- The Futurizts' Weekly Newsletter

- Posts

- 7 Places You Can Consider to Grow Your Savings

7 Places You Can Consider to Grow Your Savings

With rates up to 10.00% p.a.

1. Versa Save Conventional (Up to 10.00% p.a.*)

*For new users who sign up between 1 Feb 2026 - 28 Feb 2026 AND activate auto-debit (at least RM500).

Versa is a wealth management app that allows you to invest in local and global markets.

Their two most popular funds are Versa Save (Conventional) and Versa Save (Shariah-Compliant). Both are Money Market Funds that offer stable returns, much like TNG GO+ and StashAway Simple.

The base return rate for both funds are as follows:

Versa Save (Conventional): 3.47% pa*

Versa Save (Shariah Compliant): 3.14% pa*

*Nett returns for December 2025.

This is nothing to shout about, but to sweeten the pot, Versa is allowing new users to earn 4.00% p.a. nett on Versa Save (Conventional) and 3.70% p.a. nett on Versa Save (Shariah Compliant).

To receive these rates, just register an account and cash in to any Versa Save products.

The rewards are calculated daily and credited in following month, applicable on up to RM10,000 fresh funds in respective Versa Save offerings.

Set up auto debit, get 10% p.a. for 3 months!

By setting up a monthly auto-debit of RM500 or more into any Versa Save product, you will earn a 10% p.a. bonus on the RM500 auto-debit amount for the next 3 months.

The bonus begins from the month of your first auto-debit transaction and continues until the end of your Eligibility Period (refer below).

✅ User friendly

✅ Deposit/withdraw in 2-3 business days (Versa Save Conventional)

✅ Regulated by Securities Commission Malaysia

❌ Not insured by PIDM

🎁 Referral Code: THEFUTURIZTS (Get RM10 for first deposit of RM100 and above)

Download Versa: https://download.versa.com.my/1bAf/02iw4x48

View the full campaign TNCs: https://versa.com.my/2026-versa-starter-quests-for-february-new-joiners/

2. BoostMyMoney (3.25-6.85%* pa)

BoostMyMoney is a Shariah-compliant fund that helps users earn and save with higher returns. The base return is 3.75% pa (excluding fees of 0.50%).

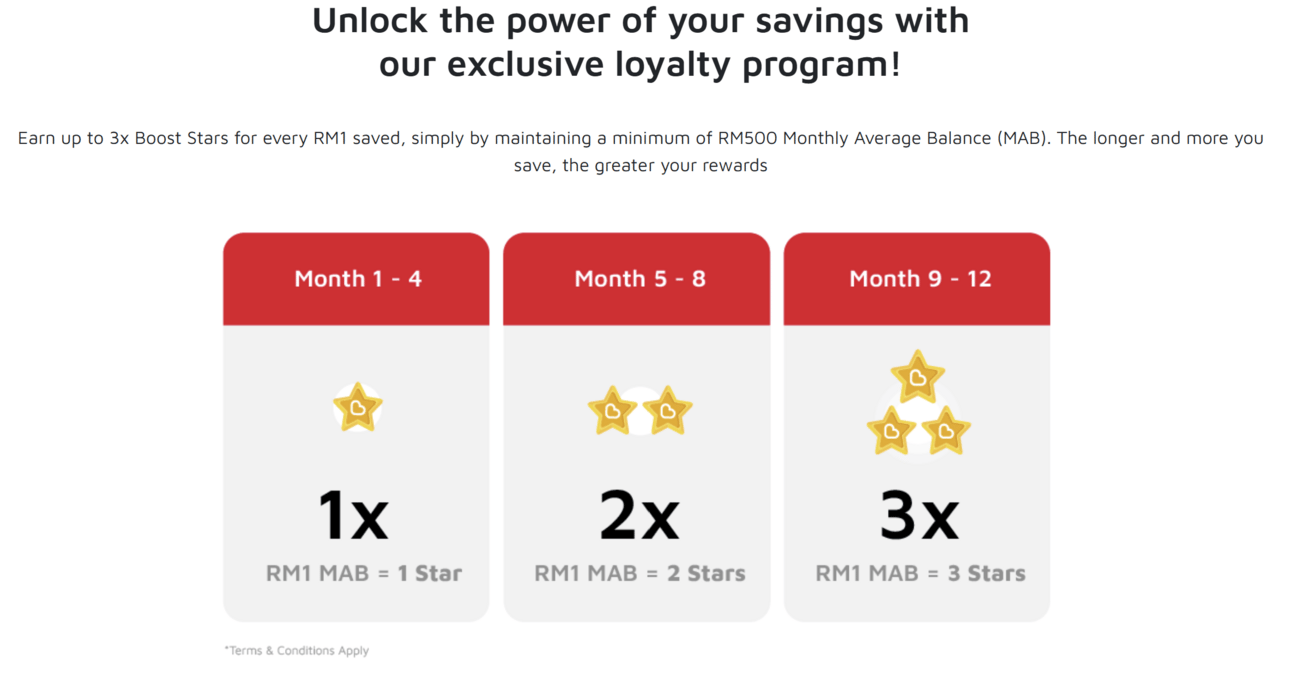

You’ll earn profit daily and also receive Boost Stars for every ringgit maintained in the account.

The stars are credited into your Boost eWallet every month and can be claimed as cashback (1,000 Stars = RM1).

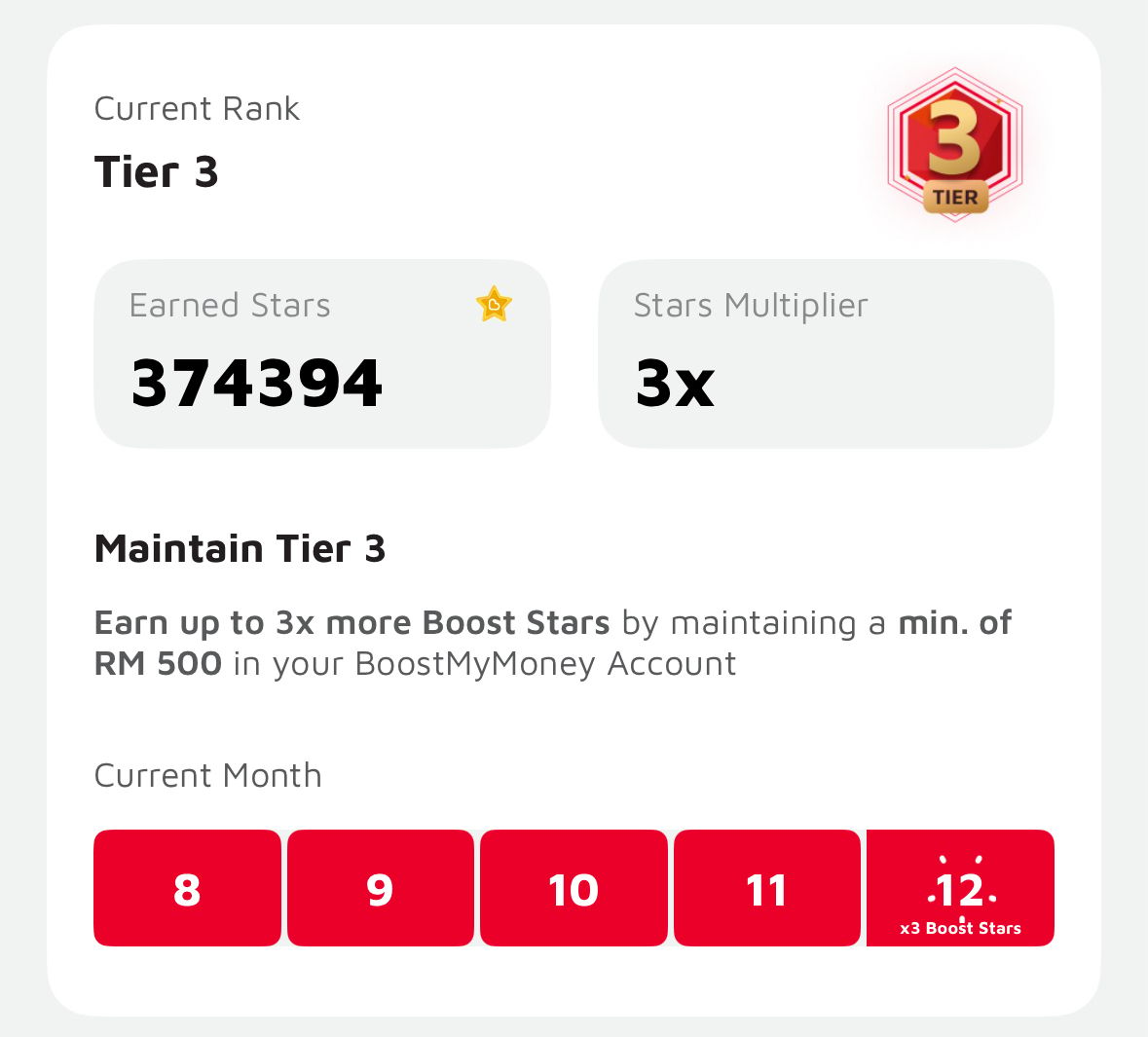

The longer you maintain the balance in your account (min. RM500), the more Boost Stars you’ll receive, up to 3x stars on every RM1.

*From month 9-12, the earnings rate effectively increases to 6.85% p.a., assuming you convert the stars to cashback.

I used BoostMyMoney for slightly over a year and accumulated 374k stars (worth RM374)

You can also withdraw 95% of your funds instantly to the Boost eWallet, which can be cashed out and sent to your bank account.

However, note that Boost eWallet has a RM10k transaction limit every month. Because of this, I keep less than RM10,000 in BoostMyMoney.

✅ Earn profit daily.

✅ Shariah-compliant.

✅ Earn Boost Stars for cashback.

✅ Withdraw up to 95% of funds to e-wallet instantly.

❌ Not insured by PIDM.

❌ Transaction limit of RM10k monthly.

🎁 Referral Code: shi57gv2

To be clear, BoostMyMoney is different from Boost Bank, which offers 3.00% pa and is protected by PIDM. Think of this product as something similar to TNG GO+.

Explore more: https://myboost.co/feature/boostmymoney

3. Moneybull (6.00% p.a.)

Moneybull is Webull’s new savings product that allows you to grow your savings and earn daily returns with no lock-in period.

The 6% p.a. rate is made up of two parts:

~3.4% from the underlying fund (AHAM Aiiman Enhanced i-Profit Fund – Class B)

The rest is topped up by Webull Malaysia

*The returns of the underlying fund are not guaranteed and can fluctuate.

The 6% p.a. campaign runs from 31 Dec to 31 Mar 2025

Open to new Webull Malaysia users only.

Deposit up to RM50,000 and earn 6% p.a. for 45 days- any amount above this will earn the base rate (~3.4% pa).

Returns are calculated daily and booster rewards are added monthly.

How to participate:

Log in to your Webull app

Deposit money into your Securities Account

Tap on “Discover” → “Moneybull” → Activate Now

Set your “Reserve amount” to RM0. Any amount above this will be automatically invested in Moneybull at 8 am every weekday.

Explore more: https://www.webull.com.my/k/TheFuturizts

4. Ryt Bank (4.00% p.a.)

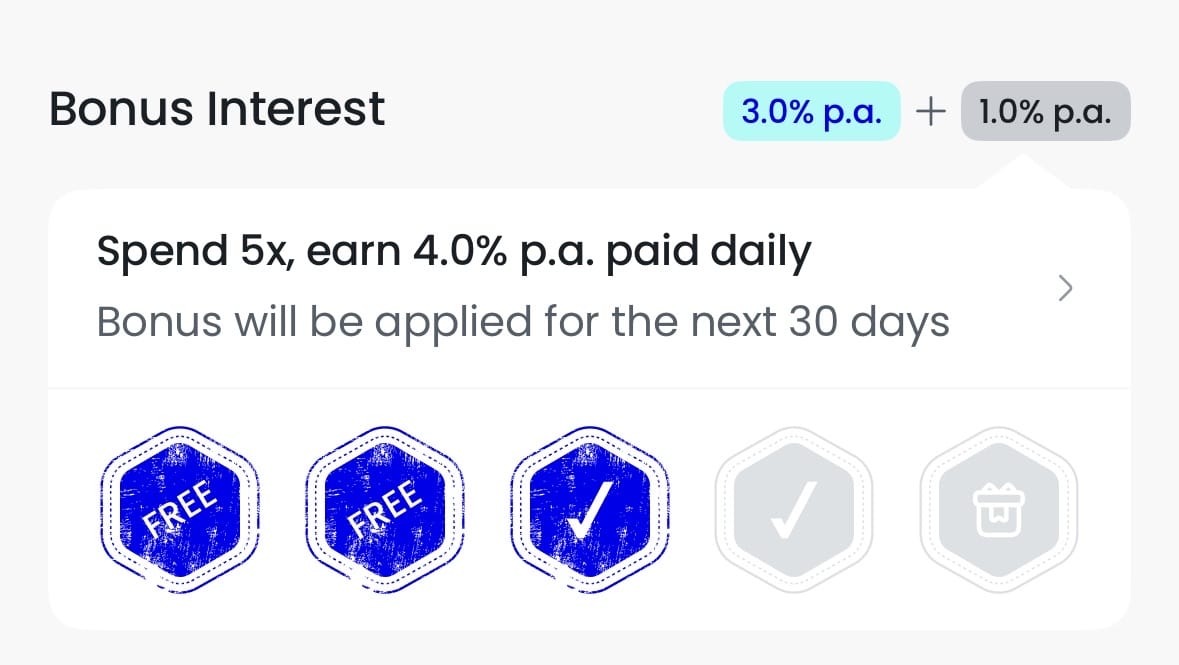

Known as the first AI-powered digital bank, Ryt Bank allows you to earn 3.00% + 1.00% p.a. in Save Pockets.

To earn the additional 1.00% p.a., you have to spend at least RM10/day in 5 separate transactions using the Ryt Card. Otherwise the earnings rate will drop to the base rate of 3.00% p.a.

Spend at least RM10/day to earn stamps. Get 5 and you’ll receive the bonus 1.00% p.a.

The balance in your main account (and any extra funds above RM20,000 in Save Pockets) will earn 3.00% p.a. (base rate) with no cap.

Apart from this, all spending with the Ryt card comes with a 1.2% unlimited cashback for overseas spending.

Notable perks:

✅ Earn 4.00% p.a., paid daily

✅ 1.2% unlimited overseas cashback

✅ WAIVED foreign transaction fees*

✅ Get up to RM5 when you use their AI to send money

✅ No minimum balance (like GXBank)

❌ Not Shariah-compliant

🎁 Referral code: 9KD4V (early access, may have expired)

Explore more: https://www.rytbank.my/

5. AEON Bank (3.00% pa + 0.50-4.00% cashback)

Dubbed as Malaysia’s first Islamic Digital Bank, AEON Bank allows you to earn up to 3.00% p.a., paid at the end of each month.

To be clear, the balance in your main account will earn 0.25% pa, while savings pots will earn 3.00% p.a.

You can create up to 20 savings pots with different goals, and the money can be deposited/withdrawn instantly.

You’ll also receive 1x AEON points for every RM1 spent using the debit card, which can be claimed for cash (1,000 points = RM5.00). This makes the base cashback rate 0.50%.

If you spend at participating AEON stores, you’ll get 4x AEON points on Thursdays and 3x AEON points on other days, which effectively increases the cashback rate to 1.50-2.00%.

To top things off, AEON Bank is running a “Grocery Mania” promotion until 15 Apr:

3.5% instant cashback for new users, capped at RM10/mo

2.0% instant cashback for existing users, capped at RM10/mo

^ Applies to all grocery purchases with the debit card. Stacks with the 0.50% base cashback rate, so it’s 4.00% in total for new users, and 2.50% for existing users.

✅ Shariah-compliant.

✅ Savings account, insured by PIDM.

✅ Deposit/withdraw instantly using DuitNow.

✅ 0.50% cashback on most spending with debit card.

✅ 1.50-2.00% cashback on spending in AEON stores.

❌ Profit payout occurs at the end of each month.

🎁 Referral Code: AB403017 (Get RM20 upon account activation)

Explore more: https://www.aeonbank.com.my/promotions/awareness

6. Touch n’ GO+ (3.03% pa)

GO+ offers flexibility and pays daily profit based on the balance in your account at the end of each day.

It will not affect your e-wallet payments. Whenever you make a deposit or transfer, the funds will automatically be added or deducted from your GO+ account.

✅ Earn profit daily.

✅ Shariah compliant.

✅ Deposit/withdraw instantly with DuitNow.

❌ Maximum deposit limit of RM20,000.💡

❌ Not insured by PIDM.

💡 You’ll still earn daily profit beyond this limit, but you won’t be able to deposit more funds.

⚠️ As of 2nd December, TNG is in deep trouble after a user complained that his account got suspended for no reason. Because of this, many users are withdrawing money from their GO+ accounts. Read more here.

7. ASB & ASM (4-6% pa)

Amanah Saham Bumiputera (ASB) and Amanah Saham Malaysia (ASM) are unit trust funds managed by Amanah Saham Nasional Berhad (ANSB).

The funds are always fixed at RM1.00 per unit, giving you the flexibility to plan your investments without worrying about market volatility or price swings.

Unfortunately, ASB is only available for Bumis. For non-Bumis, ASM is the next alternative, but the units are limited and often hard to purchase.

✅ Shariah compliant.

✅ Stable, consistent returns.

✅ Deposit/withdraw in 1-2 business days.

❌ Limited units for non-bumis (ASM).

❌ Profit payout occurs once a year.

❌ Not insured by PIDM.

“Got so many options, I can’t decide.”

Most cash apps are relatively new and often go under maintenance.

As such, it’s best to use multiple apps so you won’t be locked out from your funds.

I use AEON Bank and Ryt Bank for daily spending and saving. For emergency funds, I like to keep them in a separate place (ASB/ASM, Versa) so I won’t see them and be tempted to spend.

Growing your savings has never been easier.

At a 4% p.a., you’ll achieve RM50,000 in 5 years if you set aside roughly RM755 per month.

This is much faster than saving manually without investing (RM833/month).

Of course, achieving RM50,000 may not be feasible for everyone, but think of it this way: It’s better to have some money set aside rather than none at all.

If you found this helpful and want more stuff like this, check out our paid WhatsApp group.

You’ll receive:

Daily updates on tax, EPF, savings & investing (except weekends)

Clear comparisons to help you decide what to act on

No ads or sponsorships

Join today: https://wa.link/kwqvbg

DISCLAIMER: Investing in cash apps or unit trusts has its own risks as they are different from opening a deposit account with a financial institution. You should speak with a financial planner before making any investing decisions. ⚠️

Reply