- The Futurizts' Weekly Newsletter

- Posts

- Will the Ringgit hit RM4.00 by year-end?

Will the Ringgit hit RM4.00 by year-end?

Financial experts Hann and Sani discuss the ringgit's remarkable rally and more.

The ringgit’s performance in the past two weeks is unreal.

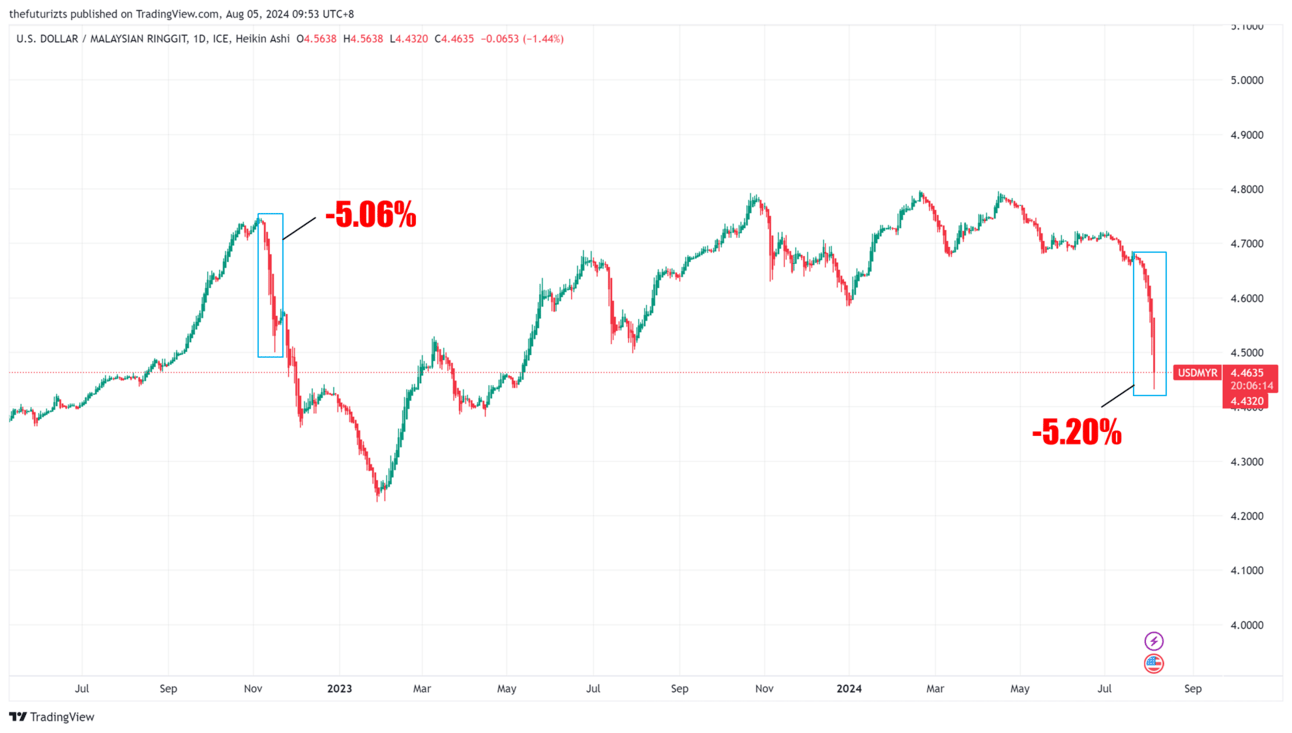

It has gained 5.42% in 11 days, from RM4.6729 to a 15-month high of RM4.4320, before settling at RM4.4635 against the US dollar.

This massive movement has not been seen since November 2022, when the local note strengthened from RM4.7380 to RM4.50.

Coincidentally, that was when Pakatan Harapan won GE15 and Anwar was sworn in as the tenth Prime Minister, which led many to believe that it was the main reason for the ringgit’s strength.

Under Anwar’s leadership, the government has pursued short-term pain for long-term gain, making several tough decisions, such as removing diesel subsidies and reforming their distribution to the rakyat.

These actions have been widely applauded by economists and analysts worldwide, but they are not the only factors contributing to the ringgit’s strength.

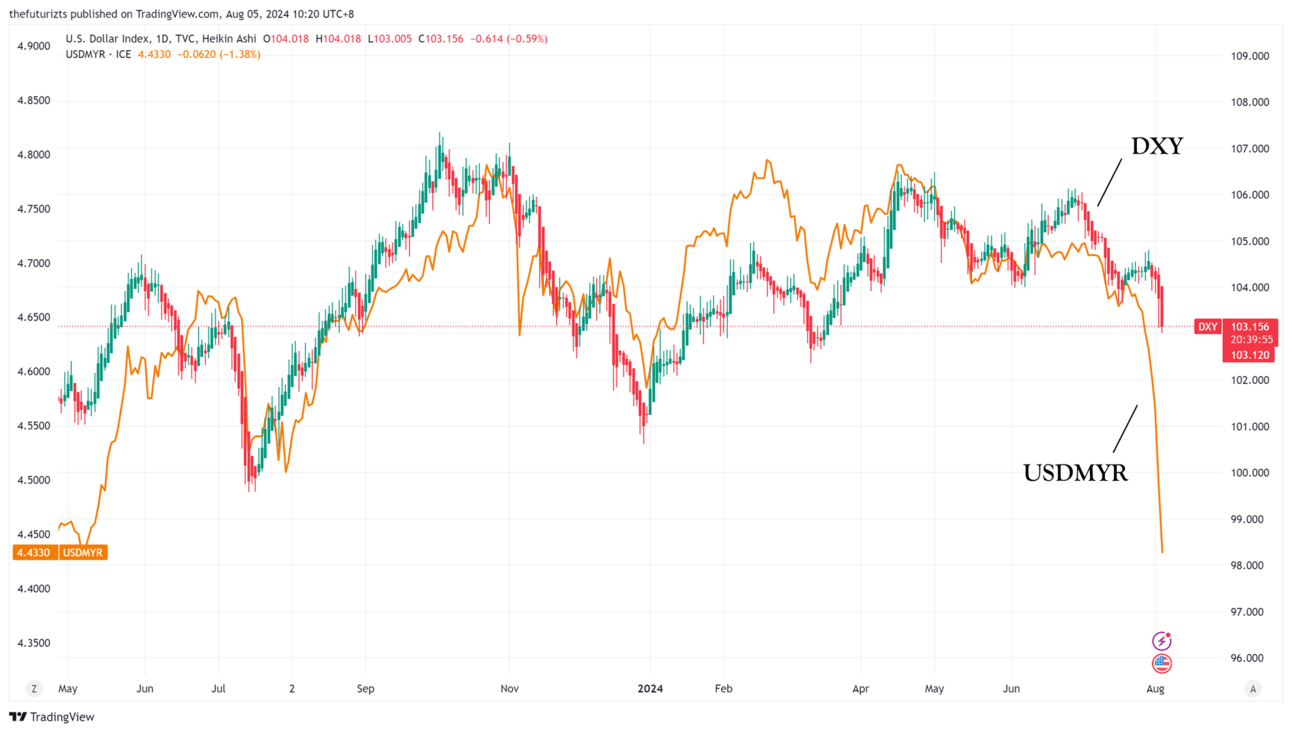

Most notably, the dollar index (DXY), which measures USD’s performance against a basket of six major currencies like the yen, pound, and euro, has plunged 1.40% in the past seven days.

The decline is driven by expectations of rate cuts by the Federal Reserve.

The dollar has declined by 1.40% in 7 days, and over 2.50% since July.

Typically, the USDMYR pair and the dollar index move almost in sync.

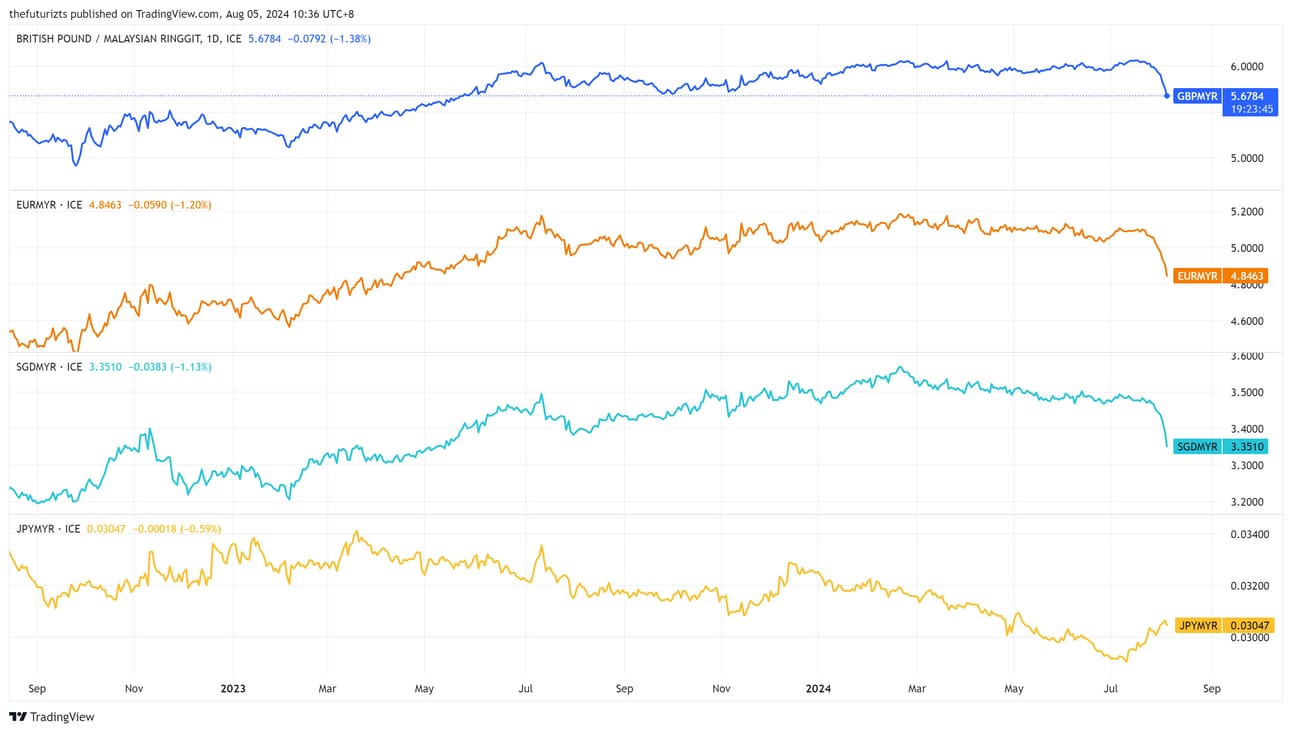

A large downswing in USDMYR (refer to chart above) suggests that something is going on with the ringgit as well, and after comparing it with other major currencies, the evidence becomes clear: the ringgit itself is also strengthening.

GBPMYR: RM5.6784 (14-month high)

EURMYR: RM4.863 (16-month high)

SGDMYR: RM3.3510 (15-month high)

The only currency which the ringgit did not rally against is the Japanese yen.

Malaysia has seen tons of good news recently.

-> Positive numbers in our trade and GDP.

-> JP Morgan upgrading Malaysia’s rating.

-> Our country is emerging as a hotspot for semiconductor firms.

-> We are forecast to be the largest data centre market by 2035.

These factors attracted foreign investors back into the local stock market, which supported the ringgit’s uptick.

Apart from this, the decision for Bank Negara Malaysia (BNM) to keep the Overnight Policy Rate steady has also kept the local note firm against other currencies.

Ringgit "mengganas" 2-3 hari ni.

Kenapa ringgit naik begitu banyak lately vs USD, £, €, A$, Yuan. Tapi matawang Baht, Rupiah, Peso or even SGD tidak naik sangat.

Jawapan: Because Bank Negara (BNM) did a great job. Keep reading to find out why.

@BNM_official

— Azharuddin (@azha_nordin)

2:52 PM • Aug 1, 2024

In fact, BNM previously mentioned that the ringgit did not correctly reflect Malaysia’s economic output when it plunged to multi-decade lows against the US dollar.

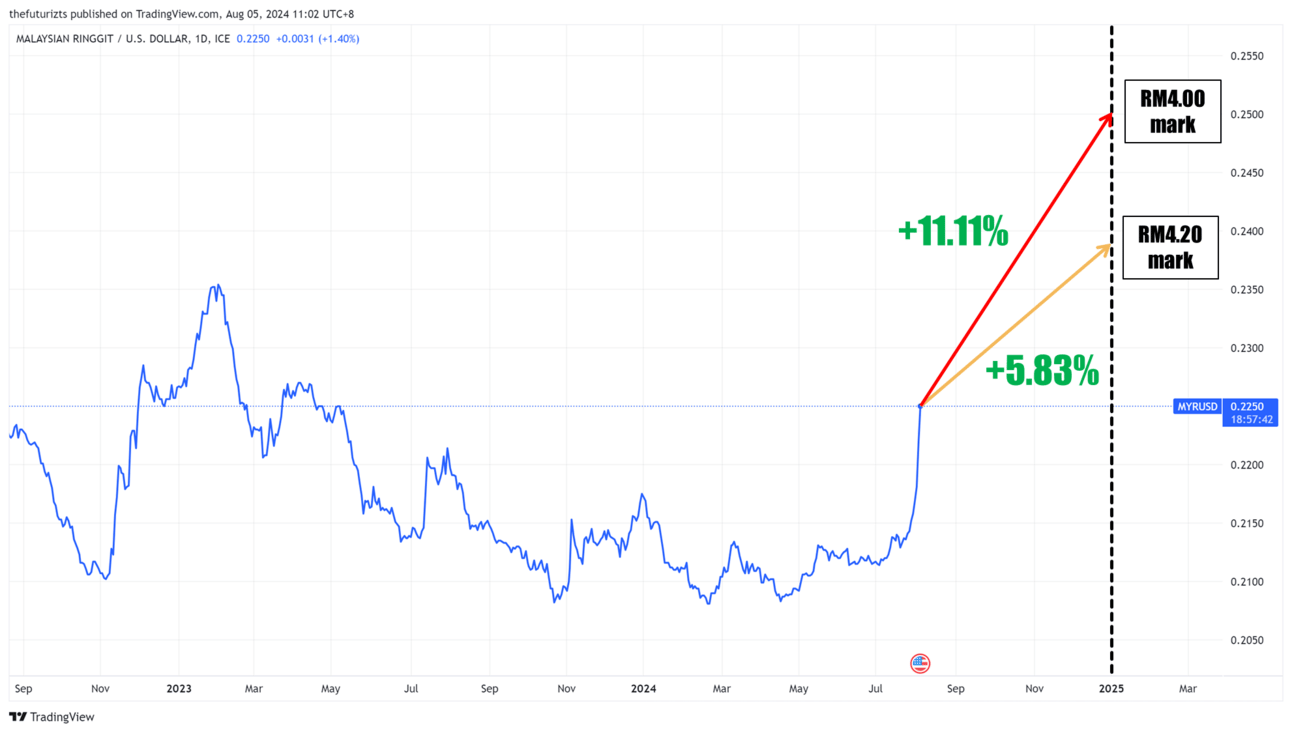

So, will we see RM4.00 by year-end?

It’s unlikely.

For the ringgit to reach this level, it has to strengthen by another 11-12% in less than 5 months.

Considering that it has already gained over 5% in the past 11 days, the ringgit is bound to retrace in the upcoming weeks or months.

Negative external factors, such as the US Fed delaying rate cuts, escalating geopolitical tensions, and the possibility of a recession for western countries could potentially cut the ringgit’s rally short.

As such, financial experts (Hann and Sani) are cautiously optimistic and are looking at the ringgit hitting RM4.20 first. This target is more realistic.

For the ringgit to hit RM4.20, it has to gain 5.83%, versus 11.11% to RM4.00.

What does a stronger ringgit mean for you?

It’s probably time to cancel your Japan trip and go to western countries instead (US, Europe, UK, etc.). 🤣

Jokes aside, your current overseas investments will underperform, which is why it is important to be not too committed to them.

Hann has always advised against having a large chunk of your portfolio in US stocks, especially when cases like this (ie. the ringgit making a comeback) are bound to happen.

If you’re planning to retire locally, then it’s best to have the majority of your assets denominated in ringgit.

But if you’re young and want to diversify your portfolio overseas, then split them equally with local investments.

Is it a good time to invest in USD or US stocks?

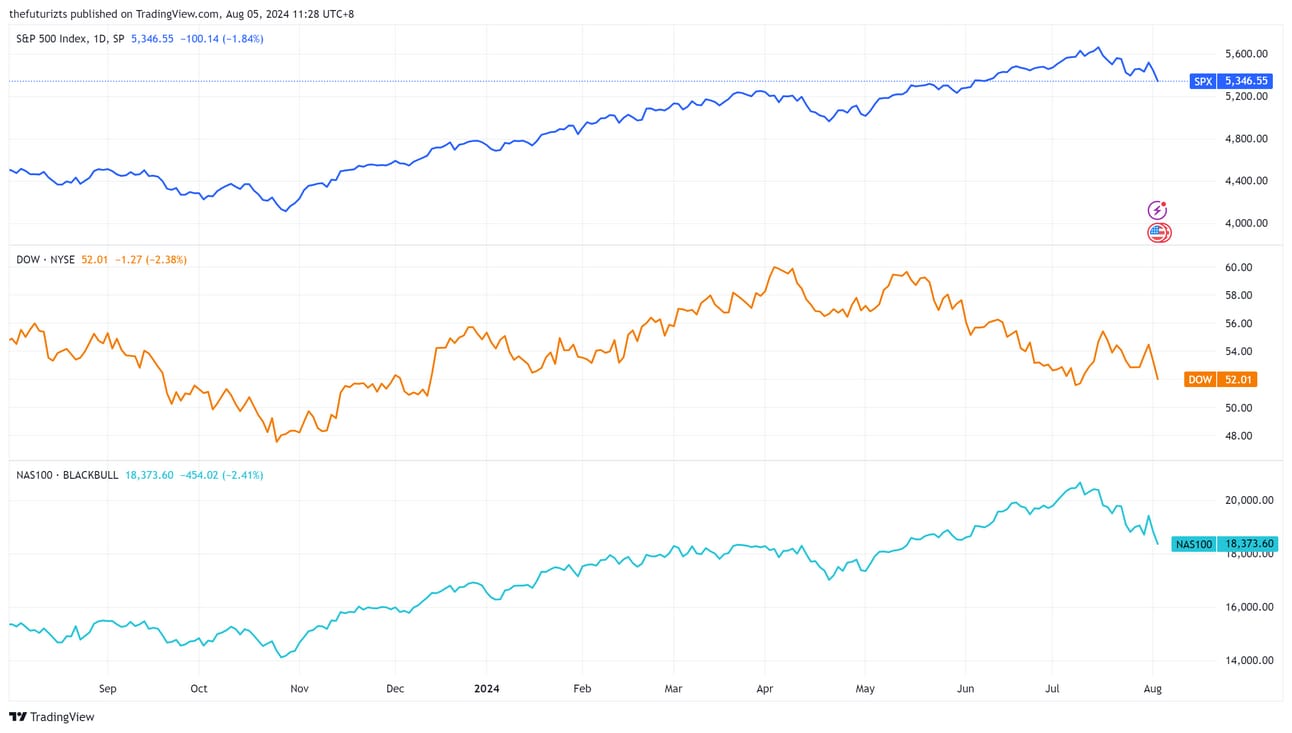

On Friday, the S&P500 experienced the largest one day drop since 2022, sparked by fears of a possible recession.

It has declined by 3.37%. Other major US indices (Dow and Nasdaq) were not spared.

The S&P, Dow, and Nasdaq faced the worst one-day decline since 2022.

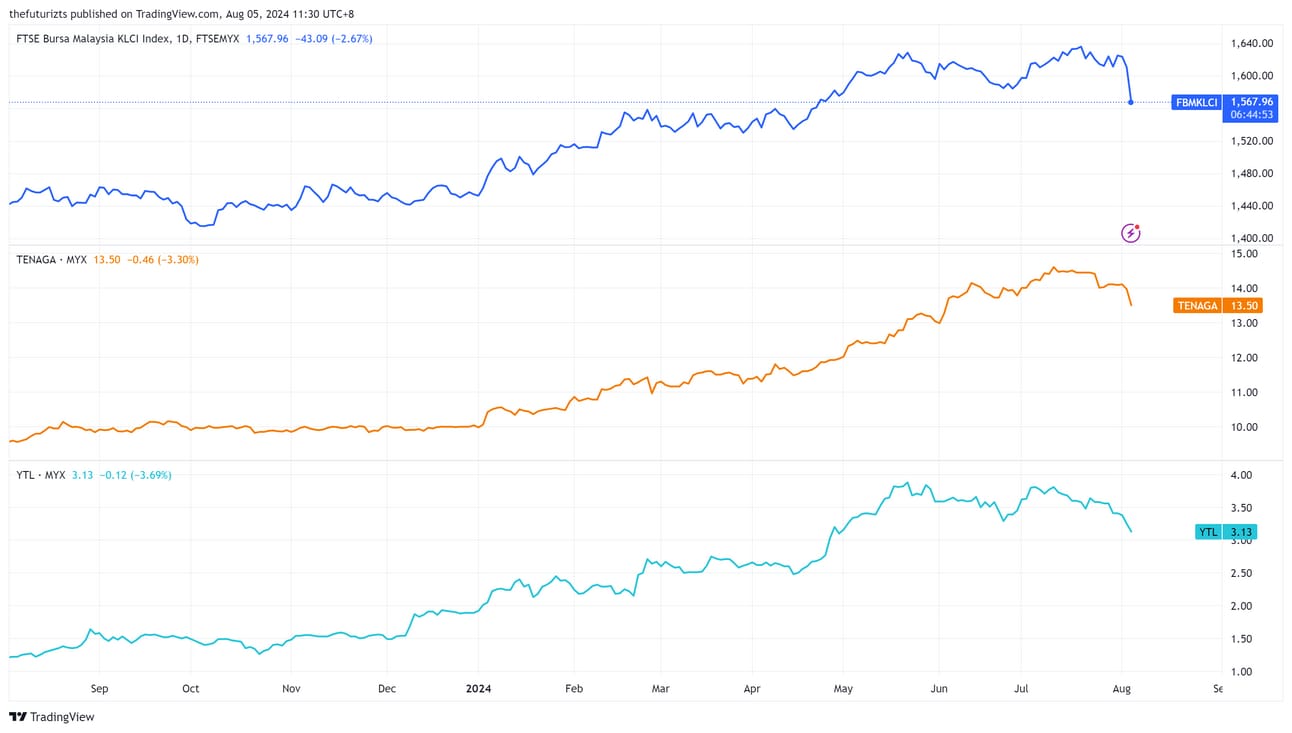

Over to the Malaysian market, the FBMKLCI faced a similar fate and has declined by 3.40% at the time of writing.

Stocks like Tenaga and YTL led the way, falling by 5.54% and 12.73%, respectively.

The ripple effect has also spread to other assets.

Bitcoin has declined by over 12% since Friday to a 5-month low of $55,700.

Regarding the question on whether it is a good time to invest, this entirely depends on what your portfolio requires.

It isn’t about timing the market, but more on whether you’re underexposed or overexposed.

If your goal is to allocate 30% of your portfolio in US assets and now it has fallen to <10%, then this is a good opportunity for you to accumulate.

You can apply this rule for all the assets within your portfolio, rebalancing them accordingly to whichever asset that is the most underweight.

This week’s newsletter contains the insights shared by financial experts Hann Liew and Sani Hamid on Sunday (4 August).

However, it does not fully represent their thoughts and is not a direct call to buy/sell/hold any securities.

If you missed the live session, listen to the replay on Spotify.

Learned something? Then join our WhatsApp group for more!

You’ll receive financial updates - best FD rates, cash app comparisons, currency & market movements, etc. on a daily basis.

✅ 200+ people have joined.

✅ We don’t spam.

✅ It’s only $0.25/week.

✅ Pay monthly, cancel anytime.

Thanks for reading till the end!

Disclaimer: The information contained in this newsletter is for informational and educational purposes only. Nothing herein shall be construed to be financial, legal, or tax advice.

Reply