- The Futurizts' Weekly Newsletter

- Posts

- Stonks To Watch Now

Stonks To Watch Now

Investment Analyst Azharuddin Shares His Stock Watchlist, Thoughts Trump's Tariffs, and BNM's Rate Cut.

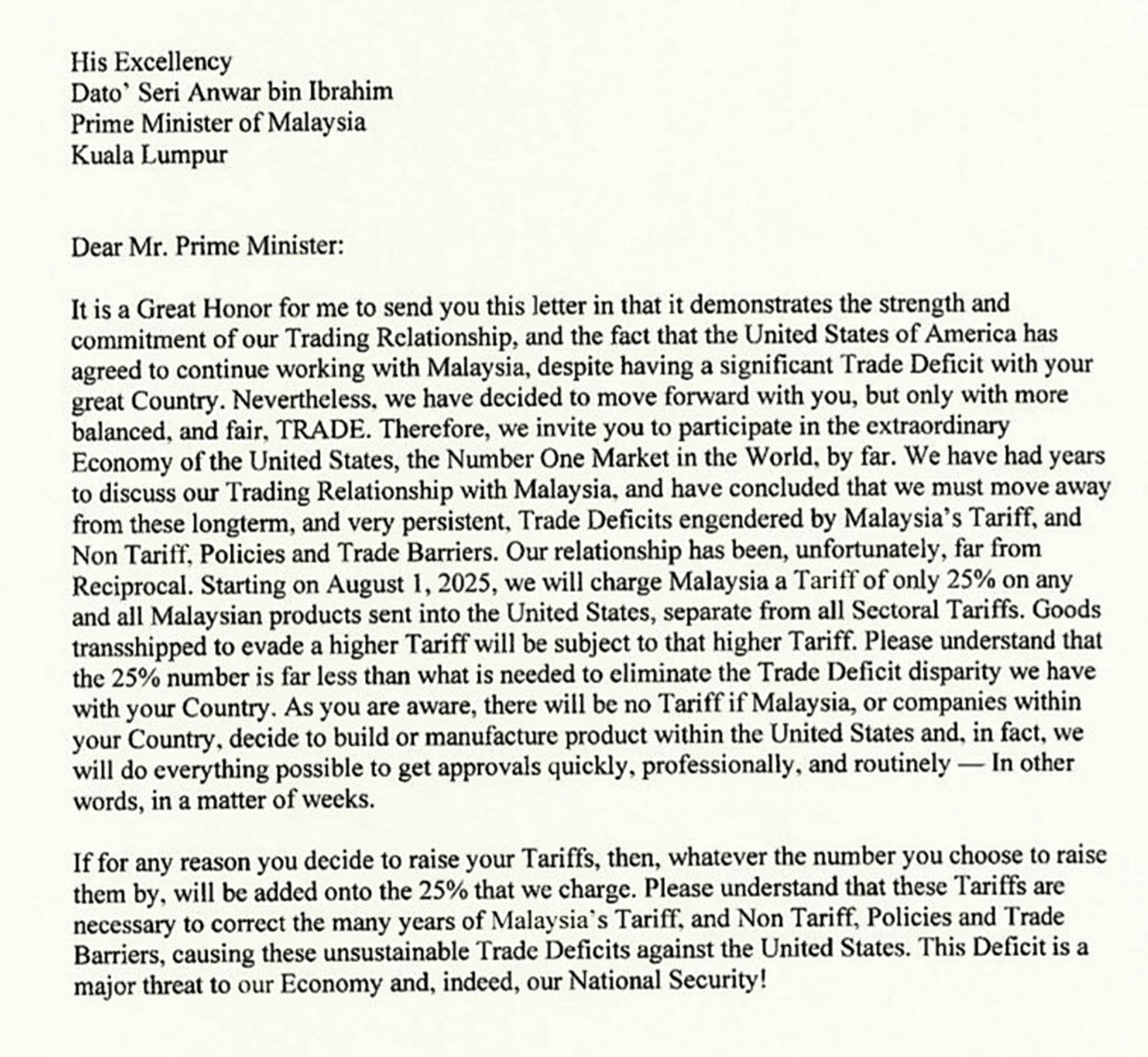

Last Monday (July 7), Donald Trump announced a 25% tariff on all Malaysian products entering the US, effective August 1.

The letter, detailing to PM Anwar, sought to escalate the Malaysia-US trade relations, which Trump previously agreed to lower Malaysia’s tariffs down to a baseline of 10% while exempting semiconductors.

The reason for the “new” tariffs, according to Trump, is to “eliminate the Trade Deficit disparity” the US has with Malaysia.

At the same time, Trump threatened Malaysia not to retaliate, saying that “If for any reason you decide to raise your Tariffs, then, whatever the number you choose to raise them by, will be added onto the 25% that we charge.”

In the same week, Bank Negara Malaysia (BNM) lowered the Overnight Policy Rate (OPR) by 0.25%, citing “continued expansion in global growth, supported by sustained consumer spending and to some extent, front-loading activities.”

Despite solid growth, BNM wants to cushion Malaysia from global trade slowdown (Trump tariffs) and geopolitical uncertainty (Ukraine and Middle East).

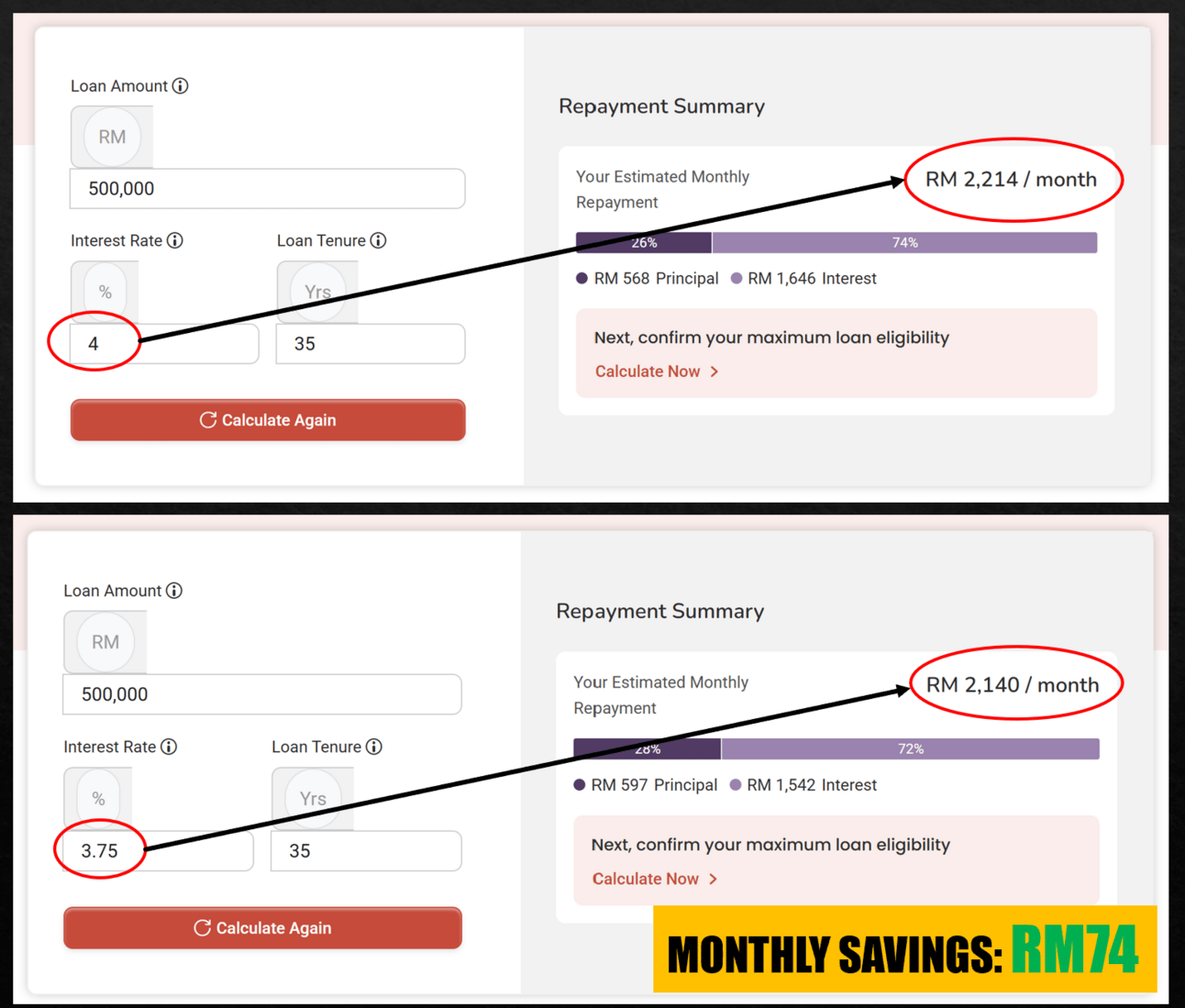

Rate cuts benefit borrowers because loans become cheaper. If you have a home loan, your bank will likely reduce the monthly repayments soon.

A RM500k housing loan might see a reduction of RM60–150, depending on loan terms.

On Sunday, I invited Investment Analyst Azharuddin to breakdown Trump’s tariffs, BNM’s rate cut, and his current stock watchlist.

Listen to the replay on:

Scroll down for a summary of the session.

Q1: What are tariffs? And what does Trump aim to do with them?

Tariffs are basically taxes on goods that are brought into a country. You can think of them like an “import duty,” used to protect local businesses by making foreign products more expensive.

In Malaysia, for example, we place heavy tariffs on imported cars. These include excise duty, import duty, and sales tax. The amount depends on whether the car is fully built (CBU) or assembled locally (CKD).

Now, what Trump is doing with tariffs is quite unusual. He’s applying them across the board—whether you’re a close ally or a rival of the US, you're still hit by the tariffs.

From his point of view, the global trade system is unfair. He believes countries like China and Japan are benefiting too much by constantly selling goods to the US, which has led to a big trade deficit for America.

Over the years, many US companies have moved their factories overseas to save on labor costs. Take iPhones for example, their parts are sourced globally, and assembly happens in China, India, and Vietnam.

Trump wants to reverse that. His goal is to bring manufacturing jobs back to the US, boost local production, and “Make America Wealthy Again.” He’s using tariffs as a way to punish countries he believes are “taking advantage” of the US.

Q2: What impact will Trump’s tariffs have on the Malaysian economy and stock market?

We won’t see the full impact right away. The 25% tariffs are set to take effect on August 1, so the real effects will start showing after that.

Right now, the US is our third-largest trading partner, making up about 11% of Malaysia’s total exports. Out of that 11%, around 60% are electronic products—mainly semiconductors. So if the US doesn’t exempt this category, it could be a major hit to our tech sector.

In fact, the Penang Semiconductor Association has warned that the industry can’t survive with such high tariffs.

That said, Malaysia has done a good job in recent years to diversify our exports. We’ve started trading more with our ASEAN neighbors like Indonesia and Thailand, which helps reduce our reliance on the US.

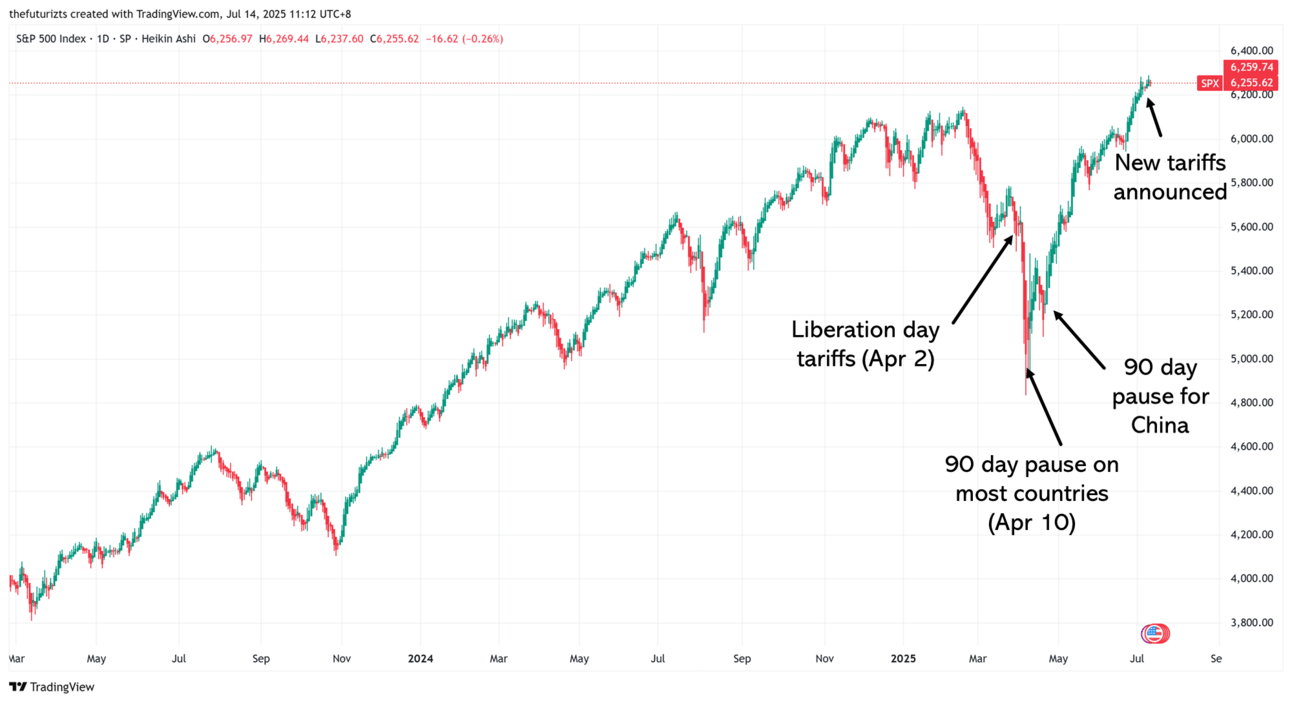

As for the stock market, it often moves independently from the real economy. Look at the US. Their market is hitting all-time highs even with these tariffs in play.

The US market is currently at an all-time high.

In Malaysia, although the main index hasn’t fully recovered, some individual stocks have reached new highs.

So, from an investor's perspective, it seems like the market is saying, "Let’s move on." Many believe the US might end up softening the tariff rate anyway, and countries like Malaysia will adjust.

Q3: How does your current stock list look?

Right now, I’m focusing on sectors that aren’t too exposed to global risks like banks, consumer staples, defensive stocks, commodities, and plantations. These are more stable and less likely to be affected by Trump’s tariffs.

When it comes to stock-picking, stick with what you know. I’ve worked in the banking sector for years as an investment analyst, so I’m naturally confident in looking at balance sheets and analyzing stocks.

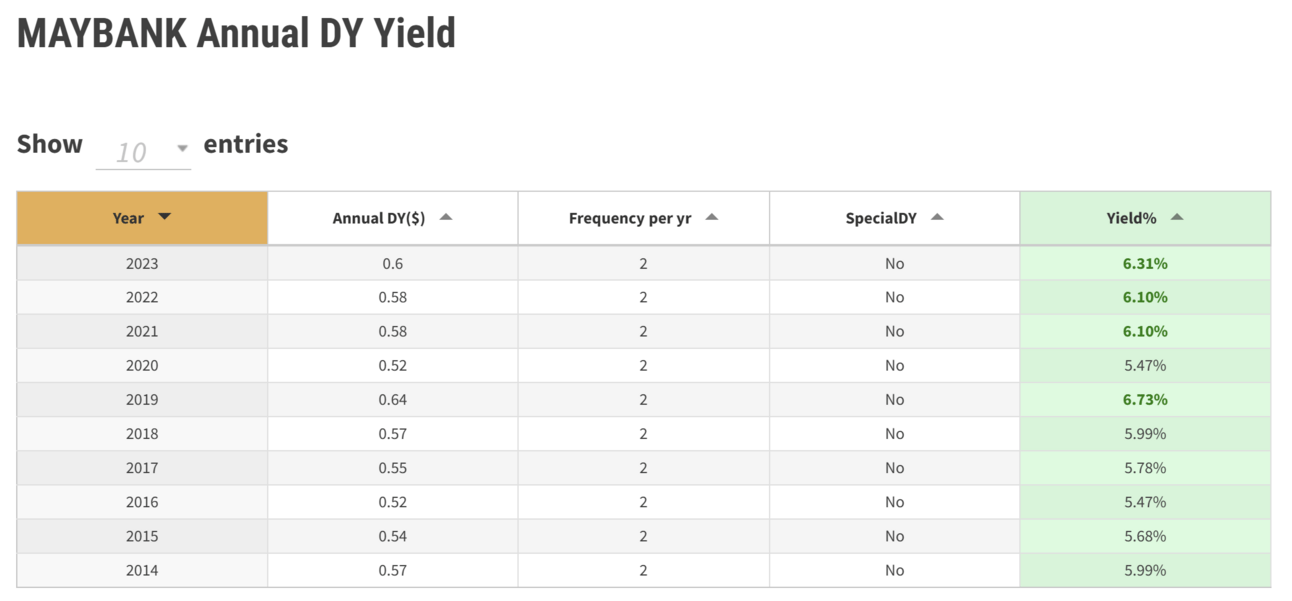

Take Maybank, for instance. It’s proven itself through multiple crises and still paid 5–7% dividends annually over the last 10 years, regardless of how the broader market performed.

Trump’s tariffs aren’t expected to hit the local banking sector too hard because Malaysia’s economy is still relatively strong. That’s also why Bank Negara decided to cut the OPR—to support growth and keep inflation under control.

It’s also worth noting that about 60% of our GDP comes from the services sector, which is mostly driven by domestic activity. That adds another layer of stability.

In uncertain times, it makes sense to stick with giants like Maybank because they have a strong balance sheet and long track record of consistency.

Another stock I really like is Spritzer. I bought into it 1–2 years ago, and the growth has been amazing. I think they’ve done a great job positioning themselves as a premium brand, and you can see it in the numbers. Their sales have soared.

One reason for that is today’s younger consumers are more open to supporting local brands that innovate and adapt. That’s why Spritzer stands out.

These are the kinds of companies you want to hold long term—local, growing, and not too affected by global drama.

Spritzer’s share price has more than doubled in the past 2 years.

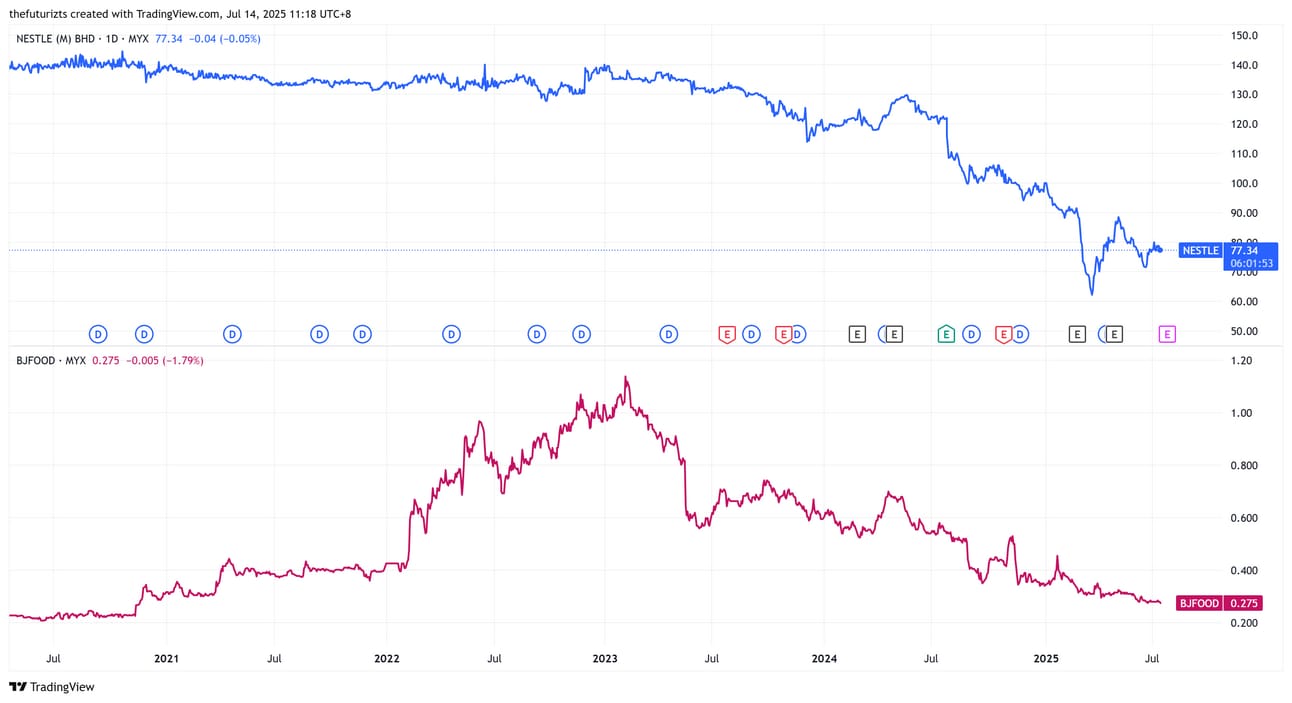

But for firms that have stuck to their old ways (ie. Nestle, Berjaya Food Starbucks), the opposite becomes true for them. NESTLE and BJFOOD are currently on a downtrading wave because consumers have opted for other cheaper alternatives.

For Starbucks, the boycott wave is long over, but I think that they’re still in quite a bit of denial. The reality is that there are so many more cheaper coffee chains (ie. ZUS, Gigi) that provide the same (or better) quality with an affordable price.

NESTLE and BJFOOD are on a downtrend because of consumers opting for cheaper alternatives.

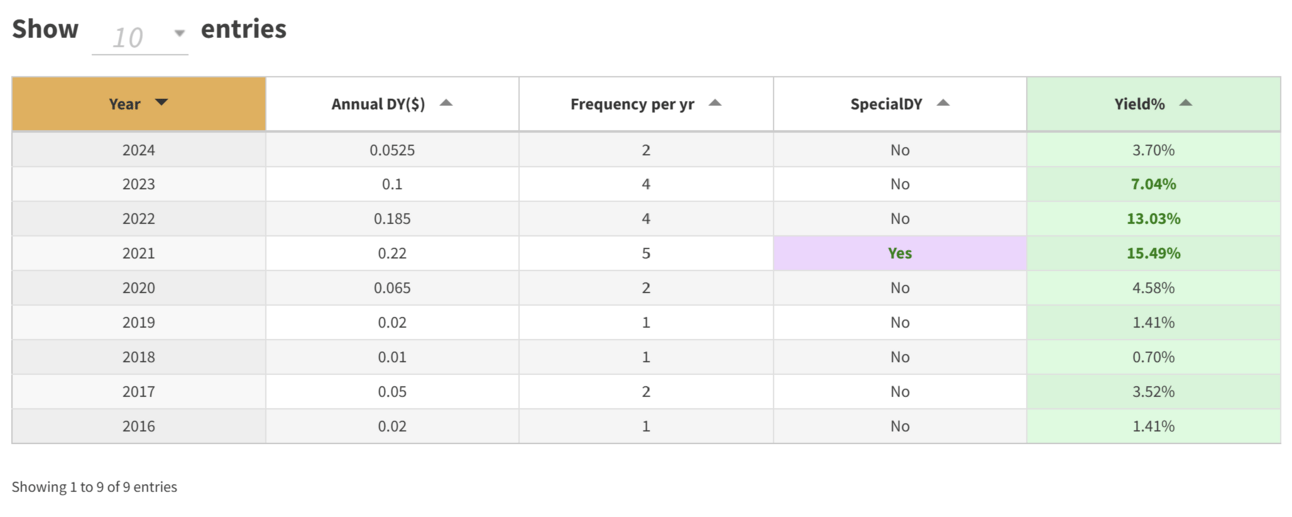

Another gem I like is Innoprise, a platation stock. They pay dividends four times a year, with a yield of >8%. That’s higher than what you’d get from ASB or EPF. For a dividend investor, that’s hard to beat.

Q4: What’s one important thing that stock investors should know about?

Ask yourself: why do I want to invest in stocks? Can I take the risks? Will I panic-sell when markets are volatile?

For me, choosing the stock market is easy because:

I’ve worked in the stock market for decades

Whenever there’s a crisis or black swan event (ie. Covid, inflation surge, US rate hikes, Iran-Israel war, Trump’s tariffs), stocks will dip initially, sure, but they always comeback, because companies will always find ways to adapt and improve their profitability.

I actually love market crashes so much because there are so many things to buy at a discount. This is the approach that you should have.

But it all starts with learning. Understand what the stock market really is. Know the difference between a stock and the actual company. Study what intrinsic value means.

Take the time to build your own investing approach. And when you believe in a stock, hold on to it unless something changes fundamentally. Don’t let short-term noise shake your confidence.

If you want to learn more about stocks, understand balance sheets, and avoid fake tips or hype, join Azha’s talk on 26 July!

✅ Learn A 7-Step Method to Pick Stocks Like Analysts – Without using fancy tools or paid apps.

✅ Analyze Real Bursa Companies – Maybank, CIMB, Gamuda, and more.

✅ Read Financial Statements with Confidence – Know what defines a successful company and what doesn't.

✅ Avoid Common Traps – Overhyped stocks (ie. SERBADK), weak industries (ie. TOPGLOV), and risky balance sheets.

✅ Build Your Own Stocklist – Leave with an actual list of stocks you’ve analyzed.

💡 Bonus: High-Dividend Strategy – RHB, Innoprise, Kerjaya Prospek, and others.

Event link: https://lu.ma/6l9725r2

Speaker profile: Azharuddin is a seasoned capital markets professional with over two decades of experience across the financial and corporate sectors. He has spent a significant part of his career as Head of Research, where he led both equity and macroeconomic research teams in several prominent investment banks. In this role, he provided in-depth market insights, guided institutional investment strategies, and regularly briefed top fund managers, government-linked investment companies (GLICs), and multinational clients.

DISCLAIMER: The thoughts shared in the session are solely that of the speaker and should not be considered as financial advice. This summary does not fully encapsulate the things shared by Azha.

Reply