- The Futurizts' Weekly Newsletter

- Posts

- (SPECIAL) 26 Dec: Wrapping Up 2022 - Looking Back at Key Events - Weekly Newsletter

(SPECIAL) 26 Dec: Wrapping Up 2022 - Looking Back at Key Events - Weekly Newsletter

Merry Christmas and a Happy New Year everyone!

I hope your holidays are filled with joy, love, and good cheer. 2022 has been a tough year, with many crises and challenges. But despite all the difficulties, you have persevered and made it through. So let's give ourselves a pat on the back and look forward to new opportunities and new beginnings.

This week's top headlines:

i) A look back at 2022 with some charts - stock market, Ringgit, inflation, etc.

ii) Examining key events (both on the crypto and macro level) that shaped this turbulent year.

Scroll down to read the details.

A huge shoutout to all Gatherer and Learner members! Thank you for sticking with me through this chaotic year. Your support means a lot to me.

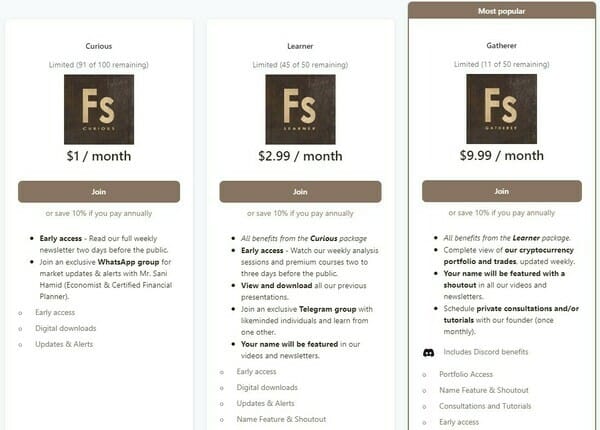

Get early access to our newsletter and miss nothing from the markets. Join our journey towards financial literacy today.

Our private announcement group will keep you updated with market movers and urgent matters. For only $1/month, you’ll receive the newsletter every Sunday night and notifications on important events, some with detailed thoughts from economist Mr. Sani Hamid.

✅ No commitments.

✅ Cancel anytime.

✅ Zero ads, zero shills.

Check out our different packages by clicking on this link.

Bitcoin hovered steadily at $16,800. Will 2022 end peacefully?

To say that 2022 has been a tough year is an understatement. The countless crises that have hit markets shaped a year filled with volatility and fear. But the price fluctuations in the crypto market have stabilized as 2022 comes to a close.

The annualized volatility for Bitcoin, covered in my previous issue, fell to a 2 year low in December as investors de-risk, de-leverage, and tighten their liquidity. This is the main reason why we see such a peaceful sideways action for Bitcoin after the FTX crisis.

I am expecting this to continue untill the new year.

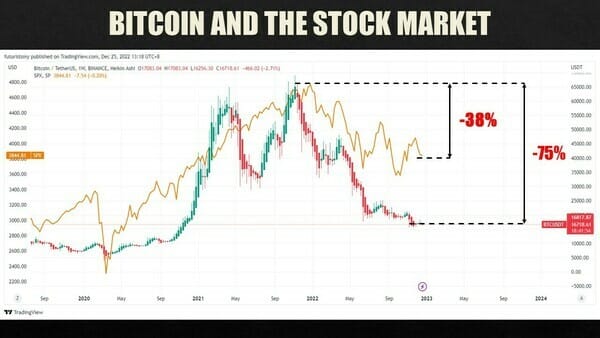

1) BITCOIN AND THE US STOCK MARKET.

i) Bitcoin has lost over 75% of its value this year, falling from its all-time high of $69,000. This is not surprising, as cryptocurrencies have been among the worst performing assets of the year compared to stocks, bonds, and hedge funds.

The poor performance of cryptocurrencies in 2022 has been attributed to macro uncertainties and several internal "Black Swan Events", such as the collapse of Terra (LUNA), Celsius, 3AC, and FTX.

ii) The US equity market, meanwhile, has declined 38% from January. "Blue-chip" stocks like Facebook, Netflix, and Amazon, which have been popular among value investors in 2021, are currently 50-70% below their all-time highs.

If you invested $10,000 in Facebook (META) at the beginning of the year, you would currently have approximately $3,300, a significant and painful loss that many investors are still struggling to accept.

2) THE US DOLLAR AND THE BURSA MARKET.

i) The value of the ringgit has declined by about 6% against the US dollar since the beginning of the year. If you had acquired US dollars in January, you would have made a profit of about 14% if you sold at the dollar's peak of RM4.75 on November 7.

Even if you did not sell at the peak, you would still have made a profit of about 6%, which is impressive given the current "risk-off" sentiment among investors.

ii) The Bursa market, on the other hand, has fallen by 5.4%, a much smaller decline compared to the 38% decline in the US stock market. Bank stocks have performed well this year, with Maybank (MAYBANK) and Public Bank (PBBANK) posting an average gain of about 6%, excluding dividends.

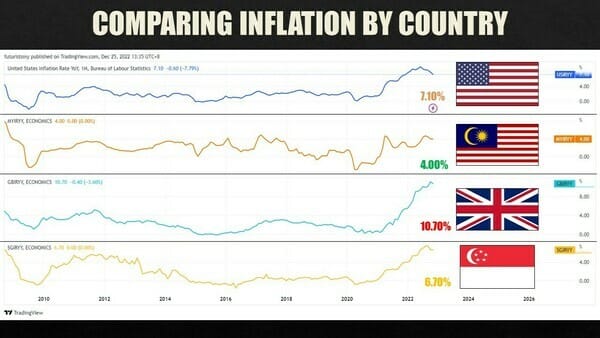

3) COMPARING INFLATION BY COUNTRY

Inflation is a concern not only for the poor and the middle class, but for central banks as well.

Over the past decade, low interest rates following the 2008 financial crisis led to an alarming increase in the circulation of money, and the COVID-19 pandemic further amplified money printing to the point where central banks could no longer prevent price increases.

Despite the Federal Reserve's rapid tightening (from 0% to 4.00% in less than a year), inflation remains above the Fed's target of 2%, though it appears to have peaked at 9.1%.

Malaysia has one of the lowest inflation rates compared to other major countries such as the Euro Zone (10.0%), United States (7.1%), Singapore (6.7%), Philippines (8.0%), Thailand (5.6%), Indonesia (5.4%), and the Republic of Korea (5.0%).

A large part of Malaysia's "low inflation" can be attributed to subsidies provided by the government on commodities such as oil, chicken, and electricity. Without these subsidies, inflation in Malaysia could potentially reach 11%, according to former Prime Minister Ismail Sabri.

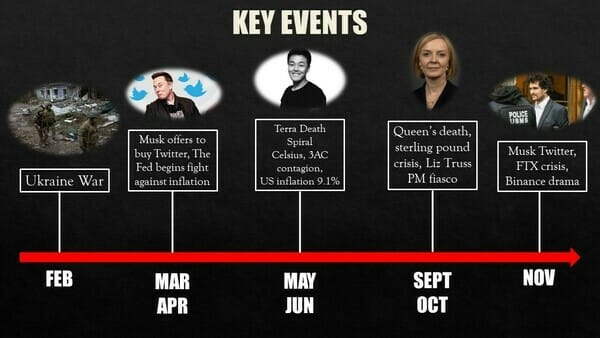

A simplified timeline of this year's biggest events:

February: Russian President Vladimir Putin announced a special military operation in Ukraine, effectively declaring war which, until now, remains unresolved.

Sept/Oct: Queen Elizabeth II's death was followed by the sterling pound crisis. Former Prime Minister Liz Truss passed a "mini-budget" which included the largest tax cuts the nation had seen in 50 years, a move that was counter to the Bank of England's efforts to fight inflation. Investors did not favor this approach. The sterling pound crashed to a low of RM4.88 against the ringgit and almost reached parity with the US dollar. Liz Truss resigned within six weeks.

A Personal Note to Close 2022...

It takes strength, resilience, and determination to overcome adversity, and it's clear that you have all of these qualities in abundance.

I know that 2023 may be forecasted to be a difficult year, but I have confidence that you will continue to persevere and come out even stronger on the other side.

It's important to remember that you are not alone, and that you have the support of others to help you through the tough times. Don't hesitate to reach out for help when you need it, and be sure to express gratitude for the people who are there for you.

In the meantime, try to focus on living in the present moment and finding joy and purpose in your daily life. It can be easy to get caught up in worries about the future, but try to stay grounded in the here and now. Remember to take care of yourself and find ways to cope with stress and uncertainty. With a positive attitude and a little bit of perseverance, you can make it through even the toughest of times.

Stay strong,

Dear Reader.

That’s all for this week’s newsletter!

Disclaimer: I am not a financial advisor. This newsletter is based on my own analysis and research. Do not take any of it as financial advice.

*This newsletter was written at 10.30 AM on 26th December 2022 and completed at 3.30 PM the same day.

To read our newsletter on the day it is published, subscribe to Patreon membership for as little as $1 a month!

Reply