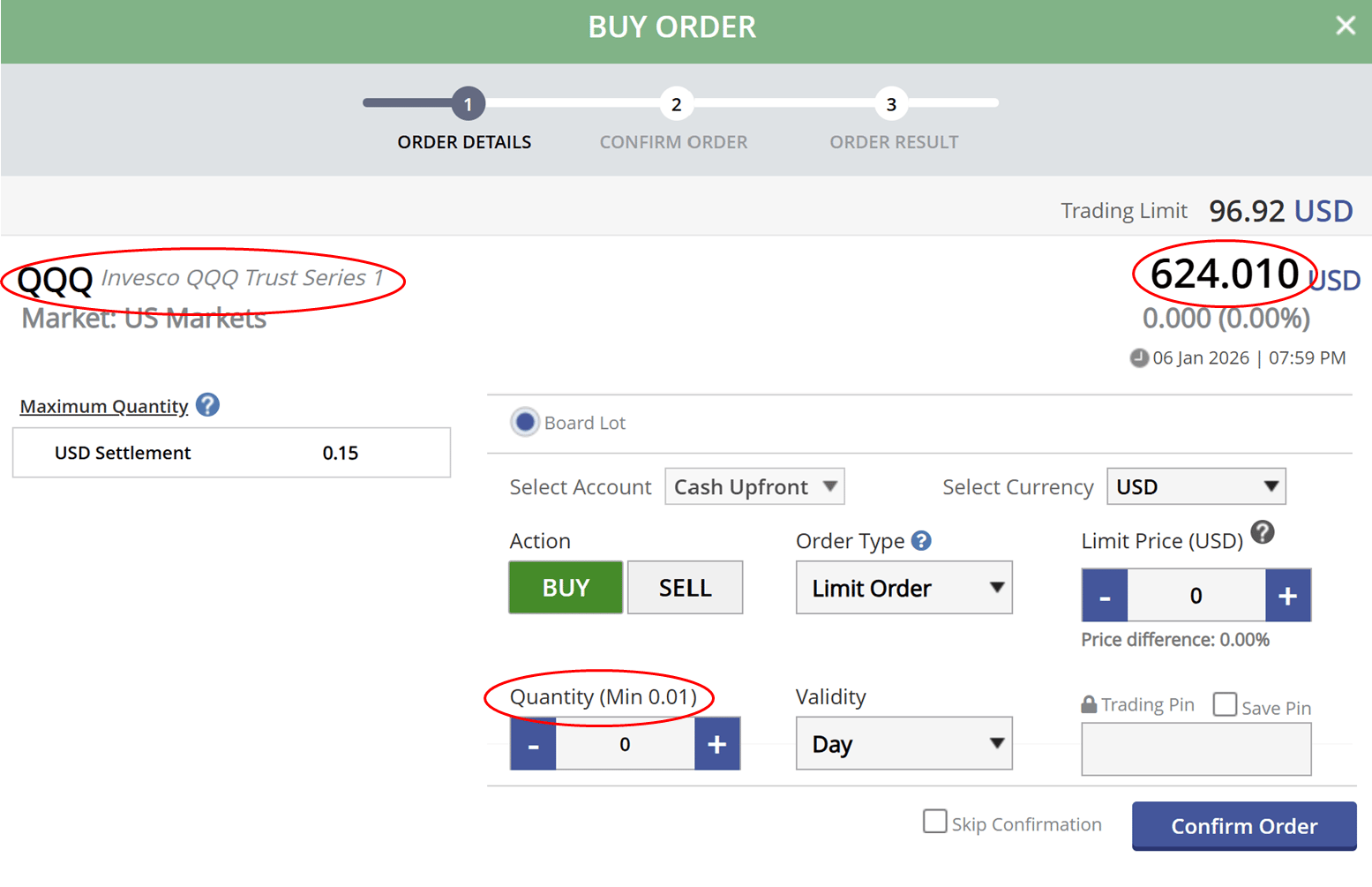

Invesco QQQ ETF (QQQ): Tracks the Nasdaq-100 Index, giving you exposure to the performance of the 100 largest non-financial companies listed on the Nasdaq.

These funds differ in their allocations, and their performances vary too.

For instance, the tech heavy VGT ETF has performed far better than VOO — mainly because it is heavily invested in the tech sector, which grew exponentially in the past decade.

That said, the long term trend generally follows the S&P500 index.

Green: VGT, Orange: QQQ, Blue: VOO, Candlesticks: S&P500 Index

With the chart in mind, here are the average yearly performances of the 3 ETFs in the past decade:

VGT: 21.77% p.a. (+616.72%)

QQQ: 19.18% p.a. (+478.06%)

VOO: 12.80% p.a. (+233.55%)

In other words, for every US$1,000 you invest in these ETFs in 2016, they would right now be worth:

VGT: $7,167.20

QQQ: $5,780.60

VOO: $3,335.50

^ As of 8 January 2026.

This growth is much more impressive compared to the options we’re familiar with (ie. ASB, ASM, cash apps, FDs, etc.), but of course, the risks are also much higher.

So, what are the risks?

1. Ringgit strength.

You’ll probably laugh when I say this, but there’s a chance of the ringgit strengthening against the US dollar over the next few decades. Although the chance small, it is still a risk you should consider.

Even though the ringgit has weakened (gradually) from RM3.50 to RM4.20 over the past 15 years, it doesn’t mean that things will stay this way.

For all we know:

The US could mess up its policies, causing people to lose confidence in the dollar (it’s already happening btw).

Malaysia could do extremely well economically over the next decade, ushering in an “age of prosperity”.

And many other “unforeseen” things that we would think is impossible to happen today.

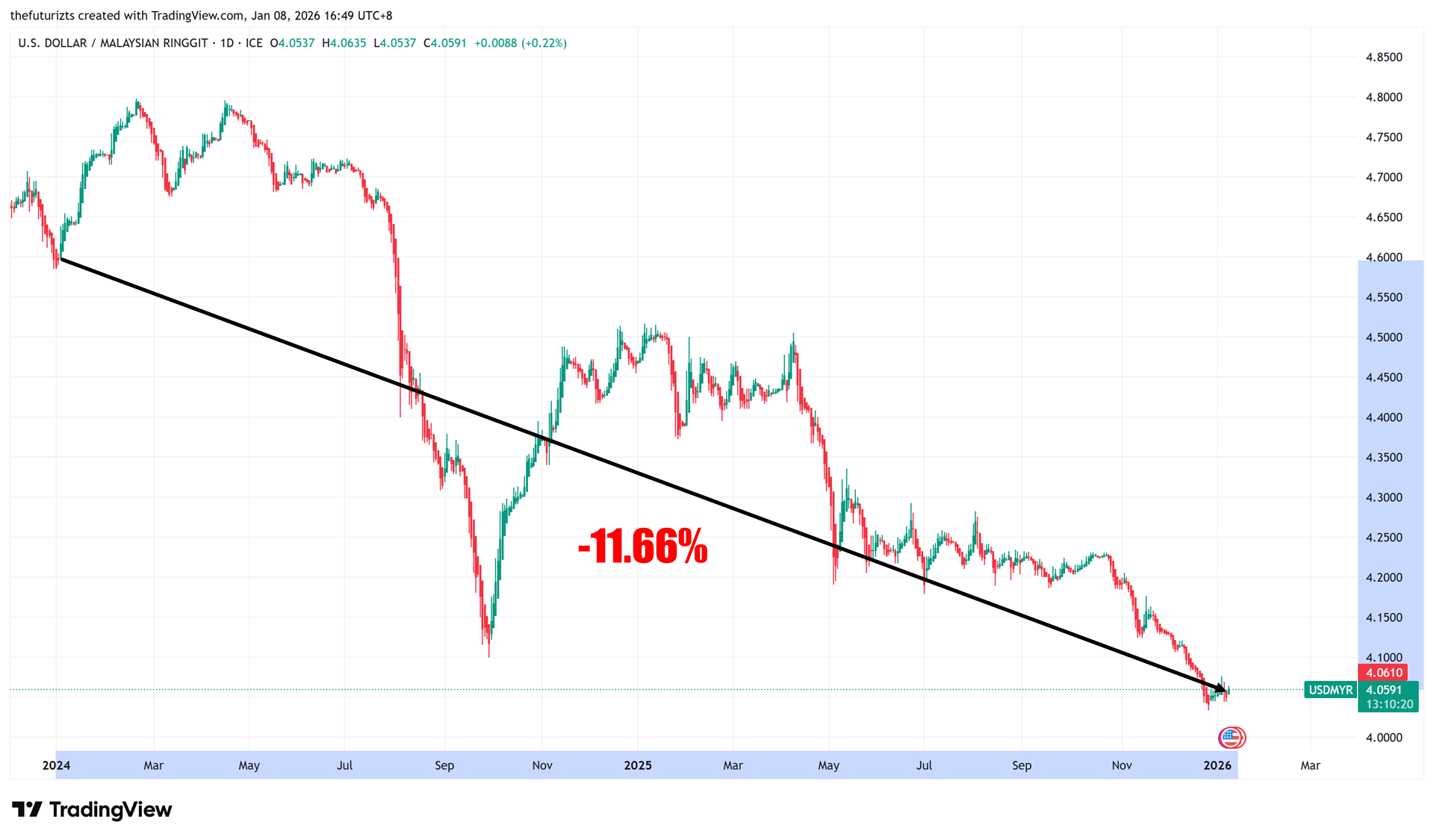

In 2025, the ringgit gained 10.15% versus the dollar, mainly because the US reduced interest rates and Malaysia’s strong economic fundamentals.

This heavily affected my profits from the US sector.

Even though the QQQ ETF has gained 52% since 2024, the real profit in ringgit is actually 33%. Sorry for clickbaiting you guys on the title of this article.

^ Chart of USDMYR: Since 2024, the dollar fell 11.66% against the ringgit.

2. Uncertainty of what Trump will say (or do)

2 April 2025: Trump announces tariffs on the rest of the world. Market panics and crashes.

Mid-Apr 2025: Trump gives a 90-day pause for all countries except China.

June 2025: Trump grants 90-day pause for China.

Today: I don’t know what Trump said, but the market has bounced back and made a new all-time high.

3. Recessions

The Dotcom Bubble

The 1998 Asian Financial Crisis

The 2008 Financial Crisis

The Covid Pandemic

Crises are bound to happen. We just don’t know when and how bad.

In fact, we could be in a massive bubble right now, and you could be reading this article again a few months later, only to find out the market has tanked.

But one thing’s (almost) certain: The US market is resilient. It has proven time and time again to bounce back from major catastrophes, even recovering beyond its previous high point.

How I mitigate these risks: I invest long term.

Not 1 year. Not 5 years. But 10-20 years.

As long as the US continues to produce products that people need for their daily lives, I will stay true to my current thesis and continue investing no matter what happens in the short term.

Another way I mitigate risk is by diversifying. Members in the Telegram group know that I only allocate about 20-25% of my portfolio in the US.

Where I invest in ETFs

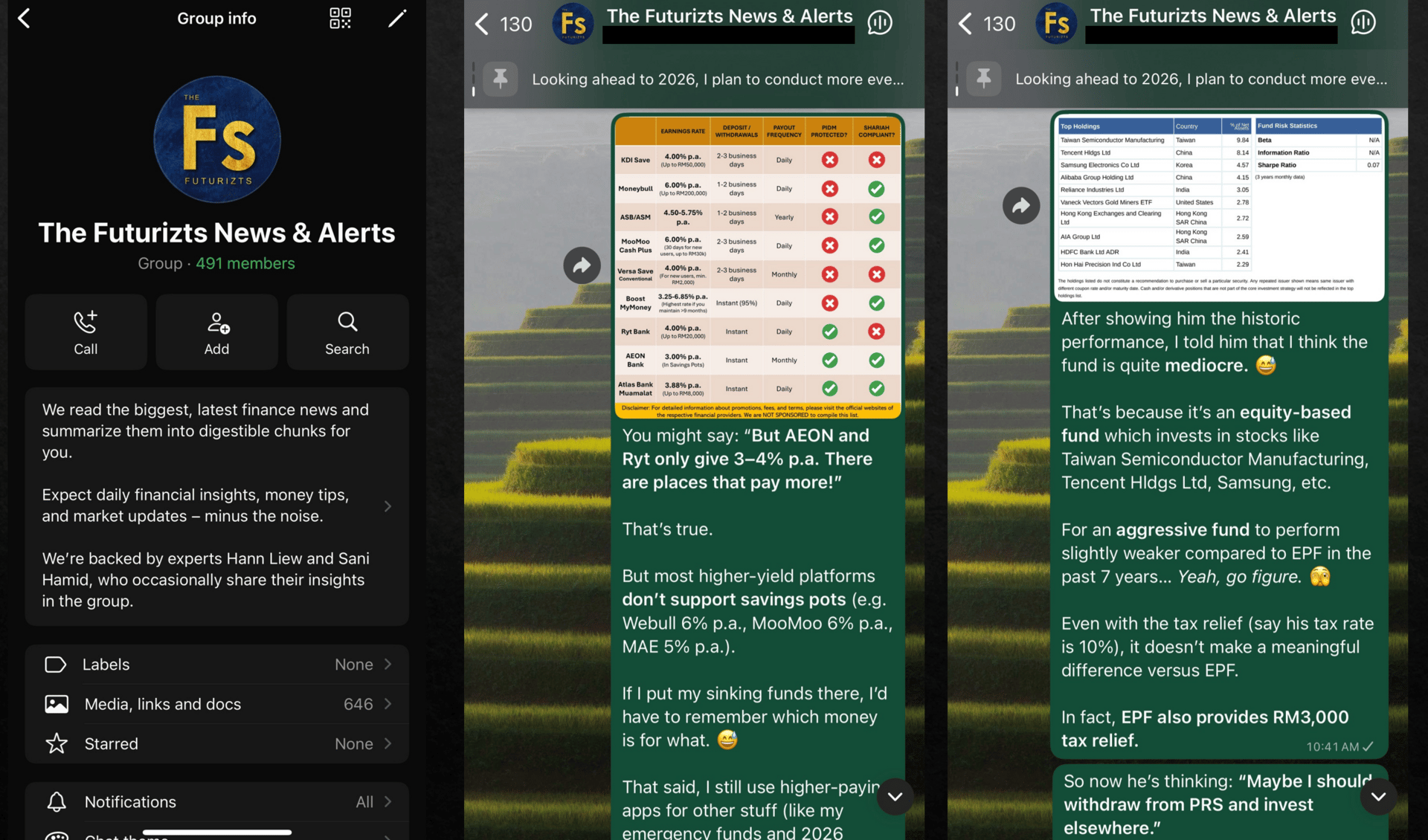

MooMoo, Rakuten, and M+ Global all offer the 3 ETFs I mentioned, but I’m using Rakuten because its fees are quite low if you buy between US$100 to US$500 — which is perfect for investing monthly.

Rakuten also allows you to buy fractional shares, meaning you don’t have to buy an entire unit of QQQ (currently priced at US$624) if you want to invest.

You can go as low as 0.01. But don’t do this because the fees will be much higher.

Other features and rewards

RM30 US shares when you activate both Bursa & Foreign Trading accounts and complete a first BUY trade of RM1,000 or more in a single transaction

RM50 US shares with cumulative trading of RM5,000 – RM9,999

RM80 US shares with cumulative trading of RM10,000 – RM14,999

RM100 US shares when cumulative trading exceeds RM15,000

If you’re interested to try out Rakuten, sign up with my referral code “THEFUTURIZTS” or click on this link:

More things you should know:

Rakuten’s mobile app is not very good. I only use the desktop.

You can buy US ETFs just like regular shares during market opening hours (9.30 pm - 4.00 am MYT).

If you’ve made it this far, it means you’re serious in improving your finances.

Everyday, 500+ Malaysians in our paid WhatsApp group receive:

✅ Updates on tax, EPF, savings & investing

✅ Clear comparisons on where to grow money

✅ No ads or sponsorships

Some of the topics may also appear on Instagram, and that’s intentional. Instagram is for summaries. WhatsApp is for more context and clarity.

DISCLAIMER: Investing in ETFs and stocks has its own risks as they are different from opening a deposit account with a financial institution. You should speak with a financial planner if you’re unsure of any investing decisions. ⚠️

Reply